The reelection of President Donald Trump has raised concerns regarding the future of biofuels in the United States, including SAF. With the U.S. expected to produce 40% of global SAF supply through 2028, the already turbulent road to SAF adoption could face increased challenges during President Trump’s second term.

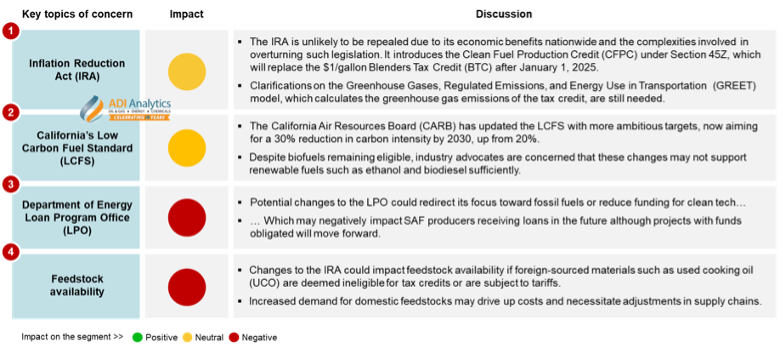

SAF stakeholders have four primary concerns, as illustrated in Exhibit 1: (1) the future of the Inflation Reduction Act (IRA), (2) the fate of California’s Low Carbon Fuel Standard (LCFS), (3) priorities at the U.S. Department of Energy’s Loan Program Office (LPO), and (4) feedstock availability.

Exhibit 1: Key concerns on biofuels in a second Trump Administration.

The IRA introduces the Clean Fuel Production Credit (CFPC) under section 45Z, which will replace the $1/gallon Blenders Tax Credit (BTC) after January 1, 2025. This new technology-neutral credit is designed exclusively for U.S. fuel producers and incentivizes biofuels that achieve at least a 50% reduction in emissions compared to traditional oil-based fuels.

Unlike the flat-rate BTC, the CFPC varies based on carbon intensity, which could result in lower credit amounts for some producers; for example, soy-based renewable diesel (RD) may receive as little as $0.30/gallon. The credit value will be determined using the Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation (GREET) model to calculate lifecycle greenhouse gas emissions. However, the ongoing finalization of this model creates uncertainty for biofuel producers, complicating their ability to predict near-term feedstock demand.

In parallel, CARB has updated the LCFS to establish more ambitious targets for reducing carbon intensity in transportation fuels. The revised LCFS now aims for a 30% reduction by 2030, up from the previous target of 20%, and a 90% reduction by 2045. Additionally, CARB has implemented feedstock restrictions on biodiesel and RD derived from soybean oil, canola oil, and sunflower oil, limiting these crop-based fuels to generating only 20% of credits.

This rule will take effect in 2028 for producers reporting more than 20% of their credits from these restricted feedstocks. While biofuels remain eligible under the LCFS, industry advocates worry that these changes may not sufficiently support essential ethanol-based renewable fuels and could instead impose additional restrictions on other types of feedstocks.

Moreover, potential changes to the LPO could shift its focus toward fossil fuels or reduce funding, potentially hindering future loan opportunities for SAF producers and refiners. However, projects that have already secured funding commitments will continue as planned. For instance, a $1.44 billion loan was granted to Montana Renewables for its facility expansion in Great Falls, Montana. Since such projects are now being supported by oil and gas companies and petroleum refiners, ADI sees them to be at moderate risk of cancellation in a second Trump Administration.

Additionally, tariffs promised by President Trump or modifications to the IRA credits might affect feedstock availability, particularly if foreign-sourced materials become ineligible for tax credits. This is especially concerning for used cooking oil (UCO) imports, which have surged by nearly 8X since 2022 and now account for about 60% of UCO used in U.S. renewable fuel production. Most of these imports come from China, which already exports over half of its potential UCO production.

While the IRA’s 45Z tax credit is unlikely to be repealed due to its bipartisan support and established stability, the new guidance related to the IRA and the LCFS presents significant challenges. The introduction of a model that sets lower dollar-per-gallon rates for certain biofuels may decrease profitability for producers, potentially affecting supply. Additionally, CARB’s more ambitious targets and feedstock restrictions could limit the availability of feedstock sources, raising concerns about adequate support for potentially abundant ethanol-based renewable fuels. These changes could further complicate matters for producers if the LPO shifts its focus or reduces funding. The situation may also worsen if foreign-sourced materials become eligible for tax credits, particularly UCO. Overall, uncertainty and risk in the market are expected to increase, although there is hope for clarification on the GREET system by the end of this year.

– Maria Lopes, Panuswee Dwivedi, Christine Ho

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including up-to-date sustainable aviation fuels (SAF) policy insights, regulatory compliance, and market dynamics, where we support Fortune 500, mid-sized and early-stage companies, government agencies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives together for meaningful dialogue and strategic insights across the oil & gas, energy transition, and chemicals value chains. Learn more about the ADI Forum, which is chaired by Uday Turaga, Founder & CEO, ADI Analytics, at www.adi-forum.com.

Subscribe to our newsletter or contact us to learn more.