Decarbonization efforts in the oil and gas sector continue to gain momentum but face significant challenges. In our previous blog, we discussed the challenges oil and gas companies face in reducing upstream greenhouse gas (GHG) emissions and highlighted several initiatives major operators such as ExxonMobil, Chevron, and Shell have made in GHG emissions reduction. However, beyond the broader focus on reducing GHG emissions, there is increasing regulatory pressure worldwide, including in the U.S., specifically targeting methane emissions reduction as methane is 25 times more potent than CO2 at trapping heat and is a major contributor to climate change.

The U.S. Environmental Protection Agency (EPA) has announced two major regulatory updates: Subpart OOOOb/c (Quad Ob/Oc) under the New Source Performance Standards (NSPS) and Subpart W under the Greenhouse Gas Reporting Program (GHGRP). These updates establish stricter requirements for controlling, monitoring, and reporting methane emissions in the oil and gas sector. Subpart Quad Ob took effect in May 2024, while oil and gas operators have until 2026 to comply with Subpart Quad Oc. Additionally, the revised rules for Subpart W will go into effect starting on January 1, 2025.

Below, we summarize the key impacts of these new methane regulations on the oil and gas industry:

1. Tightening controls on flaring and equipment emissions

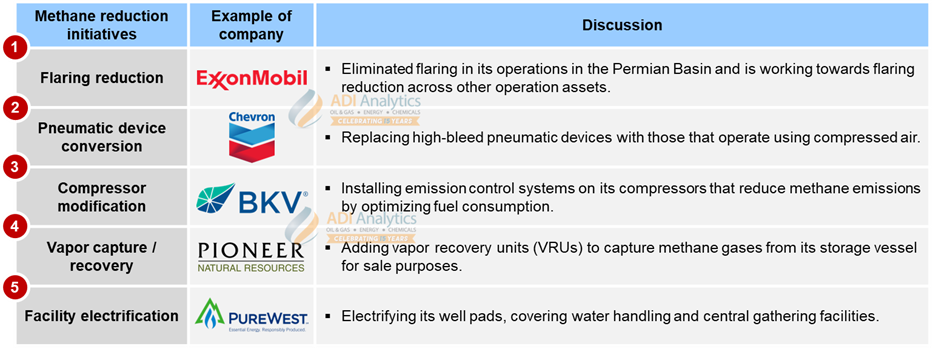

The Quad Ob/Oc regulations restrict routine flaring, allowing it only in cases of emergencies, technical malfunctions, or safety needs. Many operators have proactively reduced or eliminated routine flaring. For instance, ExxonMobil has ended all flaring in the Permian Basin and is reducing flaring intensity across other assets (see Exhibit 1).

Quad Ob/Oc also enforces strict equipment standards, including a zero-methane emission requirement for all newly installed pneumatic devices. Chevron, for example, is replacing high-bleed pneumatic devices with non-emitting options such as compressed air systems in its Rockies Basin operations (see Exhibit 1).

The Quad Ob/Oc regulations set stringent methane emission limits on various types of equipment, including compressors, process units, storage vessels, and gas well operations such as well completions and liquid unloading. Operators are actively addressing methane emissions from these sources (see Exhibit 1). For example, BKV is installing emission control systems on compressors in the Barnett Basin to optimize fuel consumption and reduce methane emissions. Pioneer Natural Resources, recently acquired by ExxonMobil, is using vapor recovery units (VRUs) to capture methane from storage vessels and redirect it for sale. Meanwhile, smaller operators such as PureWest Energy are electrifying well pads to reduce emissions from gas well operations.

Exhibit 1 below summarizes the methane reduction initiatives from a select group of oil and gas companies as discussed above.

Exhibit 1: Example of different methane reduction initiatives from a select group of oil and gas companies

2. Embracing transparency in methane emissions reporting

Data gaps with methane emissions inventory have posed a challenge to accurate methane emissions reporting, as we have noted in a previous blog. The Quad Ob/Oc regulations aim to close these gaps by enforcing more transparency in methane emissions reporting. Operators are now encouraged to invest in advanced methane monitoring, reporting, and measurement technologies, which provide real-time emissions data. The regulations also include mandatory Leak Detection and Repair (LDAR) measures, requiring that operators repair any methane leaks within 15-30 days of detection.

The Quad Ob/Oc also introduces the Super Emitter Program, which authorizes certified third-party entities to identify and report significant methane emissions incidents directly to regulatory bodies. This program acts as an early warning system, urging operators to take swift action on major emissions events.

3. A hefty price to be paid for increased methane intensity

The EPA has recently updated Subpart W, introducing new calculation methods and emission factors, while also requiring operators to account for additional emission sources, such as methane emissions from produced water and mud degassing. These changes could significantly increase the reported methane intensity of oil and gas operations, potentially raising it easily by 2 to 2.5 times (see Exhibit 2).

Exhibit 2: Projected impact on operators’ methane intensity under new Subpart W rules

In our previous blog, we covered the Waste Emissions Charge (WEC) under the Inflation Reduction Act (IRA)’s Methane Emissions Reduction Program, which oil and gas operators must pay for each metric ton of reported methane emissions when exceeding a certain threshold. The WEC starts at $900 per metric ton of reported methane emissions in 2024, increases to $1,200 per metric ton in 2025, and peaks at $1,500 per metric ton in 2026. This methane tax, combined with the increased methane intensity due to the new regulations from Subpart W, could impose substantial financial penalties on operators who fail to control their methane emissions.

In conclusion, the rising regulatory pressure is prompting oil and gas operators to take concrete steps to reduce methane emissions. These new regulations encourage companies to turn their emissions commitments into actionable practices, leading to more responsible oil and gas production. At ADI, we closely monitor these regulations and developments, and have been advising numerous clients on methane emissions with our extensive proprietary datasets on GHG emissions datasets meticulously collected over the past decade. Our datasets are enriched with granular detail, including GHG emissions breakdowns by key unit operations—such as exploration, drilling and completions, production, venting and flaring, and fugitive emissions— built on a mix of primary and secondary research. By using the same rigorous approach, we can build and report datasets on methane emissions with such granularity to enable insightful analytical outcomes for our clients.

– Edmund Lam

Please contact ADI at info@adi-analytics.com if you would like to understand methane emissions across oil & gas and chemicals, policies and regulations on their mitigation globally, and developing business, operational, technology, and sustainability strategies to mitigate them.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in these segments including methane and greenhouse emissions and their mitigation, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.