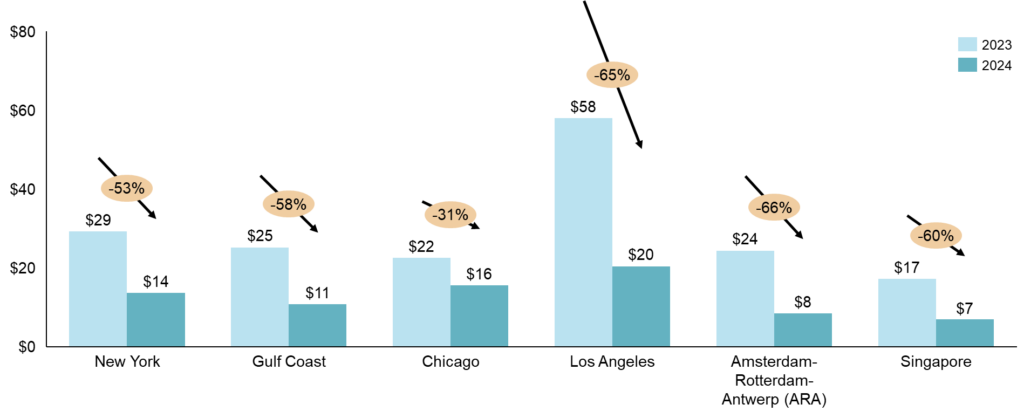

Petroleum refiners globally are experiencing reduced margins in 2024 compared to the previous year, as illustrated in Exhibit 1. The 3:2:1 crack spread has fallen sharply in several regions. Amsterdam-Rotterdam-Antwerp (ARA) has seen its refinery margins fall from $24/bbl to $8/bbl, a drop of 66%. Los Angeles has also faced a sharp decline, with margins decreasing from $58/bbl to $20/bbl, a reduction of 65%. Singapore’s margins have dropped 60% from $17/bbl to $7/bbl. In New York and the Gulf Coast, margins have decreased by about 50%. New York’s margins fell from $29/bbl to $14/bbl, while the Gulf Coast’s dropped from $25/bbl to $11/bbl. Chicago has experienced a smaller decline of around 30%, with margins going from $22/bbl to $16/bbl.

Major oil companies have felt the impact, with TotalEnergies reporting a 66% decline in its refining margins for the third quarter, while Shell’s margins dropped by 40% from the first to the second quarter. ExxonMobil also noted negative impacts on its third-quarter profits due to lower refinery margins. This downturn is driven by economic slowdown, weak consumer demand for petroleum products, and the higher demand and share of alternative fuels.

Exhibit 1: September 2023-24 regional refining margins ($/bbl). Source: U.S. EIA, ADI.

In the U.S., distillate fuel oil consumption—which includes diesel fuel for vehicles and home heating oil—decreased by 6% compared to 2023. This reduction was driven by a warmer winter in 2023-24 compared to the previous year, a slowdown in manufacturing activity, and an increased shift towards biofuels. The shift towards biofuels is more evident on the U.S. West Coast, where incentives have boosted biofuel production through tax credits. For example, Phillips 66 converted its Rodeo refinery in California to process only renewable feedstocks.

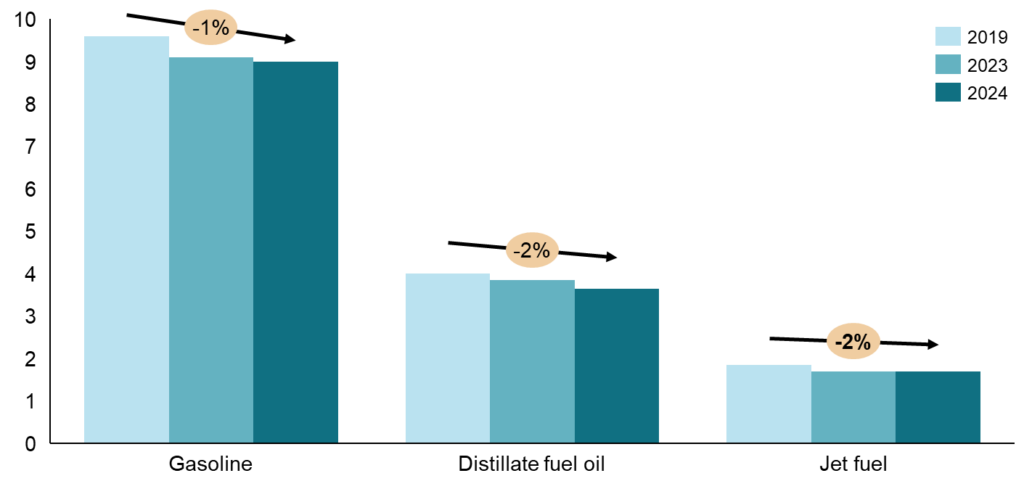

Besides distillate fuel, other petroleum products were affected, as illustrated on Exhibit 2. Annual jet fuel consumption in the U.S. rose in 2023, however, it remained below the pre-pandemic peak observed in 2019, indicating that the aviation industry has yet to fully recover to its normal operational levels. A similar trend was noted in gasoline consumption, which experienced a slight decrease compared to the previous year.

Exhibit 2: June-September 2019-23-24, U.S. petroleum products consumption (Million barrels per day). Source: U.S. EIA, ADI.

The weakness in petroleum products demand is not confined to the United States. In Asia, particularly China, a slowdown in construction activity and the increasing adoption of liquefied natural gas (LNG) in heavy-duty trucks have reduced diesel demand. Similarly, Europe is experiencing an economic slowdown, as evidenced by the composite Purchasing Managers’ Index (PMI) falling from 50.6 in August to 48.9 in September, signaling economic contraction.

The refining industry is adjusting to declining petroleum products demand due to slow economic growth and by a gradual shift towards alternative fuels such as LNG in China, biofuels in Europe and North America, and the rise of electric vehicles. In response, global refiners such as Repsol and ENI have cut their run rates by 5% and up to 10%, respectively, with some even considering closures. Although refinery margins have been robust over the past two years, forecasts suggest a downturn in profitability, and to stay competitive, refiners must reassess their strategies, emphasizing capacity optimization and diversification into clean fuels.

-Maria Lopes

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including refining markets, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives together for meaningful dialogue and strategic insights across the oil & gas, energy transition, and chemicals value chains. Learn more about the ADI Forum, which is chaired by Uday Turaga, Founder & CEO, ADI Analytics, at www.adi-forum.com.

Subscribe to our newsletter or contact us to learn more.