The aviation industry stands at a critical crossroads in its journey toward sustainability. In recent years, interest in SAF has surged, with airlines making significant commitments to incorporate this fuel into their operations, while governments around the world are launching initiatives to enhance SAF production and adoption. The Biden Administration’s SAF Grand Challenge, for instance, has set an ambitious goal of producing 3 billion gallons of SAF annually by 2030, representing 11% of total jet fuel demand.

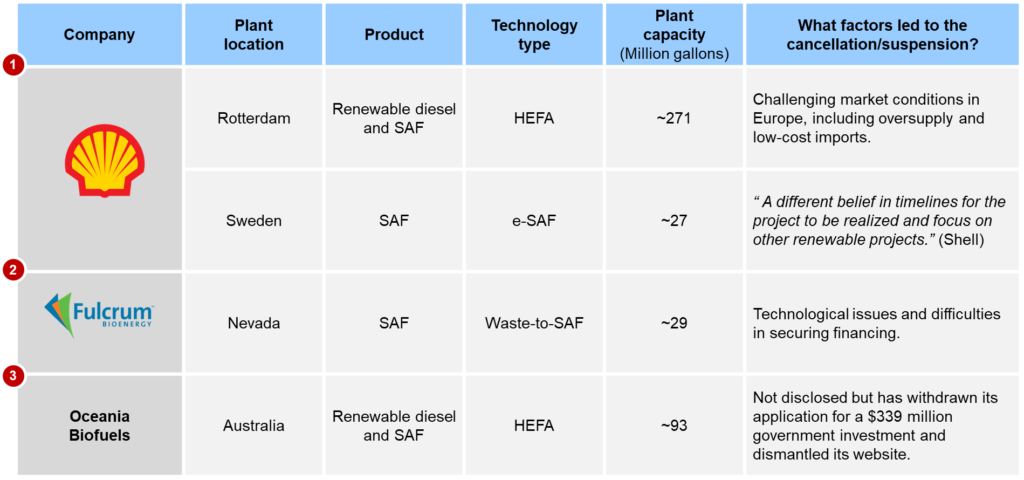

However, the path to widespread SAF adoption is proving turbulent, with more projects cancelled or paused than new ones announced this year. Despite ambitious targets, the industry faces significant challenges in scaling up production. Here are some projects that have been affected recently:

- Shell has suspended construction of its biofuel facility in Rotterdam, citing “current market conditions” as the reason for this decision. The company has also paused its planned e-SAF project in Sweden known as HySkies, which was a collaboration with Vattenfall, a Sweden-based power company. Shell has stated that the project is not feasible within the framework of the $87 million EU Innovation Fund agreement, leading them to terminate their request for financial support from that fund.

- Fulcrum Bioenergy’s pioneering municipal solid waste-to-fuels facility in Nevada has also closed, after brief operation, citing technological problems such as unexpected nitric acid build up and sludge accumulation affecting the gasification unit, as well as financing difficulties.

- These cancellations aren’t limited to North America and Europe. For example, in Australia, Oceania Biofuels has scrapped its planned $339 million SAF project in Queensland. This initiative, which

would have marked Australia’s first SAF production site, has been withdrawn from the government’s environmental review processes, with no further explanation provided. - BP has announced that it is scaling back its plans to develop new SAF and renewable diesel projects at its existing sites. The company is pausing planning for two undisclosed potential projects. This

decision aligns with BP’s strategy to simplify its portfolio and concentrate on value and returns, indicating challenges with biofuel investment’s projected returns.

These recent project cancellations and delays summarized in Exhibit 1 underscore broader challenges, including technical difficulties, financial pressures, and shifting strategic priorities among developers. Each cancelled project signifies a lost opportunity for technological advancement and scaling up production and poses significant risks for the SAF industry and potentially hindering the aviation sector’s ability to meet both regulatory and voluntary targets.

Exhibit 1: Factors leading to SAF plant cancelations.

The recent wave of project cancellations sends a concerning message to investors and policymakers about the current viability of SAF projects. Despite these setbacks, strong demand for SAF persists, as evidenced by the growing interest in SAF certificates (SAFc). These certificates enable companies to purchase, track, and claim the emissions benefits of SAF without physically acquiring the fuel, attracting not only airlines but also various businesses seeking to mitigate their Scope 3 emissions. However, this situation reveals a paradox in the SAF market: while demand is robust, production remains concentrated among a few key players. The cancellations have further intensified this supply bottleneck, highlighting the urgent need for increased investment and supportive government policies to expand production capacity.

As supply increases and the industry gains experience, production costs are expected to decrease, making SAF more accessible. Addressing these challenges will be crucial for the industry’s growth in the coming years. To stay updated on developments related to demand, supply, technology, and policy, subscribe to our bi-weekly SAF Tracker newsletter, where we explore these topics in detail!

– Maria Lopes

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in these segments including Sustainable Aviation Fuel (SAF) market dynamics, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.