Selecting the site for a new hydrogen project, chemicals plant, or renewable energy facility can be a long and rigorous process. The Inflation Reduction Act (IRA) is driving investment into new energy transition projects, but location is often a critical factor in project’s success. Whether it’s the company’s first, second, or hundredth facility, finding the best spot for a new project is often a multistage process and requires weighing and balancing several criteria.

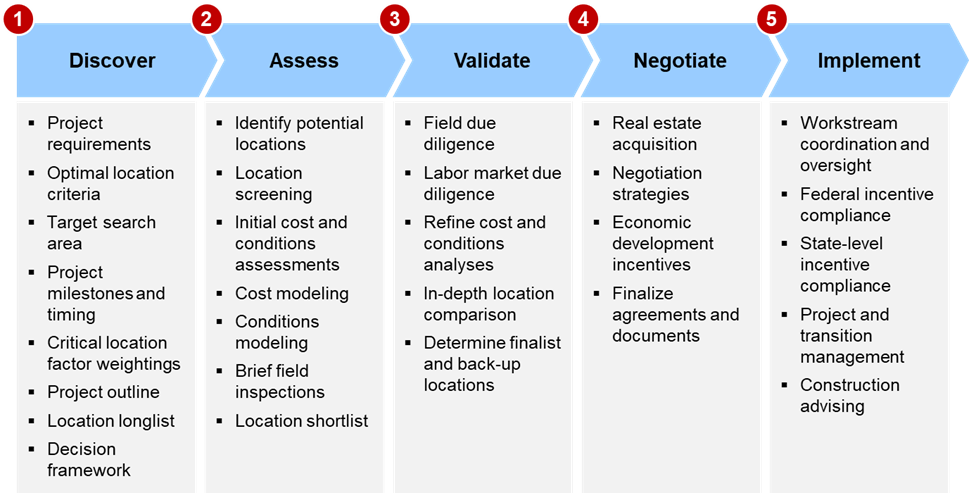

Figure 1. Example site selection methodology

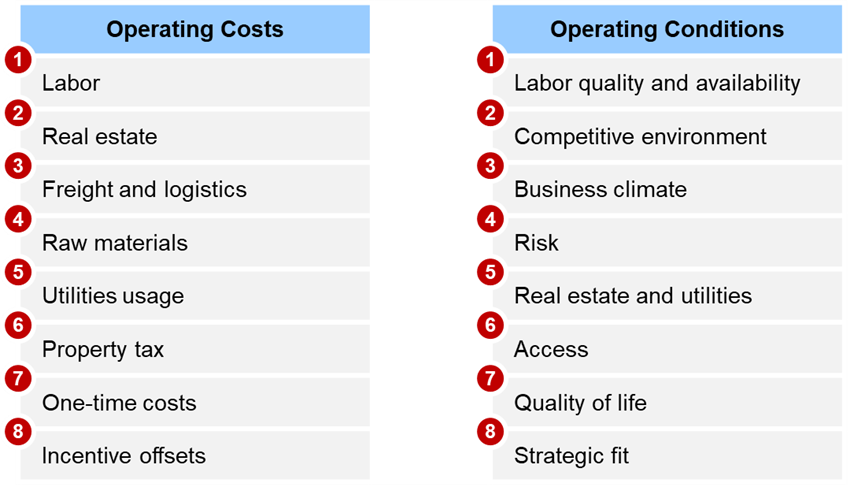

The first step in finding the perfect spot for a new project is defining the location criteria and project requirements. What are the must haves for the project to succeed? Maybe the project needs to be in an area with certain supportive policies or requires proximity to key raw materials. Then the initial longlist of locations can be narrowed down to a shortlist by assessing operating costs and conditions with modeling tools. Effective cost modeling allows a company to determine the most important operating costs to minimize for a successful project.

Figure 2. Key operating costs and conditions used in site selection

After initial assessments and modeling, all findings need to be validated. This due diligence is an important step of the process and is necessary for narrowing down a shortlist of locations to a few finalists. More scrutinous assessments of shortlisted locations can turn up critical information that may have been missed in prior stages of the site selection process. Then with all available information, shortlisted locations are compared in-depth to determine a finalist location and back-up options.

Once a final location has been settled on, the negotiation process begins. This process includes acquiring real estate and all necessary permits and permissions to build the project. This is where back-up locations may become needed if negotiations fall through or do not come out on budget.

After all agreements and documents have been finalized, the project enters the implementation phase. Implementation includes facility construction and making sure the project is in compliance with government incentive programs. This phase also typically has designated project and transition management teams to aid the process.

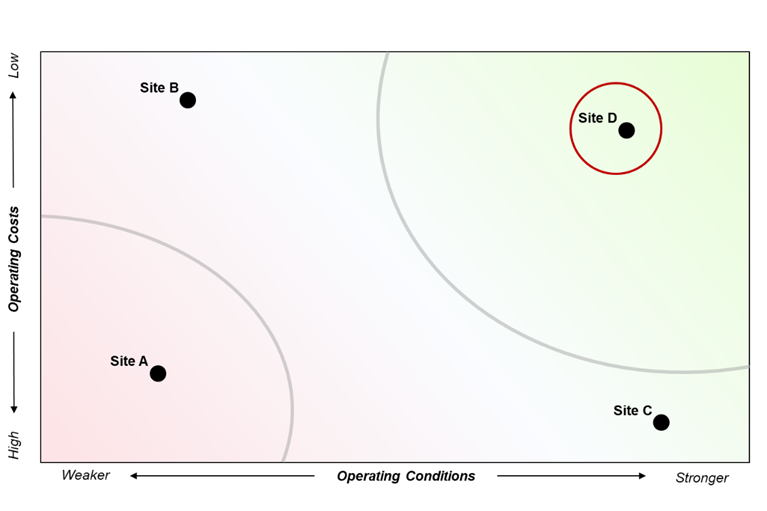

In Figure 3 below, there is an example with four locations that were evaluated based on their operating costs and conditions. Site A has high operating costs and less desirable operating conditions that make it a poor fit for the company’s next site location. Site B offers the lowest operating costs but has still has operating conditions that are less than desirable. Site C has the best operating conditions but also has the highest operating costs making it a less-than-ideal fit for the company. Site D would be the best option for the company’s new site in this example because it offers the desired mix of operating costs and conditions.

Figure 3. Example site selection comparison

ADI has helped several clients with their site selection process in the past including an advanced plastics recycler. They were looking for a location that offered favorable policies, proximity to large sources of plastic waste, and allowed them to develop and scale-up operations quickly. ADI narrowed down an initial list of 24 states with policies supportive of advanced plastics recycling to a shortlist of 10 states based on residential recycling, presence of major plastic scrap producing industries, and a high-level policy and regulatory assessment. Each state then received an in-depth assessment of waste plastic feedstock availability to determine which states would be best for the client’s next pyrolysis facility.

ADI has also helped a chemical manufacturer identify potential sites for a new liquid methionine production facility on the U.S. Gulf Coast. The study focused on feedstock availability and sourcing of the four key raw materials needed for the client’s plants namely ammonia, propylene, methanol, and H2S. ADI conducted a deep dive to locate facilities that produce sufficient volumes of these raw materials on the U.S. Gulf Coast and had merchant volumes to supply the client’s facility. Based on this assessment, ADI was able to recommend an ideal location for the client’s new liquid methionine plant.

Each of these announcements need the structured process we have discussed in the in the earlier part of this blog. Whether they are aiming to grow their core business or expanding into new markets, ADI offers the expertise to help companies at any stage of their journey.

-Piercen Hoekstra

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including oil & gas, chemicals, and energy transition, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.