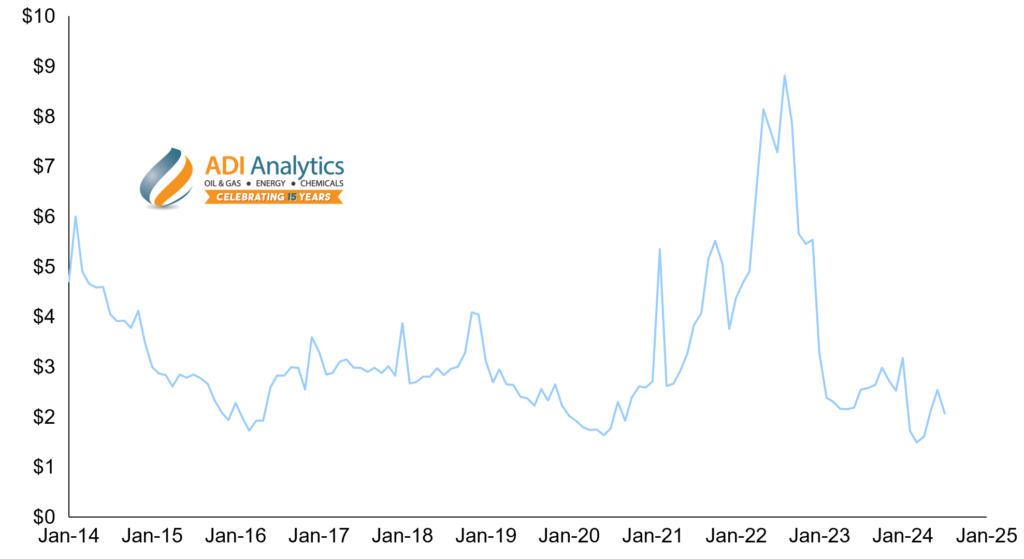

ADI has been reporting about struggling natural gas prices over the past year. U.S. natural gas prices have been on a rollercoaster again this year despite the country emerging as the top LNG exporter globally. Henry Hub benchmark prices started at $3.18 per MMBtu in the beginning of this year but fell to $1.49 per MMBtu in March before picking up again at $2.07 per MMBtu last month. Exhibit shows natural gas prices over the past 10 years.

ADI is pessimistic about natural gas prices in the short term

As the Permian continues to be the most prolific oil-producing play in the U.S., associated gas production from the region is estimated to average 24.8 billion cubic feet per day (Bcfd) in 2024. In addition to gas production growth, inadequate gas takeaway capacity, mild demand growth, and maintenance and delays at existing and new LNG export facilities have all contributed to the low gas prices. Natural gas prices at Waha went negative during May and August 2023 due to low demand and pipeline maintenance. These prices turned negative again during May, April, and July this year.

Increasing gas takeaway capacity is the only likely solution to stabilize Henry Hub prices in the region. The 580-mile, 2.5 Bcfd Matterhorn Pipeline, jointly developed by WhiteWater, EnLink Midstream, Devon Energy, and MPLX, is expected to come online as early as September 2024 providing some relief to gas producers in the Permian. Energy Transfer’s 260 mile, 1.5 to 2.0 Bcfd pipeline is expected to take a final investment decision (FID) later this year but it will not be operational for another couple years. Kinder Morgan plans to expand its 448 mile, 2.5 Bcfd pipeline by another 570 MMcfd sometime in the near future.

Talking about LNG export capacity, Freeport LNG is expected to rise to full utilization of its 15 million tons per annum (mtpa) capacity by the end of August or early September. Cheniere Energy plans to announce the expected start-up of its Corpus Christi 10 mtpa plant in South Texas in September following a slowdown due to labor issues. Golden Pass LNG, on the other hand, faces more delays and has revised the expected start-up of its 5.2 mtpa capacity to the end of 2026.

ADI is bullish on U.S. natural gas in the medium to long term

While global oil and gas demand growth has slowed down, natural gas will continue to play a significant role in the global energy mix through 2050. In the long term, the U.S. natural gas market is poised for a significant uptick in prices over the coming years, driven by a confluence of factors. A combination of increased LNG exports, rising domestic demand, and global geopolitical tensions is expected to fuel a bullish market.

Although the LNG market in the near term is beset by project delays and regulatory uncertainty with the White House pause on new LNG export projects, we anticipate U.S. LNG capacity to grow in the long term. As U.S. LNG exports increase, domestic supply will tighten, pushing prices higher.

In addition to exports, domestic demand for natural gas is also likely to rise in the medium to long term. A key driver will likely be rising electricity demand led by a growing share of electric vehicles and data centers for artificial intelligence.

Geopolitics is also likely to favor U.S. natural gas markets in the long term. The ongoing conflict in Ukraine has had a substantial impact on global energy markets, and underscored the need for access to commodities such as natural gas from geopolitically reliable suppliers such as the U.S. Collectively, ADI is forecasting that Henry Hub gas prices will average $2.25 per MMBtu in 2024 but will rise to a little over $3.00 per MMBtu in 2025.

— Panuswee Dwivedi and Uday Turaga

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including oil and gas production, pipeline capacity buildout and maintenance, and oil and gas prices, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives together for meaningful dialogue and strategic insights across the oil & gas, energy transition, and chemicals value chains. Learn more about the ADI Forum, which is chaired by Uday Turaga, Founder & CEO, ADI Analytics, at www.adi-forum.com.

Subscribe to our newsletter or contact us to learn more.