The chemical industry, a hard-to-abate sector, is a major source of greenhouse gas (GHG) emissions due to its high energy consumption. This significant energy use is largely driven by the extensive operation of furnaces and boilers, particularly in producing products such as ethylene. To address this, the industry faces considerable pressure to decarbonize and one of the key levers is reducing its Scope 2 emissions. Various protocols and strategies are available to assist chemical companies in this endeavor. For example, the Science Based Targets initiative (SBTi) and the Greenhouse Gas Protocol provide guidelines and frameworks for setting emissions reduction targets and accurately reporting emissions. The SBTi and Greenhouse Gas Protocol emphasize the use of renewable electricity for chemical companies to achieve Scope 2 emission reductions.

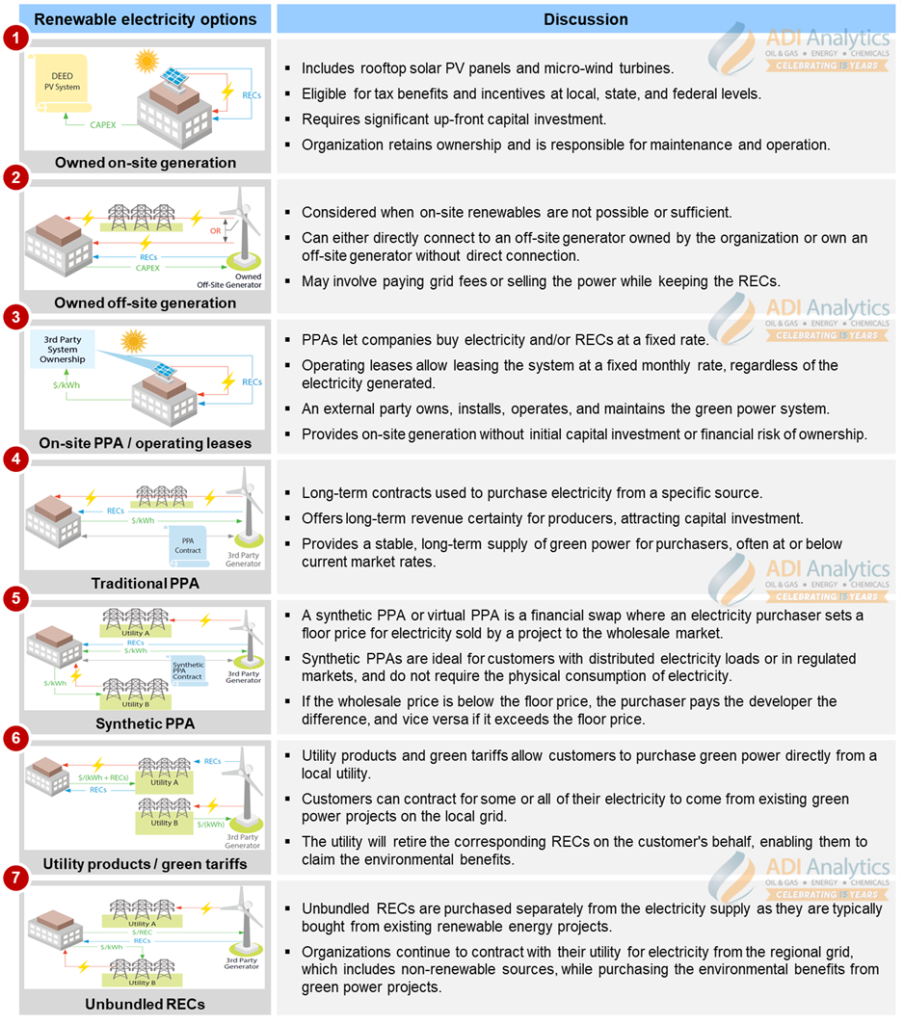

There are seven options that chemical companies can adopt to obtain renewable electricity for their Scope 2 emission reduction commitment (see Exhibit 1). These options include:

- On-site generation

On-site generation involves installing renewable energy systems, such as rooftop solar photovoltaic (PV) panels and micro-wind turbines, directly at the facility. These installations are eligible for tax benefits and incentives at the local, state, and federal levels, providing a financial advantage. The organization retains ownership of the system and is responsible for its maintenance and operation, offering direct control over energy production and use.

- Off-site generation

Off-site generation is suitable when on-site renewables are impractical. This option involves either a direct connection to an off-site generator owned by the company or owning an off-site generator without direct connection. This may include paying grid fees or selling the power while retaining the Renewable Energy Certificates (RECs) to claim environmental benefits.

- On-site Power Purchase Agreement (PPA) / operating leases

Under these agreements, a third party owns and operates the renewable system on the company’s property. Companies buy electricity and/or RECs at a fixed rate under a PPA or lease the system at a fixed monthly rate, offering on-site generation benefits without up-front capital costs or maintenance responsibilities.

- Traditional PPA

A traditional PPA is a long-term contract used to purchase electricity from a specific off-site renewable energy project. They provide long-term revenue certainty for producers and offer stable, often competitive, green power prices for purchasers, helping meet sustainability targets.

- Synthetic PPA

Synthetic PPA, also known as a virtual PPA, is a financial arrangement where the company sets a floor price for electricity sold to the market, without requiring physical electricity delivery. This option is ideal for distributed electricity loads or regulated markets, synthetic PPAs involve compensating the developer if market prices fall below the floor price, and receiving compensation if prices rise above it.

- Utility products / green tariffs

Utility products / green tariffs allow companies to purchase green power directly from their local utility supplier. Companies can contract for some or all of their electricity to come from existing green power projects on the local grid. The utility retires the corresponding RECs on the customer’s behalf, enabling them to claim the environmental benefits associated with renewable energy.

- Unbundled RECs

These RECs are bought separately from the electricity supply, typically from existing renewable projects. Companies continue to use grid electricity, including non-renewables, while purchasing RECs to claim the environmental benefits of renewable energy and support renewable projects.

Exhibit 1: Renewable electricity options for Scope 2 emission reduction. Source: WSP

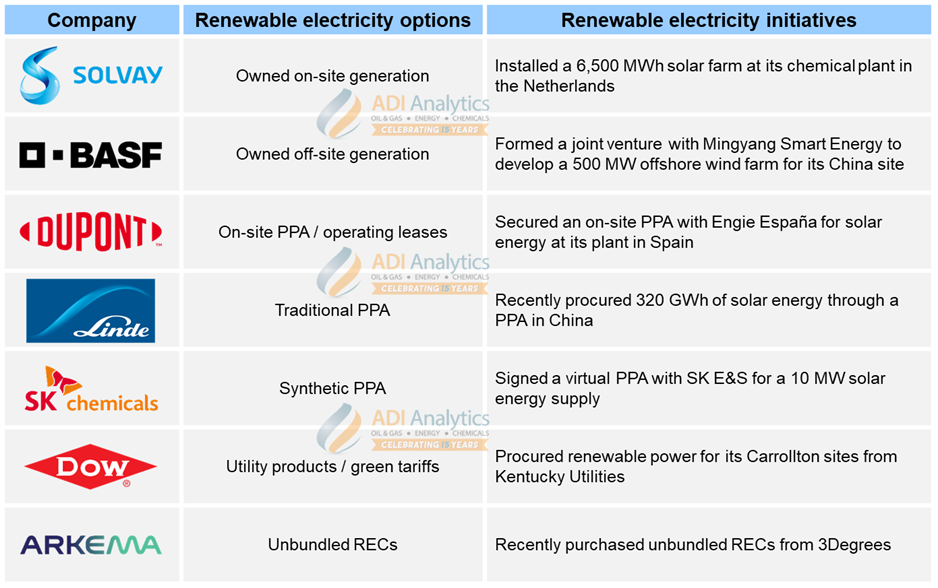

Several chemical companies are already undertaking various initiatives to obtain renewable electricity, aiming to reduce their Scope 2 emissions and achieve decarbonization commitments (see Exhibit 2). For instance, Solvay installed a 6,500 MWh solar farm at its chemical plant in the Netherlands. BASF is collaborating with Mingyang Smart Energy to develop a 500 MW offshore wind farm for its Zhanjiang site in China. DuPont secured an on-site PPA with Engie España, ensuring a reliable supply of solar energy for its plant in Spain. Linde recently procured 320 GWh of solar energy in China through a PPA with Guangdong Energy Group (GEG) and China Three Gorges Corporation (CTG). SK Chemicals signed a virtual PPA with SK E&S for a 10 MW solar supply. Dow sourced renewable power for its Carrollton sites from Kentucky Utilities, and Arkema has recently procured unbundled RECs from 3Degrees.

Exhibit 2: Renewable electricity initiatives for Scope 2 emission reduction from a select group of chemical companies

As the world transitions towards a greener future, chemical companies are under increasing pressure to reduce their GHG emissions. We observed that many major players in the chemical industry are already proactively integrating renewable electricity into their operations to reduce Scope 2 emissions. In Part 2 of this blog, we will delve deeper into the seven renewable electricity options previously mentioned, covering the characteristics of each option, and the potential risks associated with renewable energy solutions.

– Edmund Lam

Please contact ADI at info@adi-analytics.com if you would like to understand Scope 2 emissions across chemicals, policies and regulations on their mitigation globally, and developing business, operational, technology, and sustainability strategies including renewable energy procurement to mitigate them.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including renewable energy procurement and Scope 2 emission reduction strategies, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.