At roughly 20% of global greenhouse gas emissions, methane packs a disproportionate punch, being 80 times more potent than CO2 over 20 years. Reducing methane emissions, particularly from oil and gas production (Scope 1 emissions), offers a powerful and rapid way to slow climate change.

Methane emissions in oil and gas production permeate every step of the value chain, released intentionally through venting or flaring, or unintentionally as fugitive emissions. Venting, often caused by equipment malfunctions, scheduled maintenance, or inadequate infrastructure, results in the deliberate release of methane into the atmosphere. Flaring, primarily intentional due to infrastructure limitations or economic constraints on capturing the gas, can significantly vary in impact depending on the condition of the flares and the completeness of combustion. Fugitive emissions, originating mainly from gas production and transportation, stem from leaks and unintentional releases due to faulty equipment and subpar maintenance practices.

However, driving emissions reduction in oil and gas operations is not straightforward and will need significant investment in new equipment, technologies to recover methane, and infrastructure to handle recovered methane including storage and utilization options. Such investment will need policy, regulatory, economic, and institutional support along with means to share knowledge across oil and gas producers globally.

Progress and pledges

As a result, there has been significant progress in reducing methane emissions recent years, with more countries and companies joining pledges and implementing stricter regulations.

The Global Methane Pledge and Nationally Determined Contributions (NDCs) under the Paris Agreement were key drivers, alongside initiatives like the Oil and Gas Decarbonization Charter (OGDC). The European Union (EU) and the United States launched the Global Methane Pledge (GMP) at the COP26 where its more than 155 country participants agree to take voluntary actions to contribute to a collective effort to reduce global methane emissions at least 30% from 2020 levels by 2030.

Several countries have also taken concrete steps:

- United States: Finalized new regulations in December 2023 targeting new and existing oil and gas facilities. This includes a first-of-its-kind Super Emitter Program to address high-emission events and is estimated to reduce emissions by nearly 80% by 2038.

- Canada: Advanced new rules aiming for a 75% reduction in oil and gas emissions by 2030 compared to 2012 levels. These regulations focus on leak detection and repair (LDAR), limitations on routine flaring and venting, and stricter equipment standards.

- European Union: Agreed on a methane regulation requiring regular emissions reporting, mandatory LDAR, restrictions on flaring and venting, and emissions standards for imported fuels. This represents a major step as the EU is a significant energy importer.

These are just a few examples, with countries like Colombia, Mexico, Nigeria also having regulations in place, and others like China, Brazil, and Kazakhstan developing plans. The focus on LDAR, equipment mandates, and limitations on flaring/venting are common themes in these initiatives. Mitigation options go beyond regulations, encompassing leak detection and repair, equipment standards that minimize leaks, and limitations on venting practices.

Industry taking the lead

The Oil and Gas Decarbonization Charter (OGDC), launched at COP28, is a key industry initiative. This charter unites 52 companies aiming for net-zero emissions and near-zero upstream methane emissions by 2030. Notably, 60% are National Oil Companies (NOCs) new to such initiatives. The OGDC targets a 0.2% methane intensity for oil and gas production by 2030 (potentially reducing global emissions by 20 Mt annually), but the measurement method poses a challenge for comparisons between companies. Transparency and verification of emissions are crucial, and the OGDC encourages companies to join existing reporting initiatives and collaborate to extend emission reduction efforts. While the focus is on upstream emissions, addressing downstream segments remains vital.

Challenges with methane emissions inventory

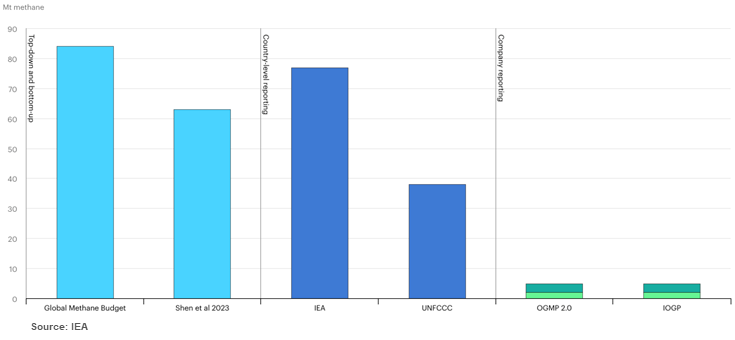

A key challenge in this area is the significant gap that exists between reported and actual methane emissions, especially from oil and gas (see Exhibit 1). New initiatives are closing this gap by combining improved measurement techniques with standardized reporting methods. The UN Environment Programme’s Methane Alert and Response System (MARS) identifies major emission events for faster intervention, while organizations like the Oil & Gas Methane Partnership develop frameworks for consistent measurement, monitoring, verification, and reporting (MMRV). Collaboration and overcoming challenges in measuring emissions from areas like offshore rigs are critical. Here are a few prominent examples of the entities and initiatives focused on addressing data gaps in methane emissions:

- The UN Environment Programme (UNEP) spearheads the OGMP 2.0 program, which establishes a framework for oil and gas companies to report and reduce methane emissions.

- The International Working Group on Measurement, Reporting, and Verification (MRRV) is a consortium of countries, including the US, EU, and Canada, working collaboratively to enhance consistency in how companies and countries measure and report methane emissions.

- The International Association of Oil and Gas Producers (IOGP) is an industry association that furnishes resources for methane mitigation, such as a methane detection technology filtering tool.

- Ipieca (originally the International Petroleum Industry Environmental Conservation Association) is an industry association that collaborates with the oil and gas sector on environmental issues, including methane emissions.

- The Oil and Gas Climate Initiative (OGCI) is an industry group comprised of major oil and gas companies committed to reducing greenhouse gas emissions.

- MiQ and Project Canary are companies developing cutting-edge technologies and services designed to assist oil and gas operators in measuring and reporting methane emissions.

These advancements offer a powerful tool to tackle methane emissions. By providing more accurate data and informing mitigation efforts, these initiatives hold immense potential to significantly reduce methane released into the atmosphere, offering a crucial step forward in combating climate change.

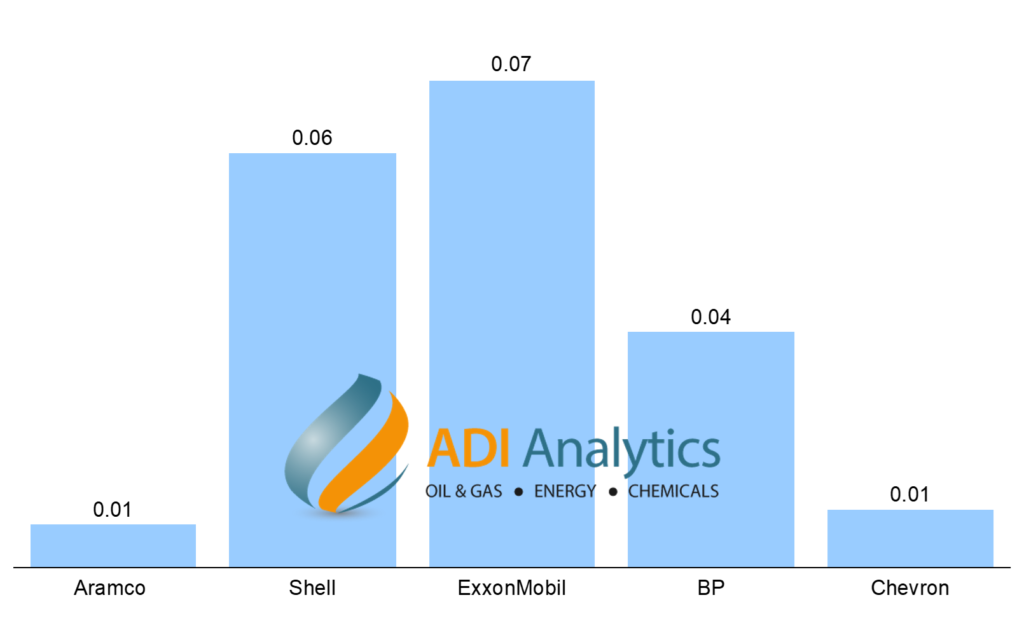

ADI’s experience with methane emissions data

ADI has been advising numerous clients on methane emissions. The foundation of our approach rests upon ADI’s extensive proprietary datasets on greenhouse gas (GHG) and methane emissions meticulously collected over the past decade (refer to Exhibit 2 for a sample). We possess a pre-established global registry of oil and gas operators segmented by a multitude of relevant categories and metrics, which will be instrumental throughout this project. These data streams are culled from diverse sources encompassing company presentations, annual reports, sustainability reports, ESG reports, and various official announcements.

As illustrated in Exhibit 2, our proprietary databases house upstream methane emissions data for select oil and gas producers, expressed in kilograms of methane per barrel of oil equivalent. These data were meticulously assembled from a comprehensive array of sources, including oil and gas companies’ sustainability and ESG reports, filings submitted to various regulatory agencies (e.g., U.S. Environmental Protection Agency, U.S. Energy Information Administration, state environmental agencies, international organizations, etc.), and similar government entities across the globe.

Furthermore, we have incorporated emission estimates derived from datasets published by the World Bank and other multilateral agencies, encompassing data on regulatory strength and governance that aids in assessing maintenance practices within the industry. Our datasets also encompass estimates derived from satellite observations, particularly for prolific emitters, which are made publicly available. Finally, we have compiled industry data and information pertaining to production types, company classifications, and flaring practices, gleaned from trade publications, academic journals, and other credible sources.

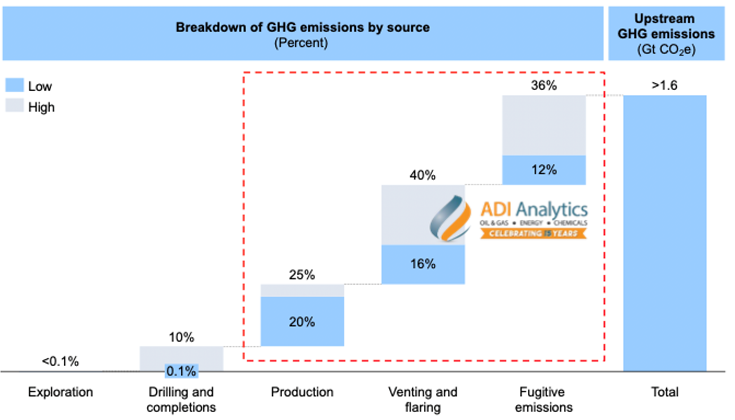

ADI’s current focus is on organizing the data by value chain segment to exploit its richness and detail for differentiated insights. Exhibit 3 is an example of the insights such data analytics can produce. It shows a breakdown of GHG emissions by key unit operations – i.e. exploration, drilling and completions, production, venting and flaring, and fugitive emissions – for an upstream oil & gas producer. ADI has helped several oil and gas companies with analysis of emissions data in the industry and for their competitors using our proprietary databases, research, and analytics. We will bring the same approach to analyzing and report the data sets on methane emissions with this granularity to enable analytically insightful outcomes.

— Panuswee Dwivedi and Uday Turaga

Please contact ADI at info@adi-analytics.com if you would like to understand methane emissions across oil & gas and chemicals, policies and regulations on their mitigation globally, and developing business, operational, technology, and sustainability strategies to mitigate them.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in these segments including methane and greenhouse emissions and their mitigation, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.