In a previous blog post, we discussed the difficulties of reducing greenhouse gas (GHG) emissions in the chemical industry. Similar challenges also exist in the oil and gas industry, particularly in the upstream sector, which is known for being one of the most difficult sectors to reduce GHG emissions. According to the International Energy Agency (IEA), oil and gas companies are currently responsible for approximately 15% of GHG emissions in the energy sector, which amounts to ~5 gigatonnes (Gt) of CO2 equivalent from their operations alone. The upstream segment is particularly challenging to decarbonize and is the most carbon-intensive part of the oil and gas industry compared to the downstream, accounting for more than half of the total emissions from oil and gas operations as noted by the IEA.

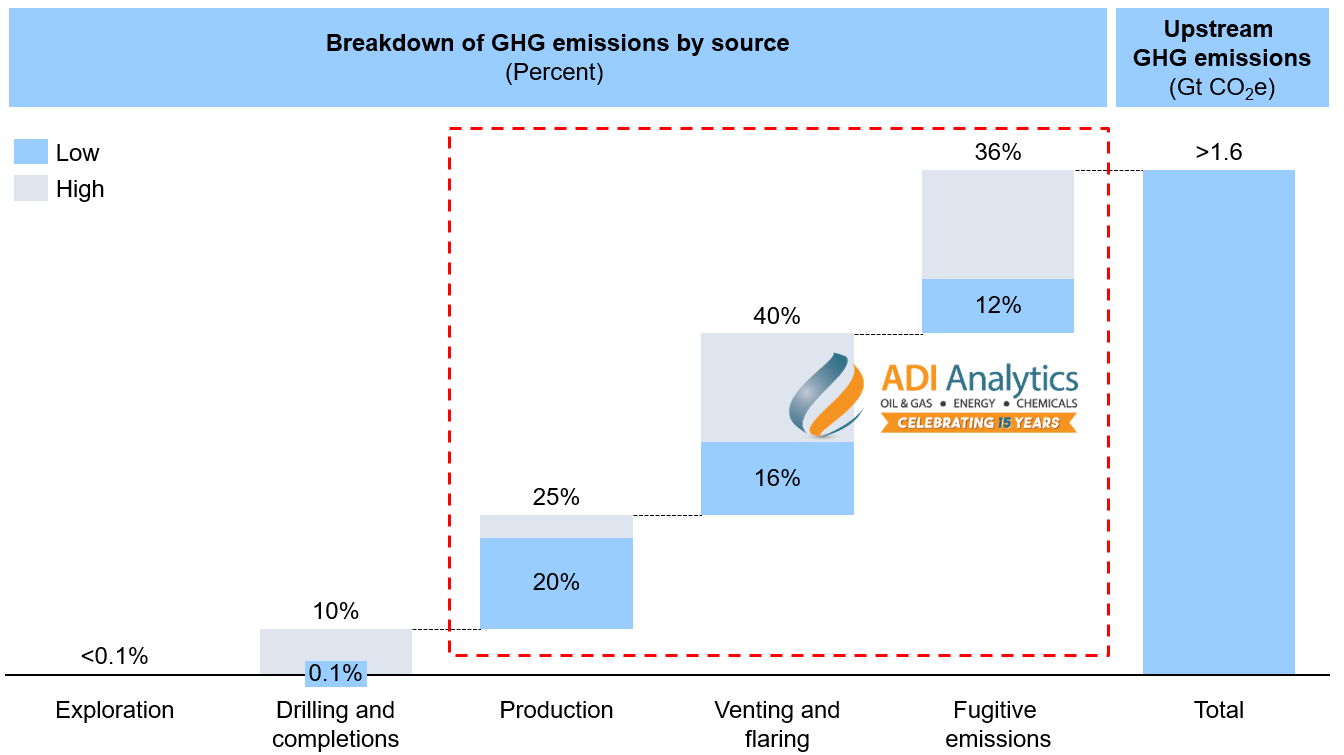

The sources of upstream GHG emissions come from various stages of the production process, including exploration, drilling, completions, and with a significant share from production, venting, flaring, and fugitive emissions (see Exhibit 1). While exploration and drilling activities contribute minimally to total upstream GHG emissions, emissions from production, venting and flaring, and fugitive emissions are the major contributors. Emissions from engines, compressors, and machinery during production account for 20% to 25% of total emissions. Venting and flaring, which involve the combustion or release of associated gas, constitute a significant portion, contributing between 16% to 40% of total GHG emissions. Meanwhile, fugitive emissions, resulting from equipment leaks and unintended releases, dominate the share of GHG emissions, representing 12% to 36% of total emissions in the upstream sector.

Exhibit 1. Upstream GHG emissions breakdown by source, percent and gigatonnes CO2e. Source: McKinsey, BloombergNEF, Resource Works, OPGEE

GHG emissions are categorized into three types based on the scope of operations that produce them for effective management and reporting. Scope 1 includes direct emissions from owned or controlled sources, such as those from exploration, drilling, extraction, production, venting and flaring, and fugitive emissions. Scope 2 encompasses indirect emissions from purchased electricity, steam, heating, and cooling. Scope 3 covers all other indirect emissions (not in Scope 2) that occur in the value chain of the reporting company, including emissions from the production and transport of purchased goods and services, business travel, waste disposal, etc.

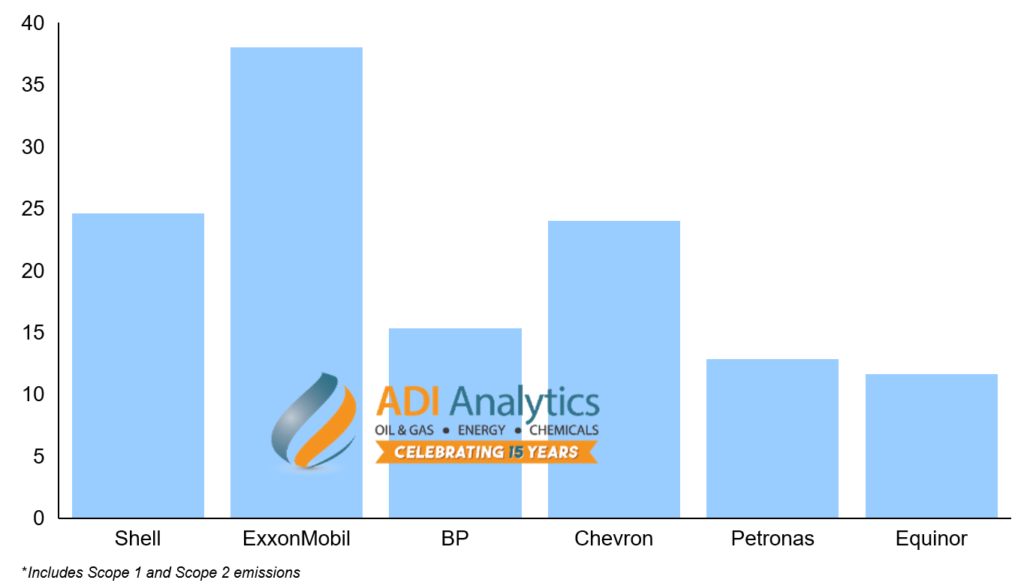

Today, the oil and gas industry is under pressure to reduce emissions and they are focusing on Scope 1 and 2 emissions as they are mandatory to report, whereas Scope 3 emissions reduction is voluntary and the hardest to monitor. Among the major oil producers, Petronas, BP, and Equinor have the lowest upstream GHG emissions compared to other giants such as Shell, ExxonMobil, and Chevron (see Exhibit 2).

Exhibit 2. Upstream GHG emissions of oil and gas companies in million metric tons of CO2e

Oil and gas companies have several options to decarbonize their carbon-intensive upstream operations. One option is to transition from diesel to natural gas as a combustion fuel for engines and machinery, or to use renewable or low-carbon electricity to power equipment, which can significantly reduce production emissions. Another option is to invest in technologies to reduce methane emissions. Improving equipment reliability and minimizing outages can also help reduce non-routine flaring. Furthermore, advanced sealing technologies can play a crucial role in reducing fugitive emissions by minimizing unwanted leakage and improving emission control. Several projects at ADI have focused on evaluating equipment and technology offerings to cut emissions.

One example of equipment electrification is BP’s investment in grid infrastructure for electrification in hydraulic fracturing. BP has successfully electrified 80% of its shale production from Permian wells with off-grid electricity and is now working towards complete electrification. In offshore Europe, Equinor is reducing emissions by powering its Norwegian offshore platforms with onshore electrification. Recently, Equinor has expanded its onshore electrification to its other two offshore natural gas hubs. ADI has been helping numerous oil and gas operators with strategies to cut emissions.

Investments in carbon capture technology are helping to reduce venting emissions by utilizing captured CO2 for enhanced oil recovery (EOR), thereby decarbonizing operations. For example, at the recent Asia Turbomachinery & Pump Symposium (ATPS) 2024 in Malaysia, ADI’s analyst Edmund Lam noted that leading upstream turbomachinery manufacturers like Atlas Copco are developing CO2 compressors for use in EOR within the growing carbon capture segment. Additionally, Atlas Copco has recently acquired three compressor specialists to improve the energy efficiency of their gas compressors, aligning with the industry’s emission reduction goals.

Flaring emissions reduction can be achieved by improving reliability and reducing the frequency of equipment outages. At ATPS 2024, Petronas showcased its commitment to enhancing the reliability of its upstream assets by establishing dedicated divisions for asset integrity and digital solutions. These divisions focus on predictive analytics to forecast equipment performance, aiding in efficient maintenance and replacement, ultimately reducing downtime and the need for non-routine flaring. Furthermore, CCC Global, now owned by Honeywell, announced the integration of its proprietary performance analytics, optimization algorithms, and predictive analysis with Honeywell’s existing offerings. This integration aims to provide upstream users with a comprehensive asset performance management solution aimed at maximizing production uptime and reliability similar to those used by CCC Global and Honeywell’s core downstream customer base.

Oil and gas companies can reduce fugitive emissions by investing in advanced sealing technologies to decrease unwanted leakage. For example, Emerson, a top supplier of measurement instrumentation for upstream operations, provides low-bleed pneumatic, electric, or hybrid instruments to minimize gas loss and reduce methane and other greenhouse gases. Furthermore, some of Emerson’s instruments, such as valves, utilize improved stem seal technology to achieve zero leakage, enhancing emission control for upstream oil and gas operations.

In conclusion, the oil and gas industry is at a crucial juncture in its history, facing increasing pressure to reduce its substantial contribution to global GHG emissions. Following the release of the Oil and Gas Decarbonization Charter after COP28, there is a strong call for the sector to achieve near-zero methane emissions and eliminate routine flaring by 2030, with the ultimate goal of reaching net-zero GHG emissions by 2050. This initiative is prompting oil and gas companies to turn their emission-reduction commitments into tangible actions, thus accelerating climate action. As leading operators continue to innovate and expand their efforts, the industry has the potential to make a significant impact on global climate goals and pave the way for a more sustainable energy future.

– Edmund Lam

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including upstream oil and gas, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.