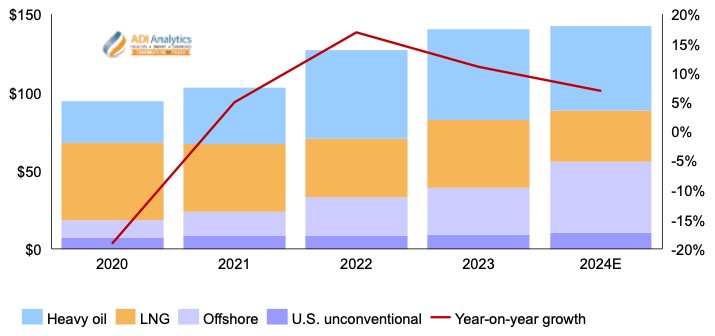

Recent decisions by governments and energy companies highlight a growing focus on energy security over energy transition. South Korea, a leading importer of fossil fuels and home to some of the largest chemical companies in Asia Pacific, recently commissioned geophysical exploration that showed likelihood of 14 billion barrels of oil and gas off the coast of Pohang. New Zealand is also revoking its offshore exploration ban, under which over 4 million km2 of exclusive economic zone has been off limits for six years, as it is suspected that the declining natural gas reserves will not be able to sustain domestic demand in the long term. Overall, as shown in exhibit 1, we expect investments in oil and gas to grow over 5% in 2024 compared to 2023 with growing share of offshore investments.

Exhibit 1. Total capex invested in top oil & gas projects by asset type in billion U.S. Dollars and year-on-year growth in total capex in percentage.

Oil and gas majors like Shell, BP, and ExxonMobil, who previously invested heavily in low-carbon technologies, are now refocusing on their core business. This shift prioritizes profitability and competitiveness in the near term. While they haven’t abandoned low-carbon technologies entirely, the immaturity of these markets and technologies limits their return on investment. Additionally, rising oil and gas prices (2021-2022), concerns about renewable energy’s intermittency, and limitations in transportation (e.g., hydrogen for light-duty vehicles) have all contributed to this shift. As a result, these majors are reorganizing their portfolios to prioritize fossil fuels.

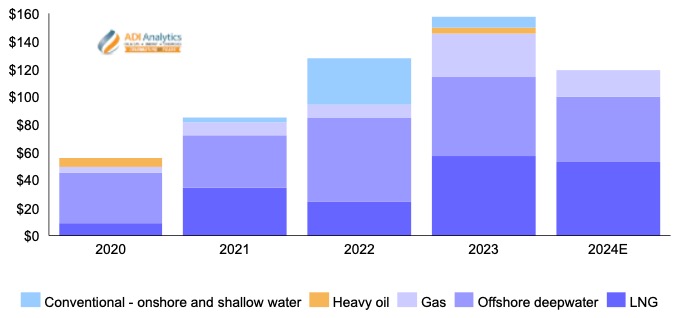

Exhibit 2. Top projects capex sanctioned by asset type in billion U.S. Dollars.

Shell is also increasing its stake in liquified natural gas (LNG), as evidenced by its acquisition of certain assets of LNG trading firm, Pavilion Energy. Global LNG demand is projected to grow significantly through 2030, with U.S. LNG capacity expected to nearly double in the near term. Exhibit 2 depicts capital sanctioned for top projects, reflecting a growing emphasis on offshore and LNG ventures. ADI Analytics closely monitors upstream trends, including how the contribution of different energy sources will look like in various energy transition scenarios. While ADI expects oil and gas to continue to play an important role in the global energy mix, drivers of that energy mix continue to evolve, be it decarbonization, profitability, or energy security.

By Panuswee Dwivedi

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including oil and gas exploration trends and LNG, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.Subscribe to our newsletter or contact us to learn more.