Ammonia plays a crucial role in fertilizer production, with 70% of the global demand for ammonia attributed to fertilizer production. Traditionally, ammonia is produced via a carbon-intensive process known as the Haber-Bosch process using hydrogen which is produced via an energy-intensive process, contributing to CO2 emissions via fossil fuel use. The Haber-Bosch process results in the production of 1.8 to 2.4 tonnes of CO2 per tonne of ammonia, contributing to the high carbon intensity of agriculture.

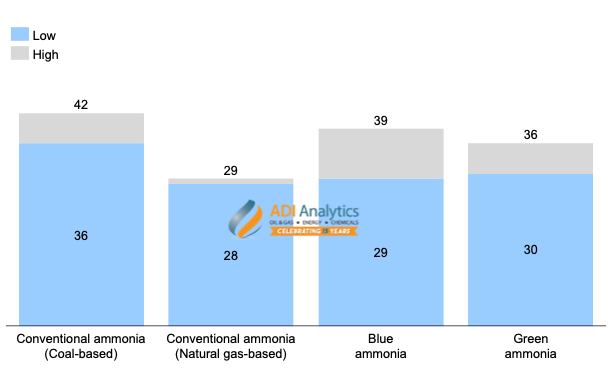

In light of the global decarbonization effort, major fertilizer producers like Yara and CF Industries have invested heavily in clean technologies such as carbon capture and storage (CCS) and electrolyzer technologies to produce blue and green ammonia to reduce the carbon footprint of fertilizer. Blue ammonia is conventional ammonia, but with CCS installed within the ammonia production process to reduce emissions. While blue ammonia may serve as a near-term solution in reducing carbon emissions, achieving a net-zero future will require a shift to green ammonia. Green ammonia, on the other hand, is carbon-free because the hydrogen it uses is produced from water electrolysis using renewable energy. Comparing the energy intensity between different ammonia production pathways, blue ammonia requires around 29 to 39 gigajoules of energy per tonne of ammonia, which is similar to the energy intensity of conventional production methods (see Exhibit 1). Green ammonia, on the other hand, is slightly less energy-intensive than blue ammonia.

Exhibit 1. Energy intensity for ammonia synthesis by production pathway, gigajoules per metric ton of ammonia produced

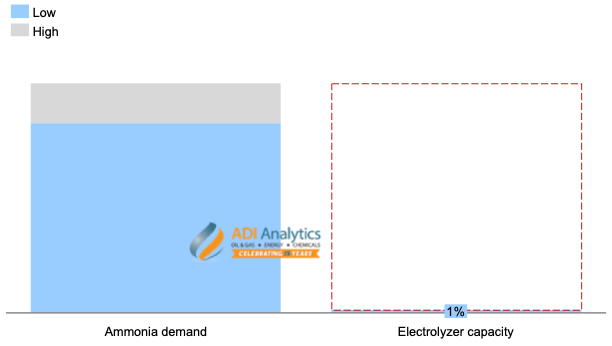

Based on the energy intensity of green ammonia and the total installed electrolyzer capacity in 2023, only around 1% of the ammonia demand for fertilizer production in 2023 is met by green ammonia. (see Exhibit 2). Producing green ammonia is not only expensive but also requires a significant increase in electrolyzer capacity to scale up production. Topsoe, leveraging its long expertise in the ammonia production value chain, is now working on solid-oxide electrolyzer technology and is partnering with companies like First Ammonia and Uniper to commercialize its electrolyzer technology on a green ammonia project in Texas.

Exhibit 2. Energy gap for green ammonia to meet global ammonia demand, gigwatts

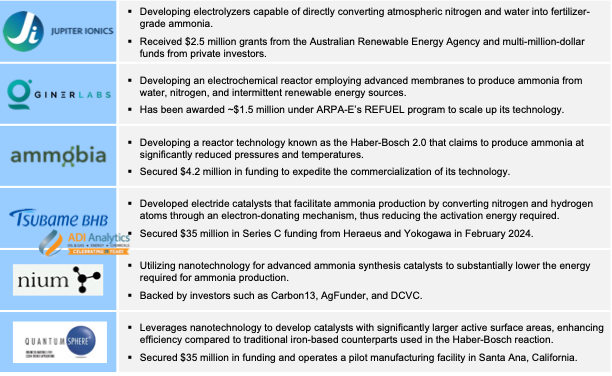

Several start-ups are exploring alternative production pathways to accelerate the scaling up of green ammonia production (see Exhibit 3). For instance, Jupiter Ionics is a start-up that has developed the MacFarlane Simonov Ammonia cell, a modular electrolyzer that bypasses the hydrogen production step. This cell combines hydrogen and nitrogen atoms directly in the electrolytic cell using renewable energy, significantly reducing the energy needed. Giner Labs is working on an electrochemical reactor that can intermittently synthesize ammonia with water and nitrogen at a low temperature and pressure using their advanced membranes and renewable energy. In addition, Ammobia has introduced the Haber-Bosch 2.0 reactor, which operates at lower pressures and temperatures, improving ammonia conversion rates and eliminating the need for recycling loops, thus reducing capital expenditures and emissions.

Besides, several catalyst start-ups are developing innovative solutions involving electrocatalysis and nanoscale engineering in catalysis to improve ammonia production efficiency (see Exhibit 3). Companies like Tsubame BHB, Nium, and Quantum Sphere are pioneering new catalysts to enhance the efficiency of the Haber-Bosch process. Tsubame BHB, for example, has developed a novel ammonia catalyst known as the “electride catalyst” which utilizes an electron-donating mechanism on nitrogen and hydrogen to produce ammonia, requiring only half the activation energy of the conventional method. Nium and Quantum Sphere on the other hand have leveraged nanotechnology in their catalyst designs to increase active surface area, enhancing catalyst efficiency compared to traditional iron-based catalysts.

Exhibit 3. Start-ups developing green ammonia technology

Leading catalyst producers like Clariant and JGC Catalysts are paving the way in green ammonia synthesis. Notably, Clariant has collaborated with Casale in developing a new series of ammonia synthesis catalysts that can offer up to a 30% increment in efficiency and has proven to be able to reduce CO2 emissions of 4,700 MT per annum at Nutrien’s ammonia production plant in Trinidad and Tobago. Meanwhile, JGC Catalysts has developed a highly active ammonia synthesis catalyst that can facilitate the ammonia reaction at much lower operating conditions compared to conventional iron-based catalysts and has been deployed in a green ammonia demonstration plant in Japan.

Beyond using green ammonia to produce clean fertilizers, Windfall Bio is a notable start-up developing an innovative solution to eliminate the need for ammonia in producing nitrogen-rich fertilizers. Windfall Bio uses bio-fermenters packed with methane-consuming microbes to create nitrogen-rich fertilizers. They enhance the methane consumption capability of naturally occurring bacteria through artificial selection, resulting in fertilizers that boost soil fertility without the carbon footprint associated with ammonia production. Recently, Windfall Bio secured $28 million in Series A funding from investors, including Amazon and B37 Ventures, bringing their total funding to $37 million, which is dedicated to scaling up their microbe production.

As the world strives for a more sustainable future, various promising avenues are emerging to reduce the environmental impact of agriculture. Clean fertilizer technologies, such as low-carbon ammonia production and innovative microbial solutions, are advancements that can help mitigate this impact. Continued innovation and investment in sustainable practices will not only reduce carbon footprints but also pave the way for a greener future in food production.

– Edmund Lam

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including ammonia and other chemicals, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.