Natural gas prices are hitting rock bottom, with Henry Hub averaging a mere $1.49 in March 2024, the lowest monthly average since 1997. Shale operators are responding by curtailing production. Chesapeake, a leading producer, started the trend with cuts announced in early March. Other companies like Coterra Energy, Comstock Resources, EQT, and CNX Resources have followed suit, reducing drilling activity or implementing production curtailments.

ADI anticipates lower U.S. gas production

Based on these announcements and ADI’s natural gas price forecasts for 2024, U.S. production is expected to fall by more than 3 billion cubic feet per day (Bcfd) this year. Lower 48 production has already dipped from 104.7 Bcfd in February 2024 to 102.1 Bcfd, with Appalachia experiencing the most significant decline. Haynesville isn’t far behind, with E&P operators like Comstock announcing cutbacks.

Renewed interest in gas-to-liquids (GTL)

Amidst production cuts, two news items caught ADI’s attention, signaling a potential resurgence of GTL technology. First, Diamondback Energy, a prominent Permian E&P company, is partnering with Verde Clean Fuels to build a natural gas-to-gasoline facility in Martin County, Texas. This facility, utilizing Verde’s STG+ process, is expected to produce 3,000 barrels of gasoline daily and be operational by late 2025 or early 2026.

The STG+ process, developed by Primus Green Energy a few years ago, is a small-scale GTL technology that converts natural gas into either methanol or gasoline. The Martin County plant will utilize flared natural gas as feedstock, and the produced gasoline will be sold to Permian Basin refiners and distributors.

GTL plants convert natural gas into liquids like naphtha, diesel, and lubricants. This process involves gasification to produce syngas, which is then converted into liquid hydrocarbons using the Fischer-Tropsch process. A broader definition of GTL encompasses the conversion of natural gas to methanol, followed by further processing into gasoline using technologies like ExxonMobil’s methanol-to-gasoline process.

Adding to the GTL revival, Calgary-based Cerilon plans to build a complex in Trenton, North Dakota, for converting natural gas into diesel, jet fuel, and lubricants. In March 2024, they announced partnerships with Chevron, Worley, and ABB for equipment, technology licensing, and engineering, procurement, and construction (EPC) services. This 24,000 barrel-per-day plant, with a capex of $2.8 billion, is expected to be completed in 2028.

ADI revisits GTL economics

These developments remind ADI Analytics of the period over a decade ago when the North American shale gas revolution was just unfolding. The surging natural gas production led us to launch our first multi-client study on gas monetization in 2011. This study attracted numerous companies, from oil majors to project developers and shale independents. It also sparked a wave of consulting projects focused on various gas monetization options over the following years.

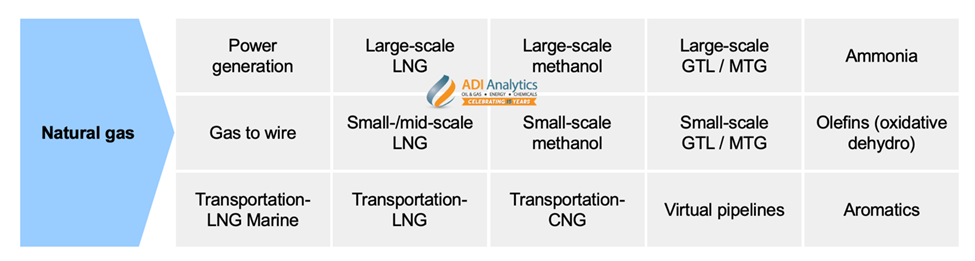

Back then, several proposals emerged for gas monetization projects utilizing LNG, GTL, CNG, methanol, and other technologies (refer to Exhibit 1). ADI conducted a comprehensive assessment comparing these options across factors like cost, economic viability, technological maturity, operational risks, and commercial models. This analysis considered how each option would fare for project developers in different regions of North America, taking into account both existing and new infrastructure requirements.

Exhibit 1. Gas monetization technologies and options considered in the U.S.

Price arbitrage: a key driver

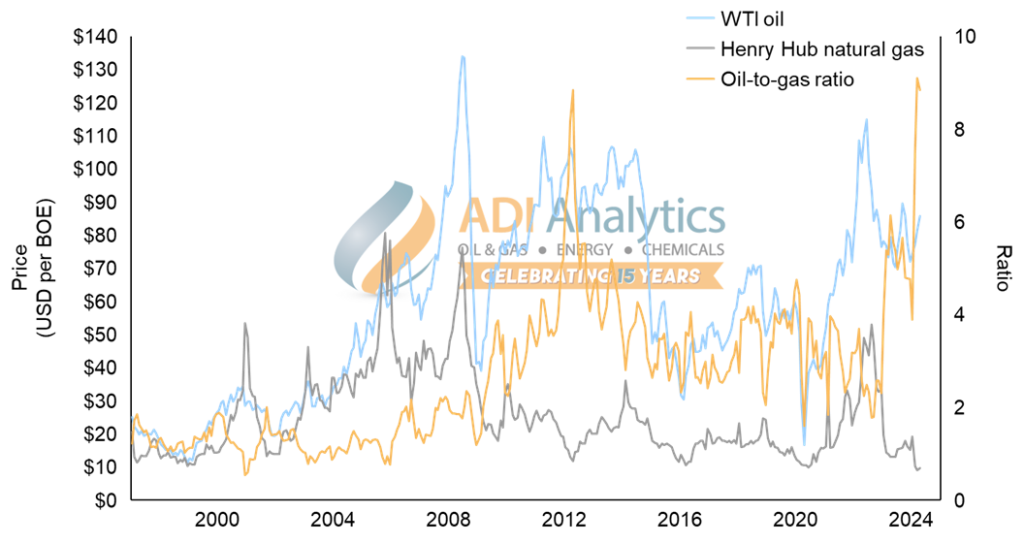

The primary economic driver for these projects was the price difference between oil and natural gas. Projects that could convert cheap natural gas into products priced on the basis of oil had the potential for significant returns. Consequently, the oil-to-gas price ratio on a barrel of oil equivalent (BOE) basis was a crucial metric. The recent decline in natural gas prices has reignited interest in exploiting this price arbitrage opportunity (refer to Exhibit 2).

Exhibit 2. West Texas Intermediate oil and Henry Hub natural gas prices, and the oil-to-gas price ratio on a BOE basis (Source: EIA).

Past analysis and renewed GTL interest

Our prior work (see Exhibit 3) compared the unleveraged investment returns of large-scale gas monetization options on the U.S. Gulf Coast. LNG projects emerged as the most profitable, while GTL and methanol-to-gasoline (MTG) projects offered lower returns. Notably, GTL using the Fischer-Tropsch process, which produces a full range of liquids like naphtha, diesel, and lubricants, had the lowest returns due to its exceptionally high capital costs.

Exhibit 3. Gas monetization projects’ internal rates of returns as a function of the oil and natural gas price ratio on BOE basis on the U.S. Gulf Coast assuming 35% taxes and no debt.

This analysis proved accurate over the following decade. Today, LNG remains the dominant gas monetization option, alongside natural gas for power generation. Unfortunately, none of the proposed GTL projects from that era materialized. Additionally, numerous attempts to commercialize smaller-scale GTL technologies fell short, with only one pilot-scale facility utilizing landfill gas ever being built, and subsequently shut down.

However, as Exhibit 3 also highlights, the oil-to-gas price ratio on a BOE basis became quite attractive in the first quarter of 2024. This shift likely explains the resurfacing interest in GTL. In response, ADI is currently updating our cost and economic models. We will revisit some of the assumptions made over a decade ago to assess GTL’s potential viability in the current market. We plan to share our findings in upcoming blog posts.

– Uday Turaga

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including natural gas monetization covering LNG, gas-to-liquids, methanol-to-gasoline, CNG, and virtual pipelines, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.