The Biden Administration’s recent pause on permits for LNG exports to non-FTA countries has sparked industry-wide debate. While motivated by climate concerns, the pause could delay the retirement of coal-fired plants in emerging economies, paradoxically slowing greenhouse gas (GHG) reductions.

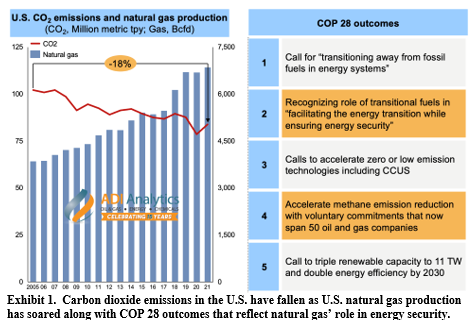

The U.S. has successfully cut its CO2 emissions by 18% since 2005, largely by switching from coal to natural gas (see Exhibit 1). Emerging economies could benefit from this strategy, and the U.S. should facilitate this transition with LNG exports aligned with the Paris Accord’s goals.

Exhibit 1. Carbon dioxide emissions in the U.S. have fallen as U.S. natural gas production has soared along with COP 28 outcomes that reflect natural gas’ role in energy security

Let’s examine the potential market implications of this pause:

- Temporary Setback: The pause is likely temporary due to the economic value of U.S. natural gas and LNG exports, and geopolitical pressures stemming from Europe’s reliance on U.S. LNG.

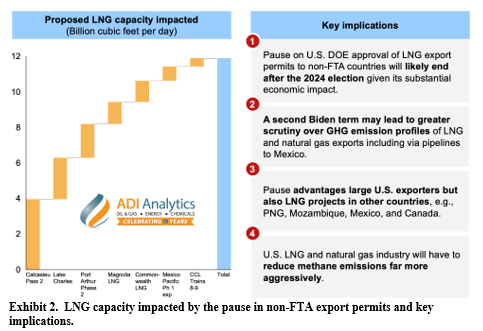

- Increased Scrutiny: Expect heightened focus on GHG emissions associated with LNG and natural gas exports, even if the pause is lifted. The industry must proactively work to reduce methane emissions to prepare for potential regulatory changes.

- Advantage for Existing Exporters: Current exporters may benefit as they can expand capacity more efficiently from a GHG perspective. However, the pause creates opportunities for LNG projects in countries like Papua New Guinea, Mozambique, Mexico, and Canada, as importers may seek diversification.

- Supply Crunch: Approximately 12 Bcfd of U.S. LNG export capacity – about 10% of demand anticipated in 2030 – is affected by the pause, impacting the global supply-demand balance (see Exhibit 2).

The global LNG market remains dynamic, with potential for volatility. This pause in non-FTA exports highlights the role of natural gas at the critical juncture of the energy transition and energy security.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including natural gas and LNG, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.

– Uday Turaga