The Haynesville shale has emerged as a major natural gas play in recent years. Natural gas production from the Haynesville shale reached a new record high of 14.5 Bcf/d in 2023, accounting for 14% of all U.S. dry natural gas production. Haynesville production growth has accounted for 40% of the U.S. gas production growth recently.

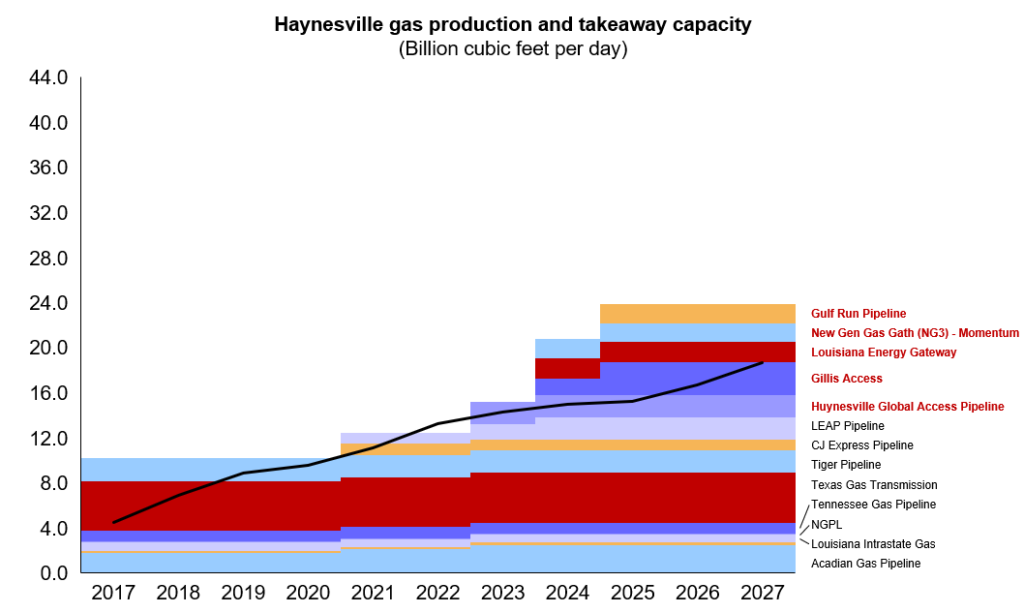

In the upcoming years, Haynesville shale production is expected to grow, primarily driven by increased demand from LNG liquefaction facilities and petrochemical plants developing along the U.S. Gulf Coast. The existing pipeline infrastructure in the Haynesville region is well-equipped to transport natural to the Gulf Coast with a capacity of approximately 16 Bcf/d.

Additionally, there are plans for three new pipeline projects –the Louisiana Energy Gateway, NG3 pipeline, and Gillis Access project– which are being considered to provide gas to emerging LNG liquefaction terminals. These projects are expected to contribute an additional 5 Bcf/d of takeaway capacity by the end of 2024.

In response to growing demand, Haynesville operators are devising various strategies to address and meet supply demands while prioritizing cost-effective supply operations. A few examples include the following:

- The average breakeven in Haynesville sits at ~$3.15/MMBtu, and operators are trying to cut it further down by reducing their service costs by delaying completions, dropping rigs, and starting wellhead curtailments. E&P companies in Haynesville like Southwestern Energy, Chesapeake Energy, and BP are also high grading their drilling plans and that could lead to enhanced well productivity.

- Completion intensity has remained steady but lateral lengths continue to grow for the top players in Haynesville. Over the past five years, the basin has experienced annual lateral length increases of more than 5%. This trend reflects companies’ efforts to extend the length of their horizontal drilling wells, aiming to mitigate rapid decline rates and achieve cost savings simultaneously.

- A small number of E&P companies have become the primary operators in Haynesville, particularly in the Louisiana region. However, additional consolidation is anticipated, with privately owned operators being strong contenders for acquisition as they seek to enter the basin and contribute to domestic gas production growth.

Overall, operators find the Haynesville play strategically advantageous for natural gas drilling due to its proximity to the Gulf Coast, where demand from liquefied natural gas export terminals and industrial facilities has been on the rise. Haynesville is set to become the largest source of gas output growth in the U.S. The outlook indicates that the region is expected to account for about 21% of the country’s gas production in 2035, compared to 14% in 2023.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including U.S. natural gas and global LNG markets, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.

Bhautik Gajera