In line with the Paris Agreement’s targets of reducing greenhouse gas (GHG) emissions by 45% by 2030 and reaching net zero emissions by 2050, companies across the world are looking for ways to reduce their emissions. There are some seeing this trend as an emerging market and are working to monetize other companies’ carbon emissions. With innovative technologies, these companies are transforming GHGs into valuable chemicals, fuels, and materials.

With 50 billion tons of GHG emitted globally in 2019, waste gas conversion is a market with abundant supply. The sectors with the most GHG emissions globally are electricity & heat, transport, and manufacturing & construction. Not every sector is a good fit for this emerging market though. For example, emissions from transport are not centralized and much harder to capture than emissions from other sectors that can be captured at static points in high concentrations. Key sectors to consider for waste gas monetization are electricity & heat, manufacturing, and industry.

In the U.S., the Inflation Reduction Act (IRA) provides several tax credit options for companies focused on sustainability. Section 45Q provides tax credits for carbon capture and utilization/sequestration (CCUS). These credits can be as high as $85 for every ton of carbon dioxide sequestered or $65 for every ton that is utilized by conversion into fuels or chemicals. In Europe where emissions are traded and priced, companies may have to pay fees as high as $130 per ton of GHG emitted. In either case, partnering with a company that wants to convert your waste gas into more valuable products provides clear financial benefits as well as environmental benefits.

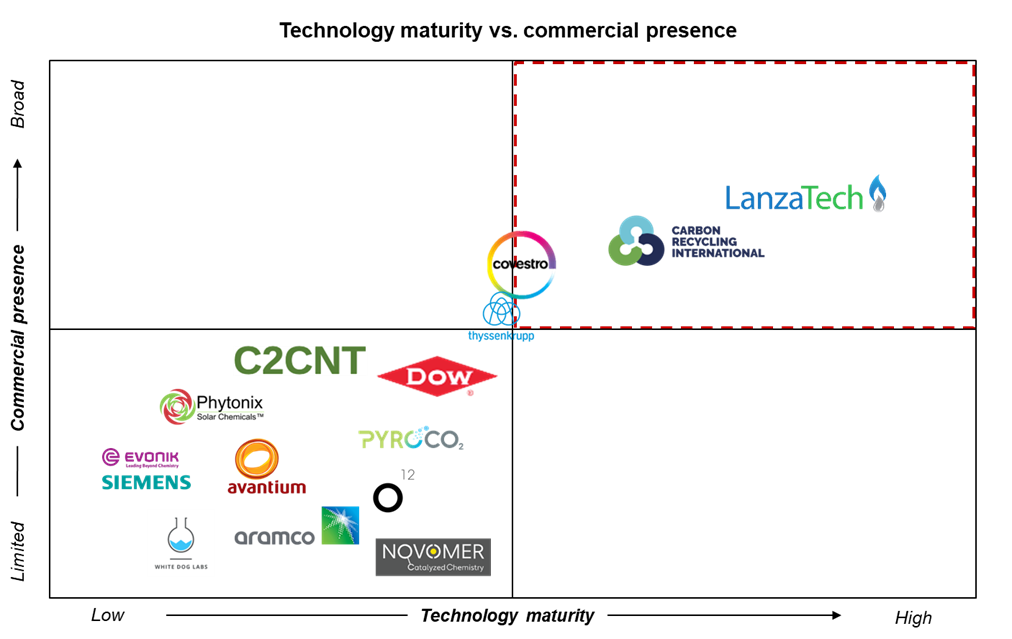

Two of the key players in this emerging market are LanzaTech who use a fermentation process to convert carbon emissions into bioethanol and Carbon Recycling International (CRI) who use electrolysis to produce methanol from carbon dioxide. LanzaTech has licensed their technology to several steel plants and oil refineries in Asia and Europe with most being in China. CRI, an Icelandic company, has also had success commissioning projects in China, each with the capacity to turn more than 100,000 tons of carbon dioxide into low-carbon methanol. Some other companies to keep an eye on include: Covestro which is looking to convert steel plant emissions into polyols; Carbon Corp which uses their C2CNT technology to transform carbon dioxide into valuable carbon nanotubes; and PyroCO2 which uses thermophilic microbial conversion of carbon dioxide to produce acetone.

The waste gas utilization market is still in its infancy with only a few players having established a significant commercial presence. Most of these plants have been in China where capital costs are significantly lower than in the U.S. This market has a high potential for growth though, which will only accelerate as more countries and companies strengthen their commitments toward meeting global climate goals.

ADI Chemical Market Resources is a prestigious, boutique consulting firm specializing in chemicals, petrochemicals, polymers, and plastics since 1990. We bring deep, first-rate expertise in a broad range of markets including sustainability and carbon emissions, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

Our former industry-leading conference, FlexPO+ is now a part of the ADI Forum, one of Houston’s distinguished industry conferences, bringing c-suite executives from across the value chains in oil & gas, energy transition, and chemicals together for meaningful, strategic dialogue.

Subscribe to our newsletter or contact us to learn more.

– Piercen Hoekstra