The U.S. energy landscape is undergoing a significant transformation leading to an impressive increase in capital expenditure (capex) in the utility sector. This upsurge in investment is fundamentally changing how energy is generated, transmitted, and consumed throughout the country. Several tailwinds are propelling the growth of capital investments in the utility sector in the U.S.:

- Renewable energy integration: The increasing adoption of renewable energy sources, such as wind and solar, will drive capex for expansion and enhancement of the transmission and distribution infrastructure to accommodate the intermittent nature of renewables and enable their integration into the grid.

- Aging infrastructure: Much of the existing transmission and distribution infrastructure in the U.S., is aging and in need of modernization. Upgrades and replacements of outdated components to reduce the risk of outages and enhance grid resilience will drive capex.

- Grid modernization: The rise of smart technologies, like advanced sensors, automation, and digital communication systems will drive substantial investment to create a smarter and more responsive grid to enable better monitoring, faster fault detection, and optimized energy management.

- Electrification of industries: The shift towards electrification in various sectors, including transportation and petrochemicals is increasing electricity demand. This surge in demand will drive capex to expand the capacity of the transmission and distribution network.

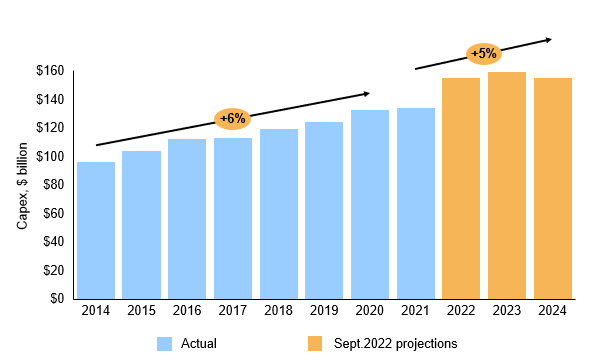

The capital investments made by U.S. utilities in 2014 amounted to $96 billion, and this figure experienced a consistent annual growth rate of 6% until the year 2020 (see Exhibit 1). In addition to the growth drivers mentioned above, significant new investments are being driven by new policies in the U.S. including the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA). Electric companies spent over $150 billion in 2022 alone, marking a 16% increase from 2020, to bolster the energy grid, enhancing its strength, intelligence, and security. Projections from the Edison Electric Institute anticipate a continued positive trend, with capital expenditure investment expected to grow by 5% annually until 2024 (see Exhibit 1).

The Infrastructure Investment and Jobs Act (IIJA) is a $1.2 trillion bipartisan infrastructure bill that was passed by Congress in 2021. The IIJA was introduced in response to the deteriorating state of the country’s infrastructure. After the approval of ~ $1.2 trillion for enhancing U.S. infrastructure in 2021 through the IIJA, the U.S. Congress further sanctioned another $370 billion for various new and existing technologies across energy generation, transmission, and distribution segments via the IRA. Additionally in 2022, the “Building a Better Grid” initiative was introduced by the U.S. Department of Energy, which allocated $12.5 billion from the IIJA to enhance the reliability of the grid.

The Inflation Reduction Act (IRA), signed into law on August 16, 2022, is the largest climate investment in U.S. history, designed to mobilize private capital to achieve climate goals, strengthen long-term growth, and improve economic competitiveness. IRA has the potential to expedite utility capital spending by offering funding and advantageous tax incentives that will also drive the electrification of transportation and other energy applications.

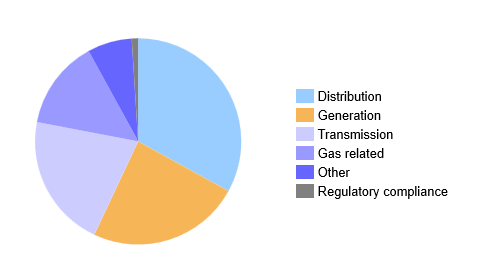

Exhibit 2 provides a summary of the capital expenditures made by investor-owned utilities in the U.S. for different functions. In 2022, U.S. electric utilities directed over $50 billion towards distribution related activities, surpassing all other functional areas (see Exhibit 2). Notably, transmission investments constituted a substantial portion, surpassing $31 billion and comprising 21% of the overall functional spending. This spending is necessary to adapt to changes in the way electricity is used, such as the increasing electrification of transportation and the growth of distributed generation. The capital spending trajectory is poised for further transformation, with a noticeable shift expected from production and generation towards the critical domains of transmission and distribution.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including power and utilities, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.

– Umair Hammad