As electric vehicles (EVs) gain momentum in reshaping the automotive landscape, it’s imperative to confront the practical challenges. The anticipated surge in EV adoption, projected to account for 33% to 50% of new car sales in the U.S. by 2030 (up from ~7% in 2022), raises critical concerns for the power grid.

In 2022, EVs consumed a mere 0.6% of total US electricity demand. However, with an estimated ~26 million EVs anticipated to be on the roads by 2030, electricity demand could surge as much as ~20%. By 2035, the increase might escalate to as much as ~40%, a stark contrast to the 5% growth in electricity demand witnessed over the last decade. This shift in electricity consumption will intensify pressure on the power grid.

Peak demand and grid issues

With the rise of electric vehicles (EVs), a unique set of strains are placed on the grid. To maintain grid reliability, balancing power supply and demand consistently is crucial. Easy usage and lower ownership costs has led policymakers and the industry to encourage residential charging. However, residential charging often aligns with when people return from work, coinciding with the existing peak power demand outside the solar energy supply window.

On a household level, having just one EV can raise electricity consumption by 40%, and with two EVs, it can nearly double. About 60% of U.S. households have two or more vehicles, so unregulated EV charging could disproportionately raise evening peak power demand. Without measures to smoothen this demand, increased peak demand will rely on coal-fired peaker plants, escalating emissions and impacting grid reliability, diluting the benefits of EVs in terms of emissions and costs.

Addressing peak demand:

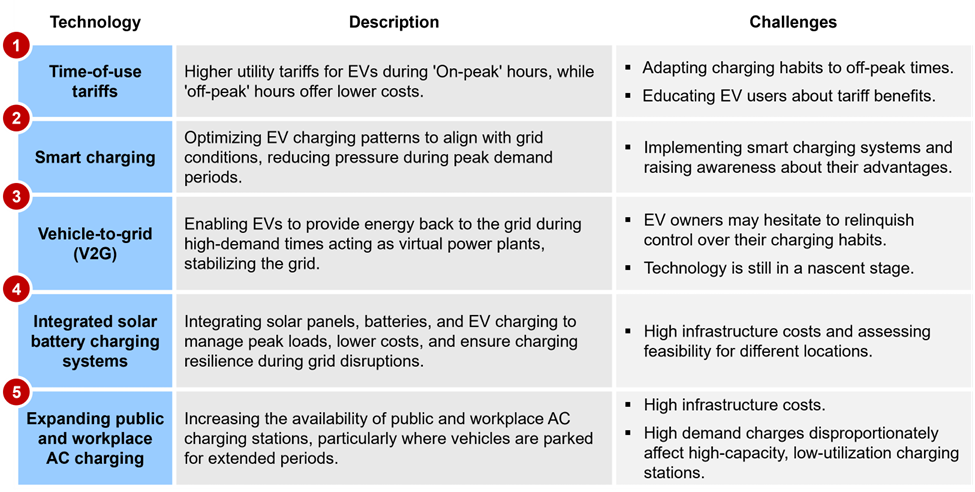

Exhibit 1: Solutions for managing electric vehicle impact on grid peak demand.

Innovative strategies and solutions have been emerging to address the challenges posed by peak power demand and grid management. As the demand for EVs grows, the synergy between technology, policy, and infrastructure becomes increasingly crucial. ADI research and consulting has identified the five approaches as potential solutions to deal with peak power demand:

- Among these approaches, seasonal time-of-use (TOU) tariffs are taking the spotlight. Utility providers are tailoring these tariffs specifically for EVs, introducing higher power costs during ‘on-peak’ hours and lower prices during ‘off-peak’ hours. This strategy sets helps EV owners to charge their vehicles during off-peak hours, effectively reducing the strain on the grid during peak demand periods. As an added benefit, this arrangement offers cost advantages for EV owners, promoting economical and sustainable charging practices.

- Another significant solution in managing peak power demand is smart charging. This method focuses on optimizing the timing and behavior of EV charging to align with grid conditions. By applying intelligent algorithms to control when and how EVs are charged, smart charging eases the pressure on the grid during high-demand periods. The United Kingdom has taken a proactive stance in this area, mandating that new residential and workplace EV charging points possess minimum smart functionality. This ensures EVs can dynamically respond to grid conditions and contribute to demand-side response programs.

- A third approach is a transformative concept known as vehicle-to-grid (V2G) bidirectional charging. This innovative approach envisions EVs as virtual power plants capable of storing excess renewable energy and releasing it back into the grid when needed. This two-way energy flow not only aids in grid stability during peak demand but also strengthens the integration of renewable energy sources. However, while V2G technology presents great potential, its progress is still in development and faces technical and regulatory hurdles.

- Another approach is to Integrate solar panels and energy storage systems with EV charging infrastructure. Co-locating these components enhances the management of peak EV loads, augments the direct utilization of renewable energy, reduces energy costs, ensures charging continuity during grid disruptions, and even extends charging accessibility to areas with limited grid capacity.

- Finally, improving charging accessibility involves expanding public and workplace AC charging stations, at sites like offices, schools, and retail centers where vehicles are parked for extended periods. This setup maximizes solar power utilization during mid-day.

Exhibit 1 summarizes all our above findings.

These solutions work together for greener transportation and a strong grid. They are a smart way to handle peak power demand, integrate EVs and renewables, and manage the grid well.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including energy transition, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.

- Anvesh Nadipelli