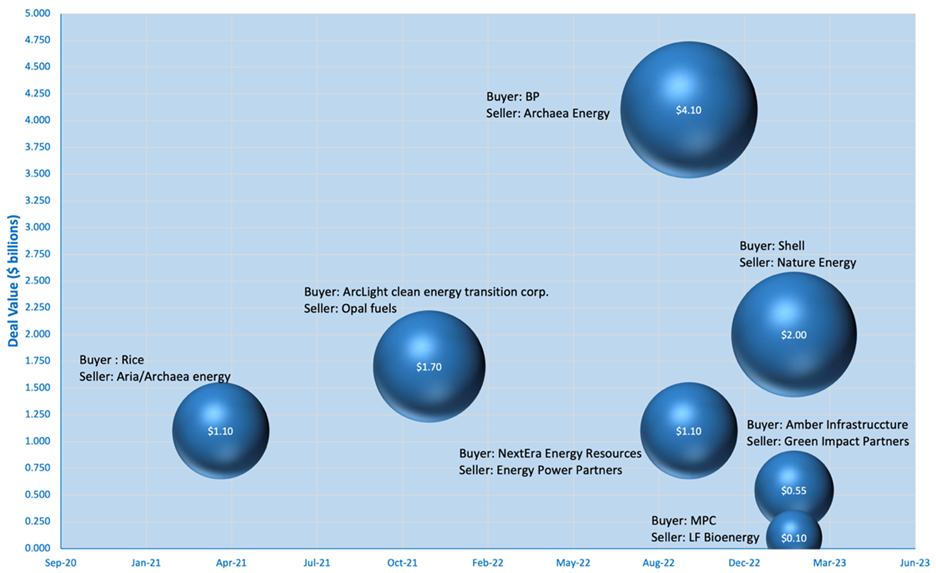

Policy, regulatory, and sustainability pressures coupled with financial incentives such as the value of Low Carbon Fuel Standard credits in California have led to significant interest and activity in renewable natural gas (RNG) over the past few years. Maturing business and technology models and the ease of integrating RNG into existing natural gas infrastructure have accelerated investments and transactions in this sector. In 2022, ~$7 billion in M&A deals were completed in North America (see Exhibit 1).

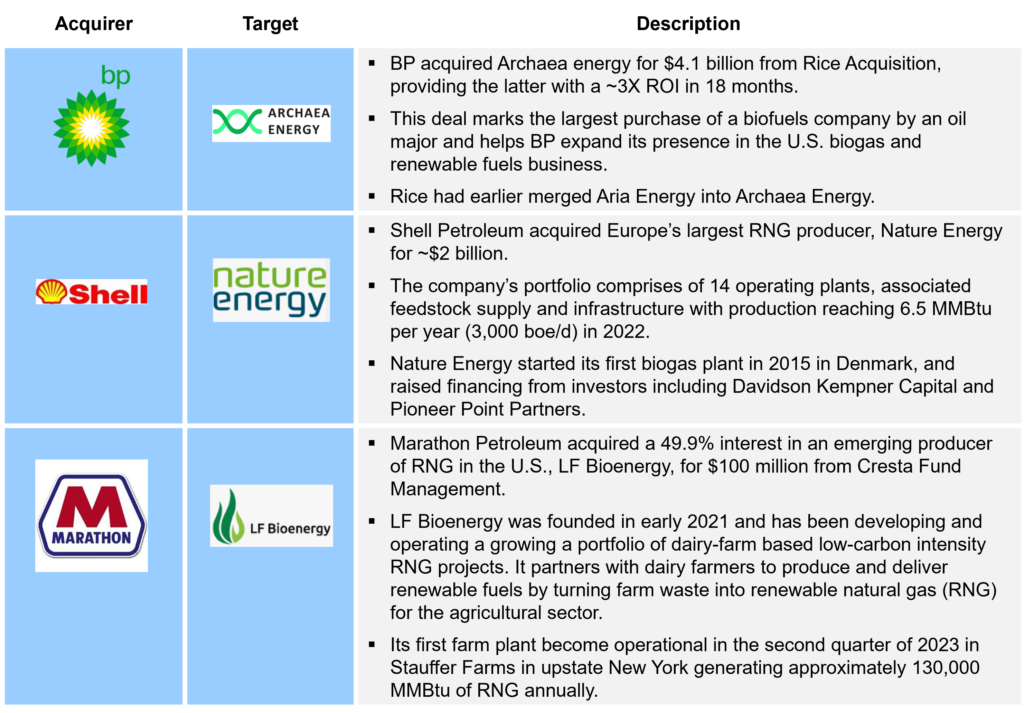

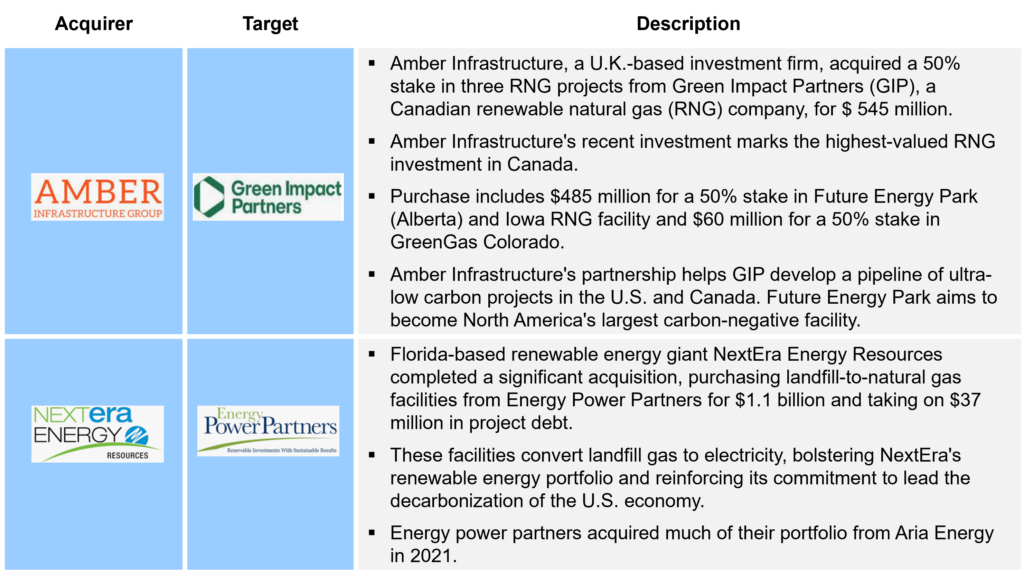

For example, BP acquired Archaea Energy for $4.1 billion marking the largest purchase of a biofuels company by an oil major. Other notable acquisitions include Shell’s acquisition of Nature Energy – Europe’s largest RNG producer – for $2 billion; Marathon Petroleum’s deal with LF Bioenergy, Amber Infrastructure’s investment in Green Impact Partners, and NextEra Energy Resources’ purchase of Energy Power Partners. Exhibits 2.1 and 2.2 provide a summary of these transactions.

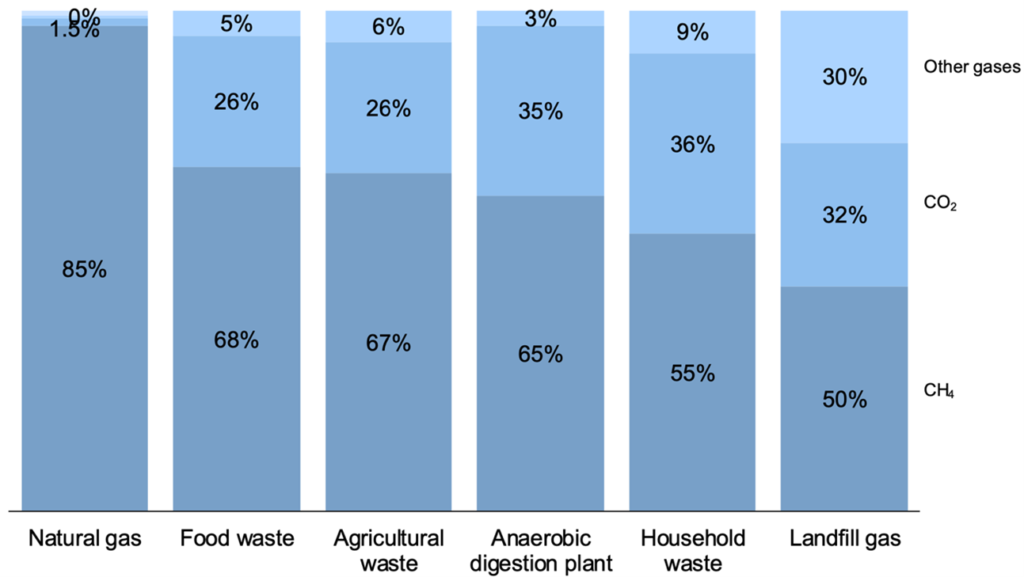

Amidst this dynamic market, RNG continues to gain recognition as an advanced biofuel that qualifies under the Renewable Fuel Standard. While conventional natural gas comprises approximately 85% methane, RNG produced through anaerobic digestion of food and agricultural waste typically contains methane levels ranging from 65 to 68%. RNG derived from landfill and household waste has a slightly lower methane content, typically within 50% to 55%. Additionally, landfill gas contains approximately one-third of other gases besides methane and CO2 (Exhibit 3).

Production methods of RNG

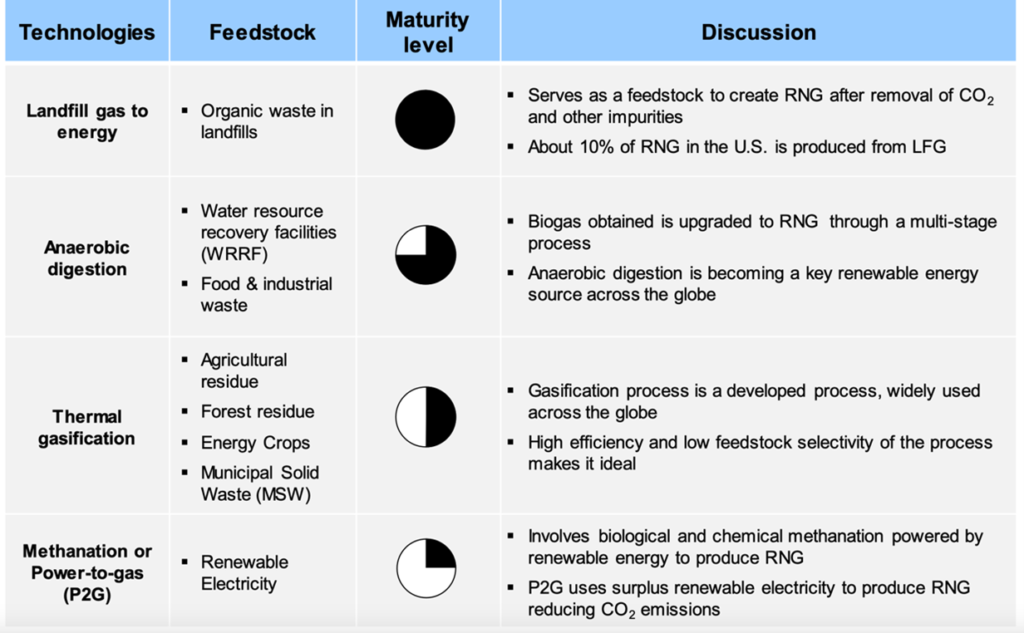

As the interest in and demand for RNG continues to grow, different technologies have emerged to fuel this moment.

In the U.S., landfill gas is a primary source of RNG through anaerobic digestion, accounting for approximately 10% of RNG production. Anaerobic digestion is also employed for water resource recovery facilities, food, and industrial wastes, with subsequent biogas upgrading to RNG. Another effective method is thermal gasification, which uses various feedstocks such as agricultural residue, forest residue, energy crops, and municipal solid waste (MSW) to yield biomethane with high efficiency. This technology’s popularity in RNG production is due to its low feedstock selectivity.

Upgrading methods for cleaning RNG

The final step in the RNG value chain is gas upgrading technologies that refine raw biogas into high-quality gas suitable for pipeline use.

These include high-pressure water scrubbing, pressure swing adsorption (PSA), cryogenic separation, chemical adsorption, and membrane separation, which result in RNG with different levels of methane content. Water scrubbing and PSA yield RNG with methane content <97% and >97%, respectively. These processes have their advantages, with scrubbing offering a mature technology that removes both CO2 and H2S with a high adsorption rate and no need for drying. However, they require high-quality solvents with solvent regeneration issues and can also present corrosion problems.

Chemical adsorption and cryogenic separation yield RNG with the highest methane content of about ~<99%. Chemical adsorption upgrading is highly efficient and results in complete H2S removal, although corrosion problems and additional chemical input requirements pose challenges. Cryogenic separation produces CO2 in marketable form. However, this upgrading process’s high-pressure and low-temperature conditions constitute significant disadvantages.

Anaerobic digestion of industrial and municipal solid waste primarily involves chemical upgrading processes such as hydrolysis, acidogenesis, acetogenesis, and methanogenesis. On the other hand, thermal gasification of woody biomass utilizes processes like drying, pyrolysis, thermal cracking, and reduction to convert raw biogas into pipeline-quality gas. For Power-to-gas (P2G) technology, biomethane production relies on powered electrolysis of water, chemical and biological methanation as the upgrading processes.

As the pressure for a circular economy grows, there is increasing interest and maturity in various biogas technologies, highlighting the potential of RNG to reduce greenhouse gas emissions. Alongside this progress, the RNG sector is witnessing new investments and consolidations led by oil majors, indicating a surge of capital flowing into this promising field. With stakeholders across industries and research communities coming together in support, RNG becomes a crucial element in shaping a more sustainable and low-carbon future, propelling us towards a brighter and cleaner energy landscape.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including the RNG value chain, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

– Madhuram Ravichandran, Anvesh Nadipelli, Snigdha Thummalapalli, and Uday Turaga