The U.S. built a little over 3,000 miles of crude oil pipeline capacity during 2018 to 2020 to reach 84,816 miles in 2021, transporting 1.2 billion barrels of crude oil that year. No significant oil pipeline capacity additions have been made since and U.S. oil production averaged 11.9 million barrels per day in 2022 that is further expected to reach 12.6 million barrels per in 2023. As a result, pipelines are now operating at full utilization, and operators have to consider several methods to optimize capacity utilization. A few options include the following:

- Capacity allocation to minimize under-utilization of certain segments of pipelines,

- Adding horsepower to existing and new pump stations, or

- Using specialty chemicals called drag reducing agents (DRAs) to reduce the turbulence in oil pipelines and optimize throughput capacity.

As the pipeline capacity build-out slows down with steady-paced oil production growth in the U.S. there will be increased use of these pipeline capacity optimization methods.

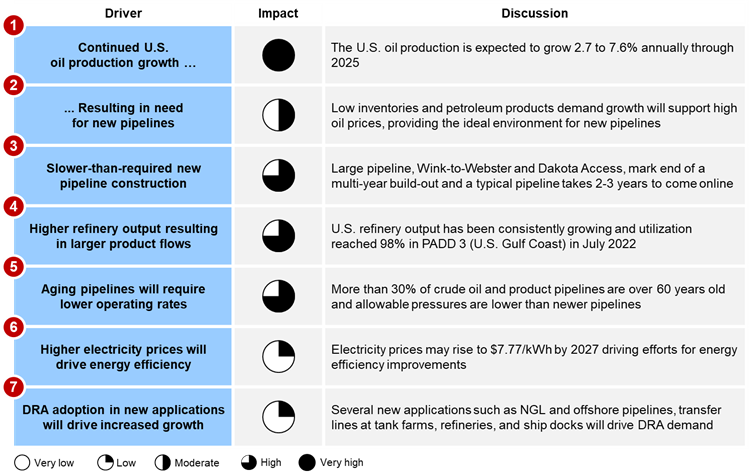

Given the growing role of DRAs, the role of suppliers is growing in importance. There are several large and small players in the U.S. midstream oil & gas industry but the same does not apply to the specialty chemicals companies supplying the DRAs. Some of the key players in the DRA industry include LiquidPower, Baker Hughes, Flowchem (owned by Entegris), Innospec, and Infineum who closely compete with each other for various DRA applications including light and heavy crude oil as well as liquid products. Last year, the U.S. subsidiary of Infineum, a U.K.-based additives JV between ExxonMobil and Shell, agreed to buy the Flowchem business from Entegris but the deal was cancelled due to scrutiny from the U.S. Federal Trade Commission and not receiving clearance under the Hart-Scott-Rodino (HSR) Antitrust Improvements Act of 1976. This was an unusual development but reflects the growing role and importance of DRAs in the oil & gas industry. In addition to oil production growth and slower-than-required pipeline build-out, higher refinery utilization rates, aging pipeline, increasing utility prices, and greater adoption will drive DRA demand. Exhibit 1 below summarizes the key drivers and their impact on DRA market.

Exhibit 1. Key drivers impacting DRA demand growth

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including blog topic areas, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results. ADI has helped various chemical companies and private equity firms understand the niche DRA market and continues to closely follow it. Contact us for intel on the DRA market and various suppliers.

Panuswee Dwivedi