The aviation industry has faced significant obstacles in reducing its environmental impact, particularly in terms of greenhouse gas emissions. However, stakeholders across the aviation value chain are now committed to pursuing sustainability objectives. In both, the United States and Europe, policymakers and industry leaders have implemented supportive policies and incentives to promote the widespread adoption of sustainable aviation fuel (SAF), resulting in substantial investments in the aviation and aviation fuels sectors. This situation has created an opportunity for startups to develop new technologies given the lucrative incentives and favorable demand.

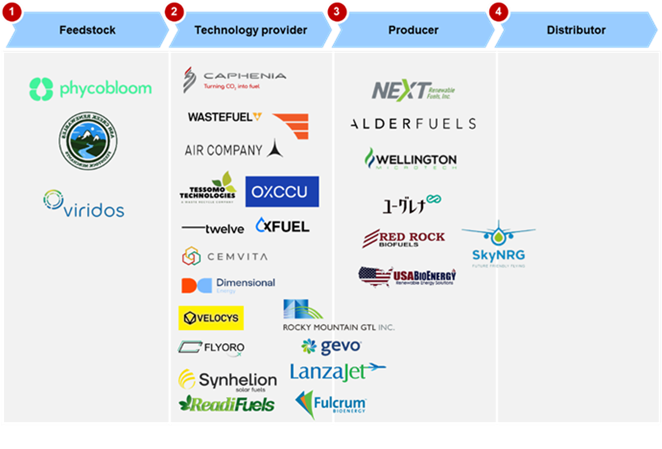

ADI evaluated several SAF startups in the market and categorized them based on their role in the aviation value chain. The assessment revealed that most of these companies serve as technology developers and producers, highlighting a gap within the aviation industry at the feedstock and distribution levels in the value chain.

From a feedstock standpoint, most of the SAF today is produced using waste oils, such as used cooking oil, animal fats, and other fatty acids via the HEFA pathway driven by its cost-competitiveness and technology readiness. However, there is a growing consensus to move away from food-based biofuels due to concerns about their social as well as overall climate impacts. To mitigate potential political controversies, the emerging SAF industry is focusing on early adoption of advanced SAFs derived from non-food feedstocks. Consequently, there is an increasing need to explore new pathways for SAF production, addressing feedstock availability, improving economic viability, and accelerating the pace of technology development.

Some examples of start-ups developing alternative pathways include Caphenia, that utilizes carbon dioxide, methane, and renewable electricity to produce SAF. Air Company is a start-up that directly converts atmospheric carbon dioxide into SAF, and Synhelion employs solar heat to convert carbon dioxide into solar fuels. Although these startups are technology developers, they are dedicated to enhancing SAF production capacity via innovative alternative feedstocks and effectively contributing to meeting the increasing demand from airlines.

ADI has updated its multiclient study which provides an in-depth exploration of SAF start-ups along with comprehensive analysis and benchmarking of these companies. This study is available immediately and offers ongoing updates. Additionally, you can stay informed about airline commitments to use SAF, off-take agreements between producers and airlines, and partnerships aimed at commercialization by subscribing to ADI’s SAF Tracker, our bi-weekly newsletter.

– Maria Eduarda Lopes