The global shift towards low-carbon energy to address greenhouse gas emissions and climate change has prompted major energy companies to transform their operations. This is driving growth in demand for cleaner fuels and their delivery logistics. As a result, we are seeing significant interest in M&A activity in the fuel distribution and logistics segment.

Superior, a North American distributor and marketer of propane, distillates, and other fuels recently acquired Certarus, a North American distributor of CNG, RNG, and hydrogen. Certarus was valued in the deal at over $1 billion reflecting both the company and this segment’s attractiveness.

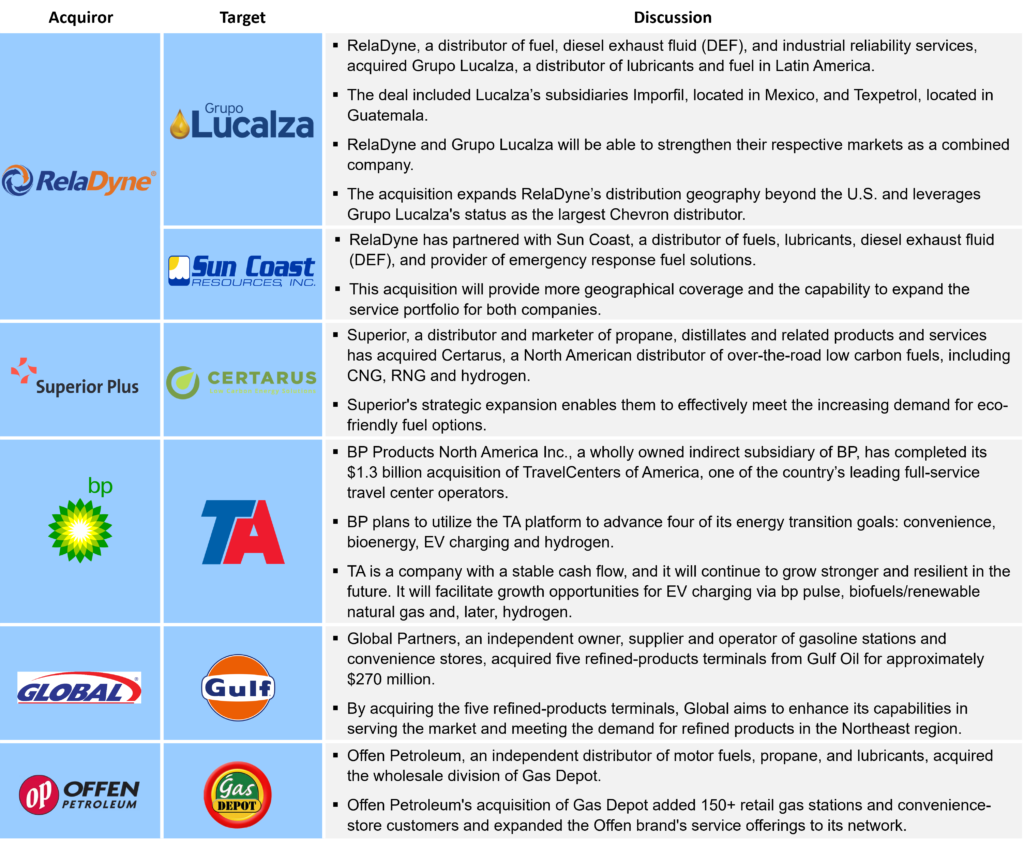

Other notable acquisitions in this segment include RelaDyne buying Lucalza and SunCoast, BP’s acquisition of T.A., Global Partners acquiring Gulf, and Offen Petroleum’s deal with Gas Depot. Exhibit 1 provides a summary of recent acquisitions and their underlying motivations.

The growth of M&A within the fuel product distribution industry is influenced by several key factors:

- Energy transition is driving demand for low carbon fuels

Fuel distribution plays a crucial role in the oil and gas value chain, delivering refined petroleum products from refineries and fuels from other sources through various mode of transportation. Energy transition and growing interest in low carbon fuels is driving more interest in this segment as several end user markets seem to source alternative fuels to cut their scope 1 and 2 emissions.

The changing energy consumption landscape in the U.S. has led to increased demand for alternative fuels, such as CNG, LNG, RNG and to a certain extent, hydrogen. Companies that have diversified their offerings to include these fuels become more appealing to potential acquirers such as Superior Plus, and BP.

- Fragmented and dispersed demand for low-carbon fuels

Mining activities, exploration and production, remote community all rely on low carbon fuels. The demand for alternative fuels is often fragmented and dispersed. Due to the growing emphasis on reducing carbon footprint, companies are transitioning to low carbon fuels. Unfortunately, accessing such fuels in these remote areas poses a challenge. To bridge this gap, there is a growing opportunity for companies to develop facilities or provide services that address to these remote regions.

- Vertical integration and market expansion

Acquisitions also provide fuel distributors with access to new markets, a broader customer base and the opportunities to cut costs and stimulate new demand. A good example of this is the acquisition of Grupo Lucalza by RelaDyne. Acquisitions facilitate the optimization of pricing strategies and expansion without the need to build additional infrastructures, improving logistics, and reducing time to market.

These trends collectively are behind the growing investments in fuel distribution. This transformation of low carbon fuel has resulted in increased demand for cleaner fuels and their delivery logistics, leading to significant interest in mergers and acquisitions (M&A). Overall, the fuel distribution industry will play a crucial role in facilitating the transition and reducing carbon footprints in various sectors.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including the logistics segment, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.

– Mitkumar Bambhroliya