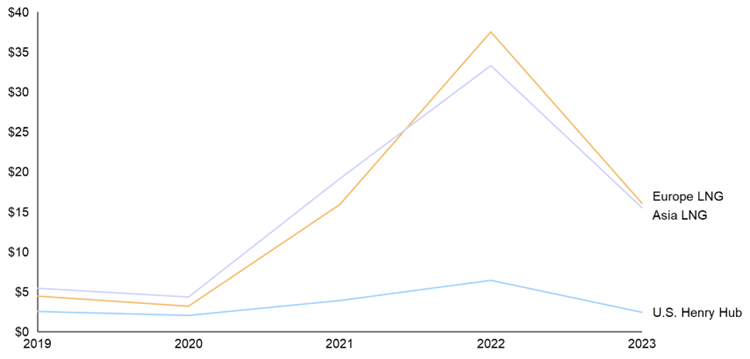

Henry Hub gas prices averaged $6.45 per MMBtu in 2022 rising from $3.89 in 2021, driven by increased demand from Europe and the gradual re-opening of China. Prices have since fallen 62% to average $2.46 in 2023. The global LNG sugar rush resulted in LNG prices to rise to over $32 per MMBtu in 2022 and have remained over $15 per MMBTU in 2023. Exhibit 1 shows average natural gas and LNG prices. While the LNG sugar rush may have not entirely subsided, the landscape for U.S. natural gas prices does seem bleak through 2023. ADI sees four key factors behind this including continued U.S. natural gas production growth, domestic demand stagnation, slowing LNG exports growth, and pipeline takeaway and storage capacity constraints.

First, U.S. natural gas production averaged ~98 Bcfd in 2022 and has reached over 100 Bcfd in 2023. Permian, a key producing region, has not seen peak production yet and although E&P operators are cutting costs and lowering drilling activity, the basin is getting gassier with increasing gas-oil ratios, which will result in gas production growth faster than oil production growth increasing pressure on producers in the region to manage gas.

Second, domestic natural gas demand is stagnating and the share of natural gas in the energy mix has remained at 17% in the last five years without any expectations of growing significantly in the next five years. Additionally, anticipation of a moderate summer is creating downward pressure on natural gas prices.

Third, the U.S. exported 28.8 million tons of LNG or ~4 Bcfd of natural gas in the first four months of 2023, reflecting a 2.5% y-o-y increase. However, recession risks and muted demand growth from China may result in a global LNG demand cut of ~60 million tons or ~8 Bcfd gas going forward, limiting U.S. LNG export growth. Anticipation of a limited refill of European gas storage in the wake of French nuclear power generation returning to normalcy and a milder winter is also negatively impacting natural gas prices.

Finally, in addition to rising gas production, localized pipeline takeaway capacity constraints and rapidly filling storage capacity are also creating downward pressure on gas prices. The Permian Highway Pipeline returned to 2.1 Bcfd capacity in the second week of May but its expansion has been pushed to December 2023 reducing the expected takeaway capacity. Gas storage in the U.S. was a little less than 2.5 Tcf in May 2023, which is 557 Bcf higher than the same time last year and 349 Bcf above the five-year average of 2.1 Tcf, igniting fears of insufficient storage capacity in case of a moderate summer.

ADI Analytics is actively tracking the U.S. natural gas and global LNG markets and while the outlook for rest of 2023 does seem pessimistic today, ADI expects this will be a short cycle and higher winter demand may strengthen the prices towards the end of 2023. Contact us to learn more.

Panuswee Dwivedi