Compressors are used in a wide range of applications in the oil and gas, energy, and petrochemical industries. The growing hydrogen, carbon capture, biofuels, and other energy transition markets present new opportunities for compressor companies. Many of these industries are being built from the ground up, offering years of growth for compressors and related equipment as the necessary infrastructure is built to handle growing demand.

Upstream and midstream oil & gas

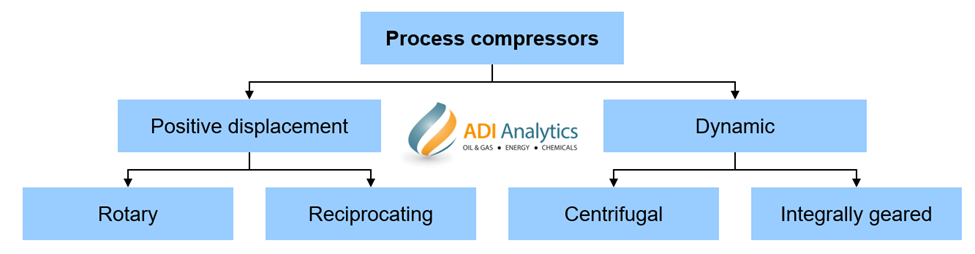

Compressor technologies can be grouped into four categories: rotary, reciprocating (recips), centrifugal, and internally geared (Figure 1).

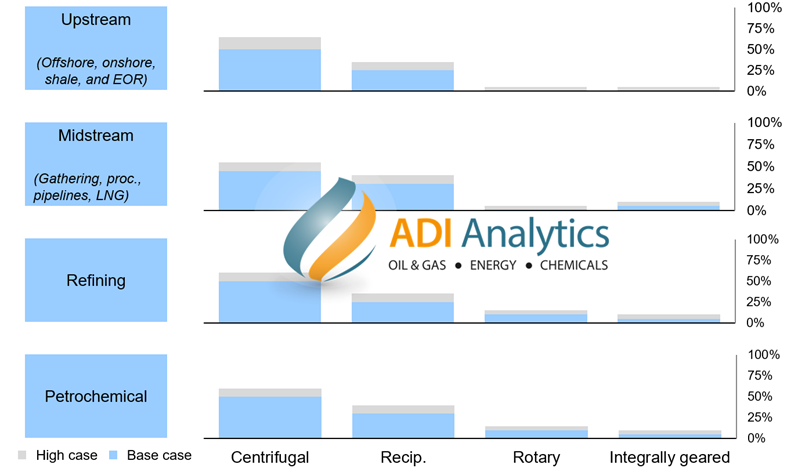

ADI Analytics has performed numerous studies for clients across the oil and gas industry, where compressors find a number of uses. Across the value chain, most oil and gas process applications utilize centrifugals and recips (Figure 2). When looking at processes across the oil and gas value chain, centrifugals dominate most process application, but recips have important niche end-uses (Figure 3).

New growth markets

With the energy transition underway, compressors have a number of growth markets including hydrogen and carbon capture utilization and storage (CCUS) in addition to increased demand in traditional markets including natural gas and chemicals. Several key drivers are shown in Figure 4 that are promoting growth in compressor markets. A large theme amongst these drivers is the energy transition. As the energy transition moves forward, new industries such as CCS and hydrogen are emerging and growing as a solution for both decarbonization and clean energy. These industries are being built from the ground up and offer years of growth for compressor industries.

Furthermore, the emerging hydrogen industry presents some key challenges that offer opportunities for innovation and differentiation among compressor OEMs. Hydrogen is so light that centrifugals must run at much higher speeds than required for heavier gases. Additionally, hydrogen causes metal to become brittle over time, affecting not only compressors, but pipelines as well. Industry will have to address these challenges going forward, but the potential is significant.

Summary

Although every project and market is different, ADI Analytics has the experience to help you assess and evaluate your particular market and your product’s competitive positioning. Over the years, ADI Analytics has researched and assessed the markets for various compressor technologies and continues to help clients assess this market.

These assessments include deep dives on particular segments, an evaluation of players in the space and competitive standing as well as proprietary market sizing models, analytics, and databases coupled with primary and secondary research drawing on a large number of sources and experience. Contact us to learn how we can help your business succeed.

Dustin Stolz