Ever since Russia invaded Ukraine on February 24, 2022, western countries have spent a lot of time cutting ties with Russia and enacting sanctions to financially pressure them, with a particular emphasis on their fossil fuel industry. With more than a year passing since the start of this war, in this blog, we take look at the state of the Russian fossil fuel market and what has changed over this time.

Russian export revenue

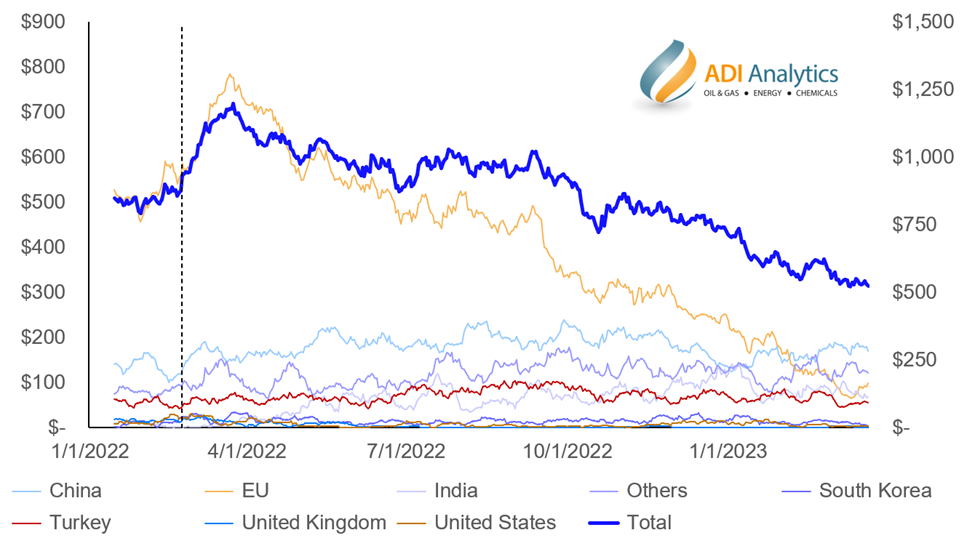

Since the war began, Russia has made more than $341 billion from fossil fuel exports, with the EU being the biggest importer at just under 50% of this revenue (Exhibit 1). However, over the last year the EU has made great progress in reducing their reliance on Russia for fossil fuels. Looking year-to-date, in 2023 EU only supplies 24% of Russia’s fossil fuel revenue, and this share is continuing to decrease (Exhibit 2). Prior to the invasion, EU imports made up more than 60% of Russia’s total import revenue; today, their share is less than 20%. Despite this significant reduction, the EU remained Russia’s largest purchaser (by revenue) until February 2023, when they were finally overtaken by China. Currently they are in a dead heat with India for third.

From an overall export revenue standpoint, the invasion of Ukraine was initially a boon to Russia as commodity prices increases more than made up for decreases in exports. Fossil fuel export revenue increased from ~$840 million per day prior to the invasion, peaked at $1,200 million per day in March 2022, and lingered at over €945 million per day for much of 2022. In October, export revenue precipitously dropped before recovering slightly and has been steadily declining since, averaging ~$540 million per day in March 2023, a ~36% decline over pre-invasion revenue.

Russian export volumes

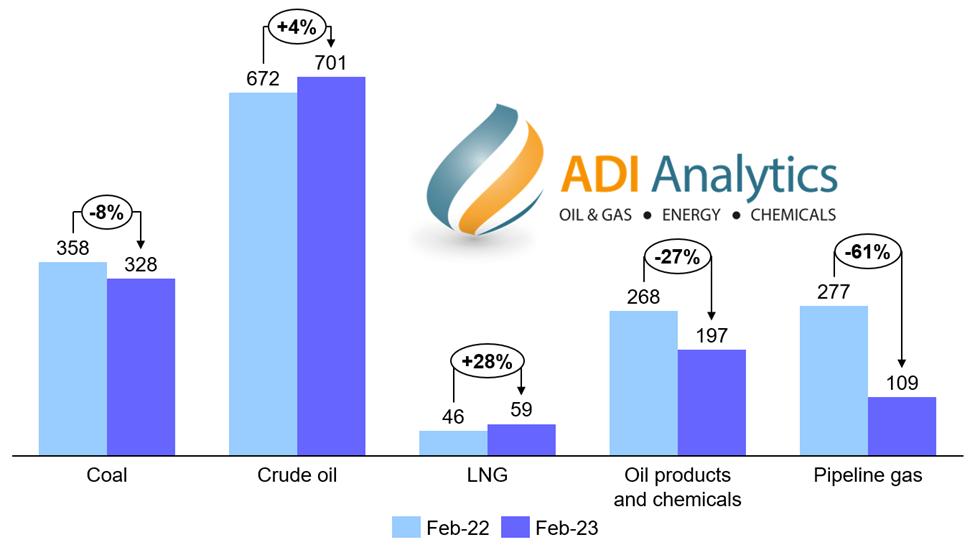

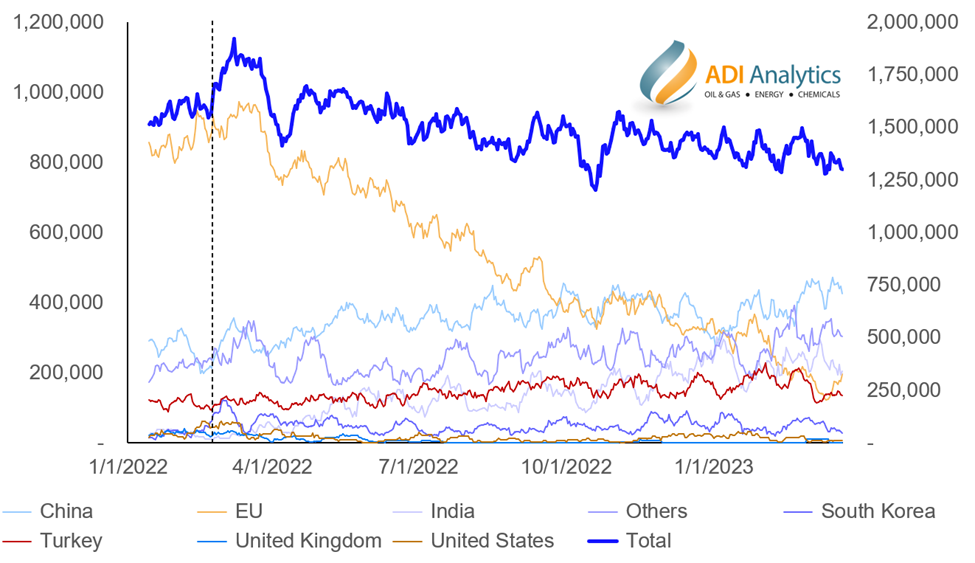

Despite the 36% drop in export revenues, export volumes do not show the same decrease (Exhibit 3). Total volumes decreased by ~14% from pre-invasion exports, indicating that a large driver behind Russia’s declining export revenues is due to lower commodity prices and price caps placed on Russian supplies. Coal and crude oil exports have remained relatively unchanged (Exhibit 4), decreasing by 8% and increasing by 4%, respectively. LNG exports have shown significant growth, expanding by 28%, while oil products and pipeline gas have shown significant decreases of -27% and -61%, respectively.

From an overall import perspective, Exhibit 5 shows the EU has decreased their Russian fossil fuel imports by over 75%, from ~850,000 tonnes per day before the war to less than 200,000 tonnes currently. Meanwhile, China, Turkey, India, and others have gradually been increasing their Russian imports, but not by enough to offset the EU’s cuts. However, Russia is finding a market for much their supplies, as their decline in overall exports remains much lower than the European cuts.

Summary

The overall energy market for Russia has been greatly affected by the war in Ukraine. China is now the dominant importer of Russian fossil fuels, but no one area dominates the market quite like the EU did before the war. Sanctions are clearly having some effect on the Russian market as overall revenue and exports are steadily declining, however overall commodity prices appear to be having a larger affect than sanctions and price caps. With crude down nearly 20% since before the invasion and natural gas prices down nearly 40%, Russia’s fossil fuel revenue was destined to drop regardless. While western countries may be shunning Russian products, it’s clear that that other parts of the world are more than willing to accept some of those supplies instead. Even so, Russia is seeing an impact on their fossil fuel demand. In a effort to lift prices for its oil, Russia cut oil production in March by 700,000 barrels per day, a steeper cut than the 500,000 barrel they had previously announced, and has announced that cuts would continue until June.

At ADI Analytics, we stay up to date on events in the energy space and can help you make informed decisions. Contact us to learn how we can help you.

– Dustin Stolz