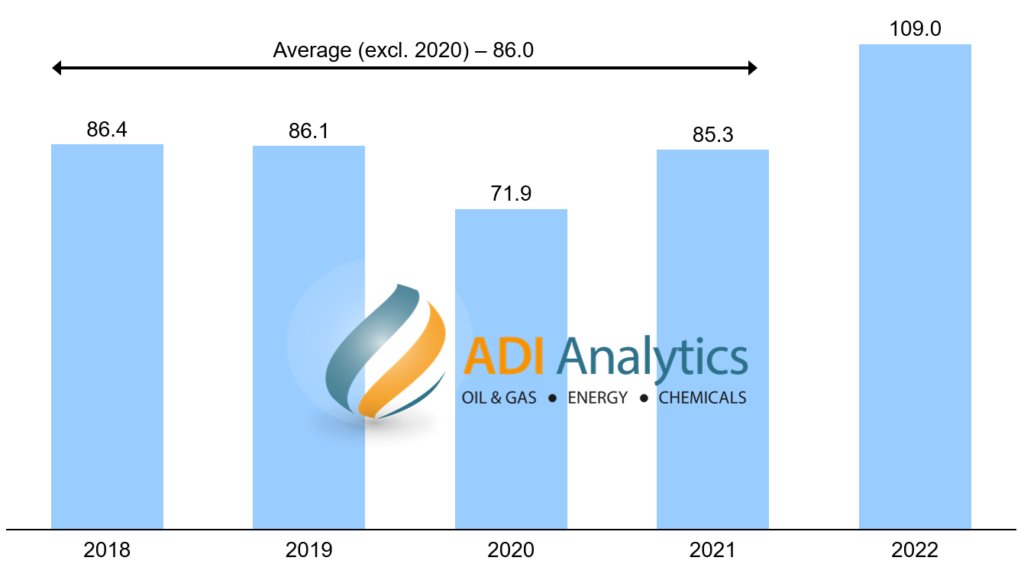

The Uinta basin, located in northeast Utah, is starting to gain some attention from oil and gas players. The basin’s ~120 thousand bpd of production pales in comparison to the Permian’s ~5.6 million bpd produced today. However, production of the basin’s waxy crude has rapidly been increasing (Figure 1), and refiners continue to desire this oil. Over 2018-2021, Uinta basin production remained relatively flat, averaging ~86 thousand bpd, excluding a pandemic induced dip in 2020. In 2022, production has increased over 25%, averaging ~109 thousand bpd, as operators have “cracked the code” on completions and operations.

Well performance and oil properties

Similar to other prolific basins, Uinta has multiple stacked pays with total cumulative thickness reaching nearly ~1,000 feet locally. One of the big players in this region is Ovintiv, which has amassed nearly 130,000 net acres with 22 thousand barrels of oil-equivalent per day. In their Q4 2022 Earnings Call, they stated that their well results outpace industry peers by 50%, with well performance in line with core Delaware basin wells.

One of the unique properties about Uinta crude is its waxiness. With much of the U.S. refining market dominated by light and super-light crudes from shale production, waxy oils can help refineries avoid major physical updates to their distillation columns to process shale’s lighter crudes. Uinta oil is well suited for blending with other crudes to create refiners’ desired feedstock specs, and the crude has a number of other ideal properties. Transporting this crude has its challenges though, requiring it to stay warm in order to avoid solidifying. Even so, this crude is a staple for five refineries in the Salt Lake City area, and refineries on the Gulf Coast seem to want as much of this type of crude as they can get.

Barriers to Uinta’s growth

While most of the oil produced today serves the local refining market in St. Lake City, the growth in production has resulted in excess crude for the local market. The Gulf Coast refinery market, however, is the biggest market for waxy crude, and despite the transportation challenges, excess Uinta oil is reaching this market. The biggest obstacle for Uinta’s continued growth comes from infrastructure. E&P companies could produce more oil, but they are facing growing challenges regarding takeaway capacity for associated gas.

Even with its low GOR, typically between 1:1 and 2:1, associated gas from growing production is maxing out key parts of the pipeline system. Flaring is not an option due to regional air quality concerns, and efforts to expand pipeline capacity have been slow. The dynamics around gas transport in the region are complex, and pipeline operators have yet to find a solution for improved takeaway capacity. If these constraints are resolved, Uinta’s production could likely increase significantly, with some proponents suggesting basin production reaching up to 250 to 300 thousand bpd over the next 2-3 years.

Summary

Although small in comparison to overall U.S. production. The Uinta basin’s production packs a punch in terms of both well Although small in comparison to overall U.S. production, the Uinta basin’s production packs a punch in terms of both well results and crude desirability. While likely to remain a smaller play, opportunities for players in this basin look significant, but midstream players have some work to clear bottlenecks and allow the opportunity to develop further.

ADI Analytics is active with research and consulting in the oil and gas space. Contact us to learn more.

– Dustin Stolz