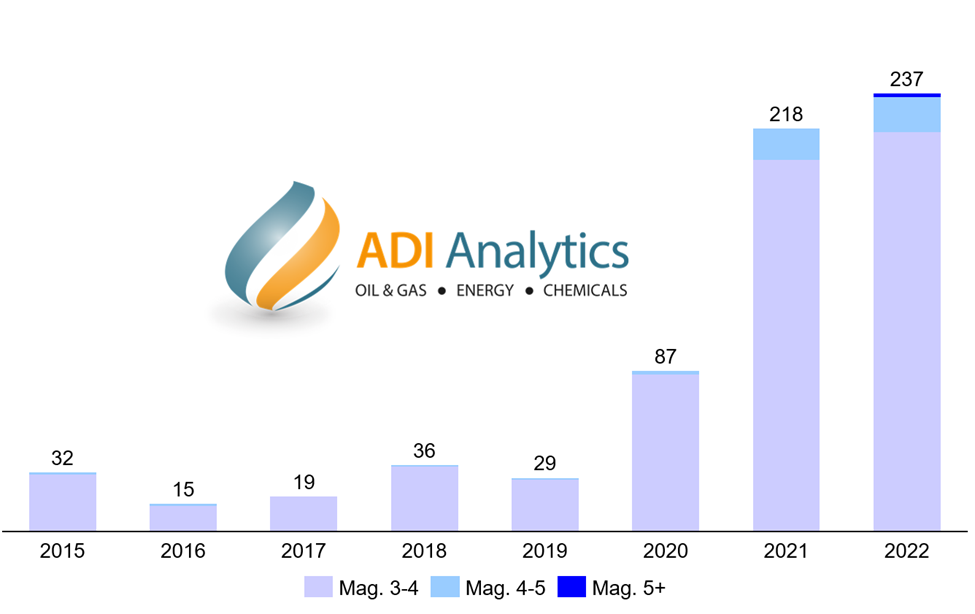

Over the last several years, earthquakes in the Permian basin have increased in both number and intensity. In 2022 there were more than 8x the number of magnitude 3 earthquakes or greater than those that occurred annually in in the years from 2015 to 2019. (Figure 1). In fact, two of the five largest tremors in Texas’s history occurred during the fourth quarter of 2022.

Regulatory response

This increase in activity has kept operators and regulators busy. In the Delaware basin, the Texas Railroad Commission (RRC) established the ~2,300 sq. mi Northern Culberson-Reeves (NCR) Seismic Response Area (SRA) in October 2021 in an effort to prevent the occurrence of higher magnitude events in the area. In December 2022, they expanded it to ~2,600 sq. miles after the 5.4 earthquake in Reeves County on November 16. Operators in the area have agreed to collectively reduce produced water disposal volumes from 298,000 b/d to 162,000 b/d by June 2023.

In the Midland basin, the RRC designated the Gardendale SRA in September 2021 and in December 2021 ordered the indefinite suspension of water injection in deeper formations. Following a 5.2 earthquake in the area on December 16, the RRC expanded the SRA to include another 17 saltwater disposal wells. Finally, in January 2022 the RRC established the Stanton SRA due to increasing seismic activity in that area.

Water Management

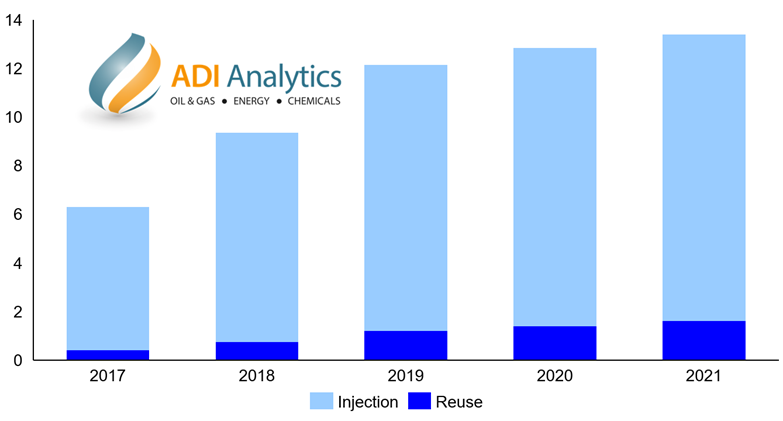

One of the biggest challenges for Permian basin production is managing increasing produced water volumes. Since 2017, produced water volume has more than doubled and will continue to grow as production continues to grow in the basin. Operators have reduced disposal by recycling produced water into completions; however, the growth in reusing water remains much lower than the growth in overall water production and there is still far more water produced today than operators use in stimulations. In some areas, operators are moving injection to shallower formations; however, this activity can lead to further complications, such as interfering with operations and pressuring up new formations.

Figure 2. Permian produced water and end-use in thousand barrels per day (Source: World Oil, ADI Analytics)

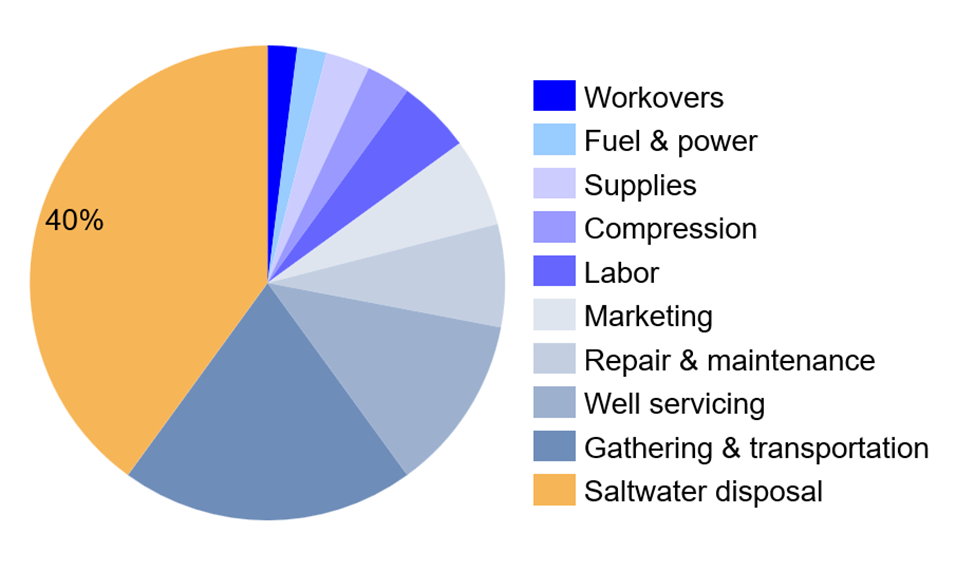

Saltwater disposal remains one of the biggest operating expenses for E&P operators (Figure 3) and growing seismicity concerns are likely to lead to more regulations and costs. In fact, increased water handling over the years has led to a multi-billion-dollar midstream industry and attracted private equity investment as operators rely more on long-term contracts and fee-based structures. In fact, disposal and hauling accounted for ~60% of the $27 billion U.S. unconventional wastewater market in 2019.

Figure 3. Delaware basin Wolfcamp well LOE breakdown

Summary

It is unclear whether regulators will be able to rein in this seismic activity. Water management is and will continue to be aIt is unclear whether regulators will be able to rein in this seismic activity. Water management is and will continue to be a significant issue in the Permian, and undoubtably, operators are paying attention to seismic activities as SRAs and regulations can change rapidly. Additionally, as new segments like CCUS look to take off in the region, this seismic activity has the potential to cause a lot of headaches and disrupt a lot of investment.

ADI is active in the oil and gas space and has helped numerous clients evaluate wastewater management options. Reach out to learn more.

– Dustin Stolz