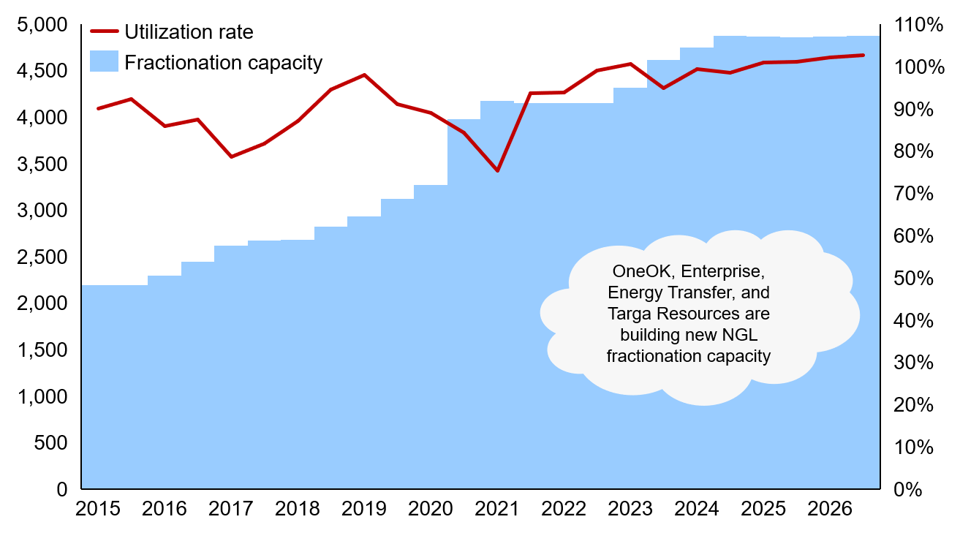

For roughly two years, NGL fractionation capacity utilization rates have been over 90%. Roughly 820,000 barrels per day (bpd) of new fractionation capacity is coming online in the next two years. Will this amount be enough to relieve the constraints in the Mont Belvieu-Texas Gulf Coast? What other options are available? This blog will cover new additions, current status, and alternatives in the NGL fractionation space.

Phillips 66 completed the Sweeny Frac 4, which has a capacity of 150,000 bpd, during the fourth quarter of 2022. OneOK aims to bring online its two 125,000 bpd fractionators, the MB-5 Frac in the second quarter of 2023, and the MB-6 by 2025. Enterprise and Energy Transfer are planning to add 150,000 bpd fractionators in the third quarter of 2023, while Targa is expecting its 120,000 bpd fractionator to come online in the second quarter of 2024. In total, this amounts to an additional 820,000 bpd of fractionation capacity bringing the total U.S. Gulf Coast capacity to 4.8 million bpd.

Exhibit I shows that the new additions in fractionation capacity will push the capacity to close to 4.8 million bpd, but the utilization capacity will continue to remain over 90%. High utilization rates lead to more turnovers and maintenance for these facilities which can cause more frequent shutdowns.

Due to the 210,000 bpd fractionator in Medford, OK, being out of service, Y-grade volume is expected to move to Mont Belvieu. OneOK will not re-open the Medford fractionator. This will limit fractionation capacity in the Texas Gulf Coast and will continue to keep utilization rates high.

NGL volumes from the Permian will need a home and ethane rejection may not be of much help due to limited pipeline capacity. Flaring is an option, but the latest ESG standards also limit this possibility. As a result, new fractionation capacity is needed without which a build-up of NGL storage will occur with a potential detrimental effect on the prices of NGL products.

At ADI Analytics, we follow NGLs and natural gas markets carefully. Consider subscribing to our newsletter to stay up to date with the latest industry insights.

– Manuel Diaz