The transportation sector has the highest reliance on fossil fuels and accounted for 37% of CO2 emissions from end-use sectors in 2021. Various industries of the transportation sector have started researching hydrogen as an alternative fuel source, and in this blog, ADI will look at the technological progress that has been made and some of the partnerships being established to implement hydrogen on a commercial scale.

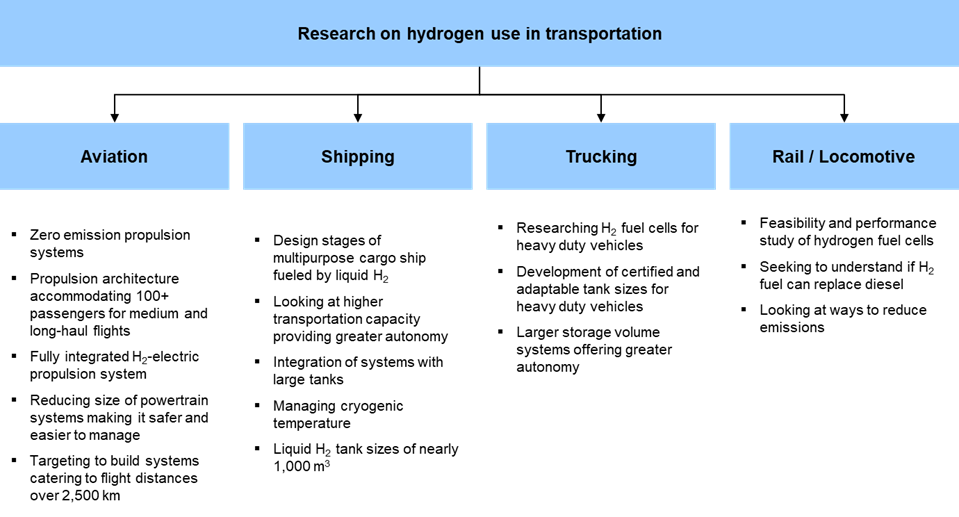

Currently, ADI sees three key common drivers within the sector – leveraging of partnerships, providing greater autonomy, and aiming net zero emissions by replacing conventional fossil fuels. We also see a special focus on hydrogen electric powered propulsion systems in the aviation industry, liquid hydrogen storage tanks in the shipping industry, and hydrogen fuel cells in the trucking and locomotive industries.

As shown in Exhibit 1, the different segments of the transportation sector are implementing hydrogen in different ways. For aviation, the focus has been on developing hydrogen-integrated propulsion systems and powertrains. Progress is being made by H3 dynamics for hydrogen-electric propulsion architectures that can fly over 100+ people over medium- and long-haul routes, whilst ZeroAvia recently completed the first ground tests for its hydrogen-electric powertrain system.

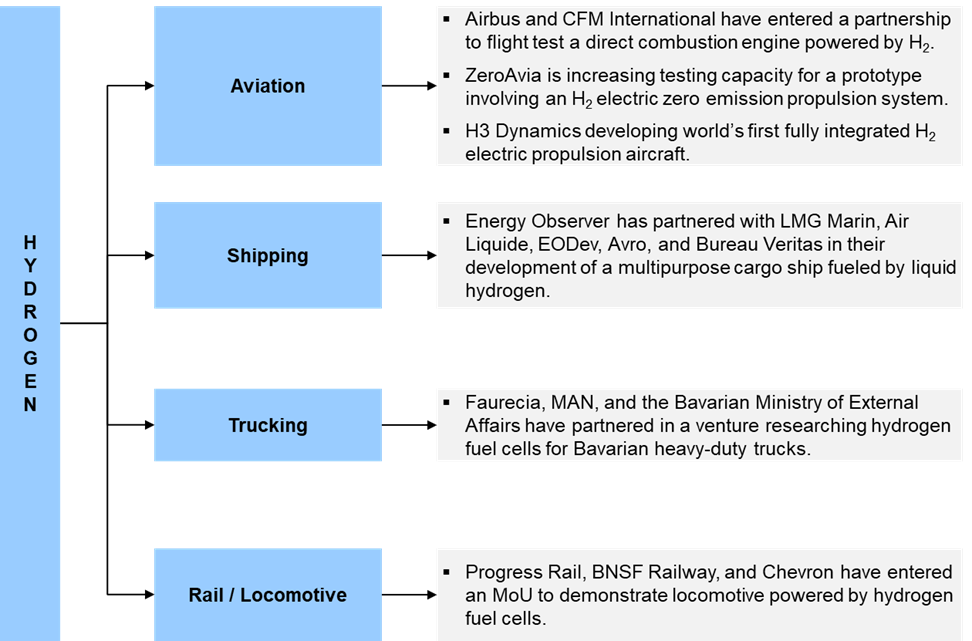

Companies are entering into partnerships leveraging different core competencies to build innovative products which can accommodate the transition from fossil fuels to hydrogen, as shown in Exhibit 2. As previously mentioned, H3 dynamics and ZeroAvia are making big plays in the aviation sector, developing propulsion systems, but other players in the field are Airbus and CFM International, who have entered a partnership to develop a direct combustion engine fueled by hydrogen.

Meanwhile in the shipping industry, we see Energy Observer has partnered with several companies for their expertise and support in areas such as design, maritime regulations, and fuel cell integration. As trucking and rail are further in their infancy, comparatively, we see deals being made at earlier stages with Faurecia and MAN partnering for fuel cell research in trucks and Progress Rail, BNSF Railway, and Chevron entering an MoU to advance demonstrations of locomotives powered by hydrogen.

researching ways to advance hydrogen-based products

On the flipside, there are also several technological constraints slowing down the implementation of hydrogen in transportation. As things stand, the major hurdle to overcome is storage and distribution.

Due to hydrogen’s low volumetric energy density, it requires a high pressure and low temperature to keep it contained, and liner permeabilities in storage tanks mean that hydrogen storage is inefficient and costly. Development efforts are being made for a new hydrogen storage tank, Type five, though it won’t be commercially available for a few years to come. In the meantime, pipeline networks are being built that efficiently transport hydrogen as a gas; however, they lack the accessibility that tank transport can offer. This means that it is difficult to get hydrogen to shipyards and airports, particularly ones in remote areas.

As countries look for ways to reduce emissions and meet net zero targets by 2050, ADI sees the transportation industry steering towards cleaner alternative fuels. ADI Analytics is closely following the global alternative fuels market. Reach out to learn more about ADI’s alternative fuel research and consulting services.

Victor Toffoli