Following the pandemic-induced recession and drop in investments in 2020, global investments in energy have increased. Investments in both fossil fuels and renewables have steadily increased, with renewable energy gaining the most. In fact, investments in renewable energy (solar and wind) are set to surpass oil and gas for the first time ever, with $494 billion spent on wind and solar versus $446 billion on oil and gas.

Electricity prices

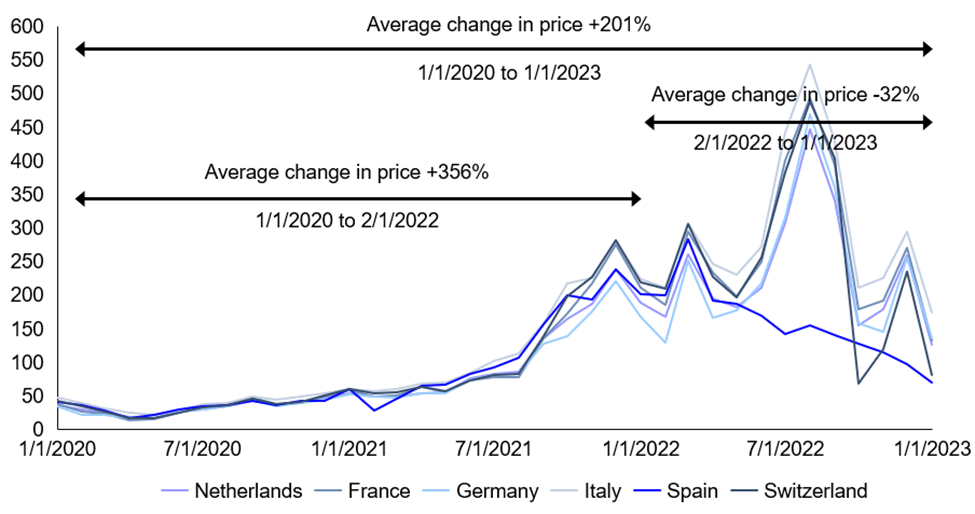

Part of the reason for the increased spend in renewables is the push for clean energy, with much of the world trying to decarbonize and many countries attempting to move away from fossil fuels. However, another reason for the increased investment is the price for electricity, which has swelled in recent years, particularly in Europe. As shown in shown in Exhibit 1, electricity prices have grown from around €40 per MWh in at the beginning of 2020, to over €500 in August 2022 in some countries. Even prior to Russia’s invasion of Ukraine, prices had swelled, on average, ~350%. Fortunately, a mild winter and restocking of gas stocks has allowed prices to decrease significantly from their August 2022 highs; however, prices on average are nearly triple what they were three years ago.

A return to fossil fuels

High energy prices coupled with supply security concerns following the Russia-Ukraine war, however, have done more than increased interest in renewables; they have spurred many countries to revert to fossil fuels. The U.K. has lifted a ban on fracing and issued new licenses for drilling in the North Sea, Europe is consuming as much LNG as possible, Germany has reactivated coal-fired power plants, and the APAC region is relying more on coal due to higher LNG prices. The IEA predicts that global coal demand will return to its all-time high in 2022 and remain elevated in 2023.

This U-turn is also affecting climate pledge goals and emissions targets. European emissions have increased 4% over last year, and globally emissions have increased 2.2% in 2022 compared to the first eight months of 2021. This increase is somewhat surprising considering China’s emissions were down 2.1% in 2020 as COVID lockdowns and policies took an economic toll on their country. Sustained high energy prices are likely to continue this trend.

Summary

This energy crisis should make it more apparent that all energy is good energy. Higher prices are likely what the renewable industry really needs to justify a significant and rapid expansion of its infrastructure, but it comes at the expense of consumer and economic pain. Meanwhile, climate pledges and emissions targets are being pushed aside to keep the lights on. These two goals can coexist but will require consistent energy policies with a diverse energy mix that enables appropriate investment decisions.

ADI Analytics closely monitors the energy industry. Contact us to learn more.

– Dustin Stolz