After nearly a decade of stagnant growth, geothermal energy may be poised for a period of growth again. New technologies, new investors, and technological innovations for geothermal systems including enhanced geothermal systems (EGS), supercritical geothermal, and advanced geothermal systems (AGS). A discussion of these systems can be found here.

Changing Landscape

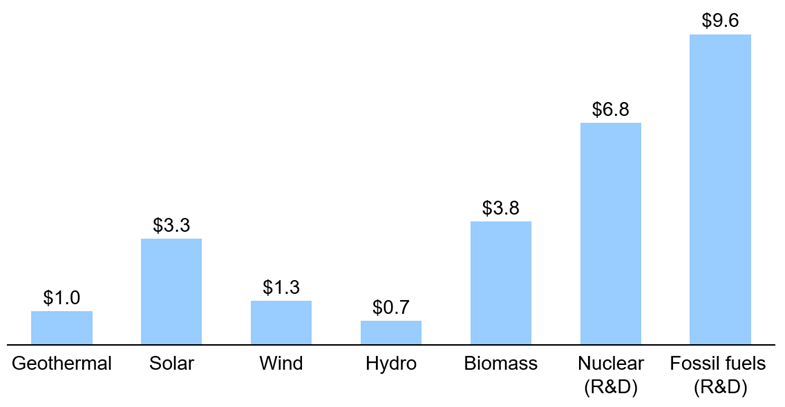

One of the biggest reasons geothermal has not advanced much is likely due to its historical lack of funding. Exhibit 1 shows that renewables overall receive less funding, with geothermal being one of the lowest funded areas of research for the U.S. DOE (Department of Energy). Around 2010, there was a flurry of activity associated with Obama era stimulus money that quickly faded. By the time drilling technology from the oil and gas industry crossed over, funding had dried up.

In 2014, the DOE opened its Utah FORGE (Frontier Observatory for Research in Geothermal Energy) facility, a dedicated underground laboratory for developing EGS. The federal government plans to provide $200 million from 2014 to 2024 at the facility, with half the funds supporting research by external groups and the rest for operational costs, including drilling wells and running tests. In September 2022, the DOE announced their “Enhanced Geothermal Shot” initiative aimed at reducing the cost of EGS by 90% to $45 per MWh by 2035.

In an effort to reduce drilling costs, the DOE is funding research into drilling with millimeter waves that essentially vaporize rock instead of pulverizing with mechanical drills. The department awarded ~$4 million to AltaRock through its ARPA-E initiative to develop this project. Baker Hughes is also developing some innovations specifically for the geothermal industry, these include a vertical drilling system that ensures a perfectly vertical wellbore, minimizing casing-borehole contact during directional drilling, and non-metallic flexible pipes more resistive to corrosion. Baker Hughes, along with numerous other oil and gas companies are actively investing in geothermal start-ups to help advance this technology and develop drilling innovations. These investments include closed-loop, supercritical, and EGS technologies.

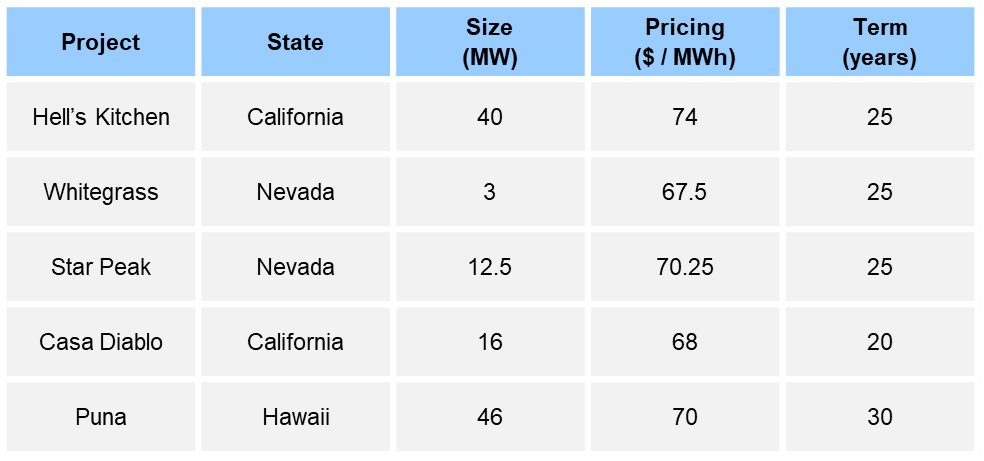

This growing interest and investment from both the public and private sector has the potential to revamp this industry. Much of this interest is largely due to renewable energy goals. Numerous geothermal start-ups have emerged with more funding than the government has provided in years, and many of these companies are well into demonstrating their technology through pilot projects. A further indication that geothermal may be poised for growth comes from increased power purchase agreements (PPAs). Since 2019, there have been 9 new geothermal PPAs signed in the U.S.; six in California and one each in Alaska, Hawaii, and Utah. Within these PPAs are plans for two new geothermal facilities in California, Hell’s Kitchen, and Casa Diablo. The PPA details made public so far are summarized in Exhibit 2.

Emerging Companies

Beyond the leading geothermal companies operating in the U.S. discussed herein, there has been a flurry of new companies started in the last 15 years (Exhibit 3) to advance some of the new geothermal technology. Most of these companies are based in the U.S., but there has been some international development also. Expansion in geothermal startups took off in the mid to late 2010s and several of them have active pilot programs in place.

Summary

The push for clean energy has renewed interest in the geothermal industry after years of business as usual. Additionally, after years of low prices in the oil and gas industry and rounds of layoffs leaving many oil and gas professionals on the sideline, the geothermal industry may finally be positioned with the expertise and capital to grow. Despite the rosy outlook, there is still reason to be skeptical. Much of this technology remains unproven and expensive, and federal funding remains relatively low. For example, the infrastructure bill passed in 2021 allocated $30 billion for carbon management, hydrogen, energy storage, and critical minerals. Renewable energy received just $420 million with only 20% of that allocated for geothermal. The next few years could look just like the era from Obama stimulus money: a flurry of activity followed by a decade stagnation.

ADI Analytics actively monitors the energy industry and is engaged in the energy transition. To learn more, contact us.

– Dustin Stolz