The surging prices and demand for lithium-ion batteries (LiBs) are a matter of concern for their end-use markets such as critical infrastructure, automotive electrification, renewables, and other smart devices. What makes LiBs a preferable choice is their longer life spans, faster charging, size customizability, low self-discharge rate, and extended run times.

Surging LiBs prices and demand

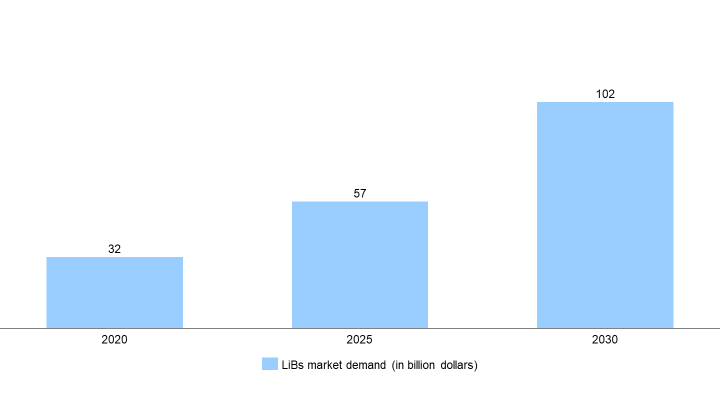

The LiB value chain requires stability, cost competitiveness, and efficiency at each stage to meet the growing demand. Global demand for LiBs is projected to grow from $ 41.1 billion in 2021 to $102.4 billion by 2030, with a CAGR of 12.3% (Exhibit 1). Although the recycling of LiBs is gaining momentum due to initiatives by companies such as Umicore, CATL, and Aqua Metals, it still has quite a few limitations and challenges that must be addressed in the times to come.

Altering cathodes to meet demand

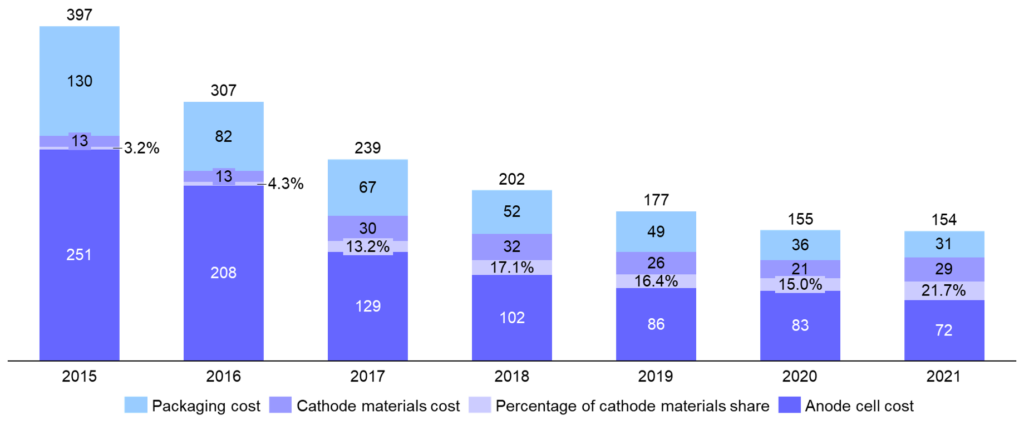

One of the most critical components in a LiB is its cathode. The cathode materials determine the density, voltage, and capacity of a cell, and thus play an important role in LiBs production and packaging cost. The cost of cathode materials is less than the cost of anode materials in total LiBs packaging (Exhibit 2) so its modification is a more cost-effective approach to reduce battery costs.

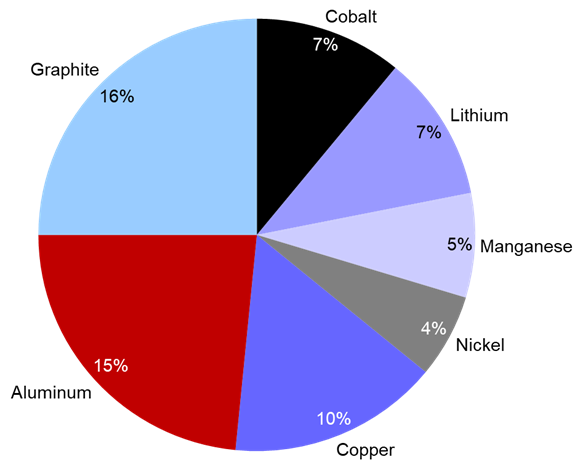

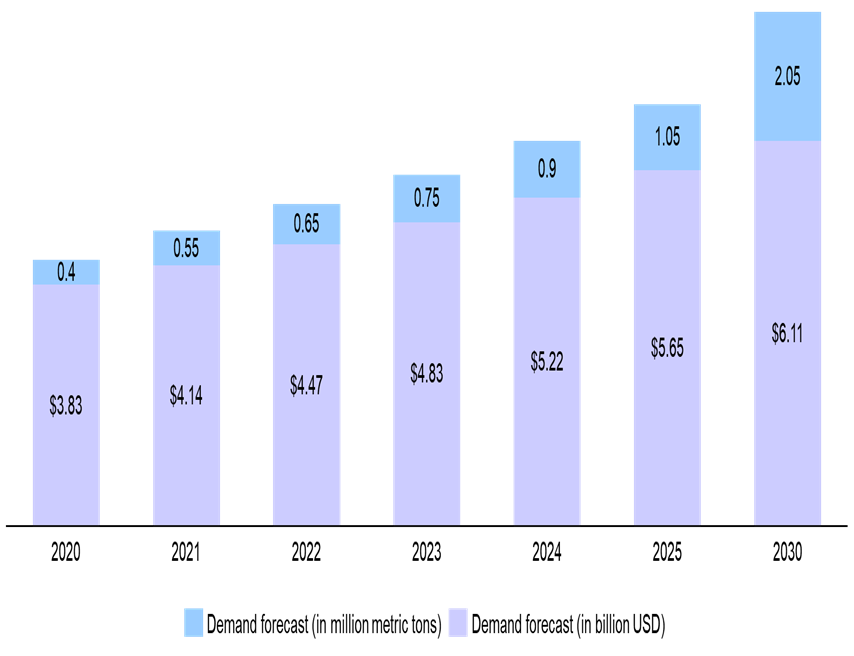

The cathode of typical LiBs comprises cobalt, lithium, nickel, manganese, aluminum, copper, graphite, and a few other materials in different ratios (Exhibit 3). Lithium and cobalt have been the most preferred active components in cathode cells, but price hikes are leading the search for cheaper alternatives. This is pushing companies to make batteries with lower lithium content to make up for the shortage in supply while maintaining pricing (Exhibit 4).

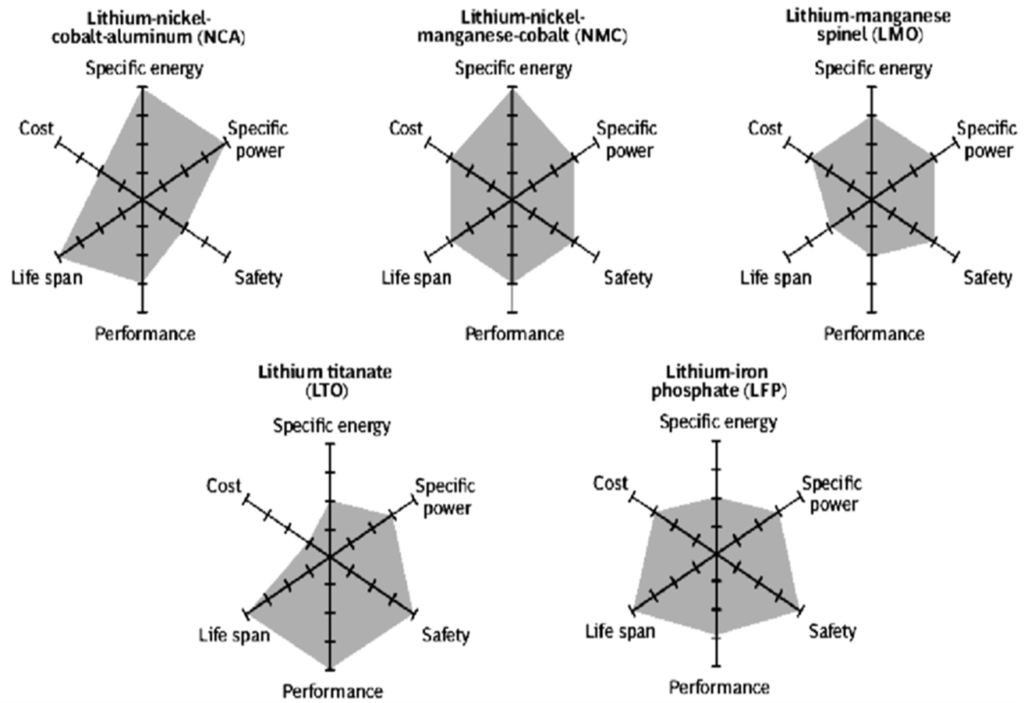

Popular alternative cathode materials for LiBs are nickel, manganese, aluminum, iron phosphate, and even titanate, each having its own advantages and disadvantages to meet the market’s application needs. In this analysis (Exhibit 4), ADI talks about the chemistry behind these batteries, how they are used, and growing initiatives to use them.

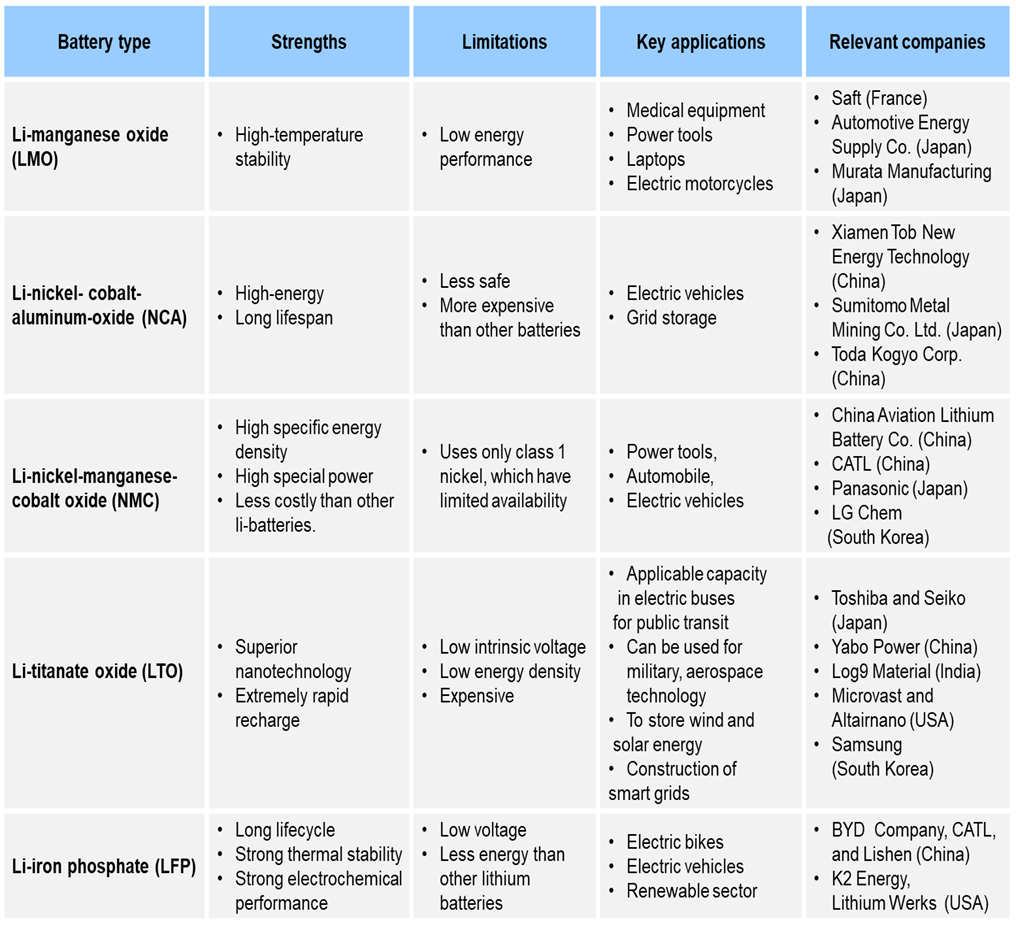

Exhibit 5: Strength, limits, and applications of different lithium batteries (Source: ADI Analytics)

- Lithium-manganese oxide (LMO)

LMO has a moderate specific power, energy, and safety. Due to its low cost, it has the potential to meet the demand of the medical sector for devices and power tools. For instance, LiMnO2 by Saft (France) is used in health equipment and devices like prosthetics, neurostimulation, remote monitoring, respiratory assistance, and defibrillators, to meet their durability and efficiency needs.

However, the moderate specific power in LMO leads to lower capacity and shorter life. This can nevertheless be fixed by using less expensive solid precipitation methods, than the co-precipitation method, in the production process.

- Li-nickel- cobalt- aluminum-oxide (NCA)

Due to its properties like moderate performance, cost, specific power, and longer lifespan, NCA can be used in powertrains. Toda Kogyo Corp (Japan) and BASF (Germany) announced a joint venture called ‘BASF Toda Battery Materials LLC,’ which provides state-of-the-art cathode active materials. This includes NCA and NMC in LiBs for automotive electrification.

This mixture of cathode materials too has some limitations, like thermal instability that occurs if nickel content increases. Aluminum ions can give stability in such a case, but it would reduce the overall capacity.

- Li-Iron Phosphate (LFP)

Due to Tesla’s announcement on using LFP batteries in their standard-range EV models, the limelight on this combination has peaked. As nickel prices are surging, LFP cells cost 30% less than NCA and NMC cells. Another factor that makes LFP a top choice for EV manufacturing companies is its low production cost.

LFP’s cost advantage comes from its lower raw materials costs; for example, a ton of LFP cathode production only consumes ~0.2t of lithium carbonate, compared to the 0.4t of lithium carbonate needed for NCM cathodes. As a result, a ton of LFP cathode is selling at USD 12k/t, compared to USD 28k/t for NCM cathodes.

China’s CATL is the leading LFP producer. Ford recently announced a major LFP cell supply deal with CATL for EVs that will start in 2023. Similarly, KYBURZ (Switzerland) entered into a supply agreement with CATL for its electric cargo tricycles.

- Li-nickel-manganese-cobalt oxide (NMC)

The high specific energy requirements of electric powertrain vehicles and bikes make NMC significant for them. It involves a 60% nickel, 20% manganese, and 20% cobalt ratio in its cathode cell combination, making it cheaper than other lithium batteries.

The increase of nickel in the ratio of NMC chemistry adds energy density but brings instability, and thus requires a balance with the cobalt ratio. In addition, it requires class 1 nickel, whose limited availability restricts NMC production.

China is the major source of NMC batteries, with CATL as the key producer. CATL and Fisker in the US recently entered into a collaboration agreement to secure a supply of NMC and LFP batteries to produce the Fisker Ocean SUV, which will be the most sustainable SUV and will be launched by June 2023.

- Li-titanate oxide (LTO)

The remarkable fast recharge time and high performance of LTO make it reliable for renewable technologies, such as storing solar energy and creating smart grids. The use of LTO batteries within hybrid energy storage systems carries environmental and economic benefits due to their long lifecycle and low-temperature performance.

With a cell voltage of 2.40V, it releases a discharge current of ten times higher capacity than other LiBs. Log9 Materials in India recently launched its tropicalized-ion battery that uses LTO and LFP battery chemistry to match the local climate. The series of SCiB™ Rechargeable batteries by Toshiba in Japan is the most successful application of LTO cells.

Summary

The demand surge for LiBs is mostly owed to the global shift towards clean technologies, which certainly needs the supply sustainability of cathode minerals. Manufacturers try to optimize battery chemistry on the parameters of cost, lifecycle, safety, and range. Due to their high-performance capacity and low-cost production, LTO and LFP are emerging as the most preferred cathode materials to meet the supply gap (Exhibit 6).

The qualities of self-discharging and charging efficiency and initiatives of companies, mostly from China, have been driving the growth of the LFP market size for electric vehicles. LTO brings a real advantage with its capacity to modify not only the cathode cell, but also the anode by replacing graphite with titanate. Although LTO costs 5% more than graphite, its extended lifecycle and higher performance reduce the total LiBs packaging cost.

ADI has been closely tracking energy storage and battery technology, manufacturing, and recycling trends. Contact us to learn more.

By Neha Mishra