One of the biggest challenges to direct air capture (DAC) has been the costs, as discussed in our previous blog that can be found here. Notable interest in carbon capture and DAC from both the public and private sector are providing new funding and incentives to promote the advancement of these technologies. Numerous projects are in the works worldwide with new start-ups developing ways to reduced costs and improve efficiencies.

Public support

Recent policies have started to incentivize DAC. The Infrastructure Investment and Jobs Act (a.k.a. the Bipartisan Infrastructure Law) passed in November 2021 provided unprecedented funding for DAC, allocating $3.5 billion for the development of four regional DAC hubs, each with the capacity to capture 1 MtCO2 per year. The law also allocated $115 million for FY2022 for development of DAC technologies.

This funding, coupled with changes to 45Q credits in the recently passed Inflation Reduction Act of 2022 (IRA) provides financial incentives for DAC deployment. Prior to the IRA, the 45Q credit was $50 per tCO2 for non-EOR use and $35 per tCO2 for EOR use, regardless of DAC or industrial capture. Under the IRA, those amounts increased with DAC carrying a much higher value ($180 vs $85 per tCO2 for non-EOR use, and $130 vs $60 per tCO2 for EOR use). The IRA also expanded the threshold for DAC facilities to qualify for 45Q credits, lowering it from 100,000 tonnes captured annually to 1,000 tonnes, and made it easier to monetize the 45Q credits. These changes provide a financial incentive to pursue DAC research and projects that should drive down costs for the technology over time.

Investors

In addition to financial incentives at the federal level. There has been increasing interest from the private sector for DAC, and carbon capture in general. Examples of this include United Airlines multi-million-dollar commitment for carbon removal programs, namely the DAC facility being developed by 1PointFive and Microsoft’s commitment to spend $1 billion from 2020-2024 through their Climate Innovation Fund to fund technologies to remove or reduce CO2.

Venture capital investments are making significant investments in carbon capture as well. In Q2 2022, VC invested a record setting $882.2 million across 11 projects, compared to a total of $432.1 million over the previous four quarters. A large portion of that record investment came from Climeworks series F fundraising, which was reported at $650 million, the largest ever investment in DAC.

One notable trend in investments in these technologies is the participation of big tech companies and their founders:

- Breakthrough Energy Ventures is a philanthropic organization led by Microsoft founder, Bill Gates, working to advance and develop technologies to reach net-zero

- Investments by the Chan Zuckerberg Initiative, a philanthropic organization led by Facebook founder, Mark Zuckerberg, and his wife Priscila Chan, include a $21 million donation to UCLA Engineering Institute for Carbon Management to test multiple carbon removal technologies, including electrochemical DAC

- The Musk Foundation and XPRIZE partnered for a $100 million carbon removal challenge

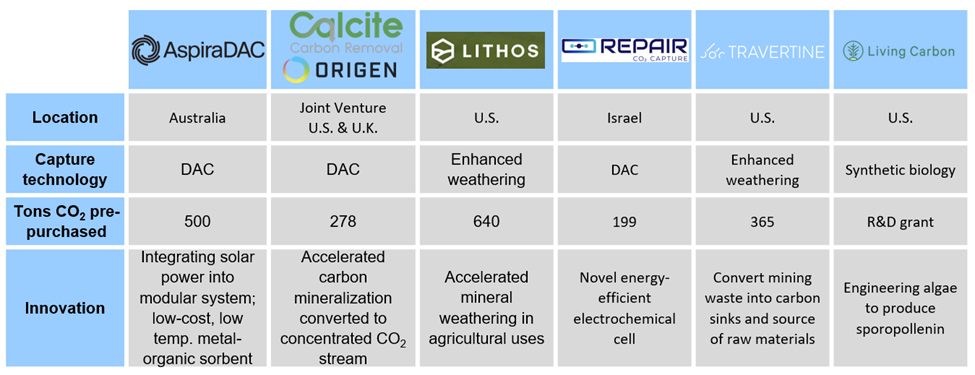

In spring of 2022, Frontier was developed. Frontier is an advance market commitment (AMC) with $925 million funded by Stripe, Alphabet, Shopify, Meta, and McKinsey & Company. AMCs are a concept borrowed from the vaccine industry that provide a funding mechanism to incentivize product development. The idea being to create a market or send a demand signal that there will be buyers once technologies are advanced and scaled. Frontier’s first group of awards was announced this summer and are shown in Exhibit 1. Most of these companies were funded with a prepurchase of carbon credits with prices ranging from $500 to $1,800 per ton. To qualify for Frontier’s program, however, the innovation must have the projection for costs to decrease to below $100 per ton as the technology is scaled. Half of the companies selected are developing DAC technologies

Companies and upcoming projects

Climeworks, Carbon Engineering, and Global Thermostat represent the leading DAC companies today. They operate the only DAC in operation today. Exhibit 2 provides a summary of these three companies.

In addition to these companies and their existing projects, numerous other facilities are starting to take shape. In the U.S., two new companies are developing large scale DAC projects:

- 1PointFive (part of Oxy Low Carbon Ventures) is financing and developing a facility with a 1 MtCO2 per year capacity. The plant is using Carbon Engineering’s technology and should be operational by 2024.

- CarbonCapture is developing Project Bison in Wyoming. They plan to be operational in 2023 and capture up to 5 MtCO2 per year by 2030 using a modular platform. They are planning to sequester the captured CO2 in a class VI well.

Outside the U.S. are two other projects:

- Carbon Engineering is in the early stages of development with Pale Blue Dot to develop a project in Scotland

- Carbon Engineering has started designing an air-to-fuel plant in Canada targeting completion in 2026

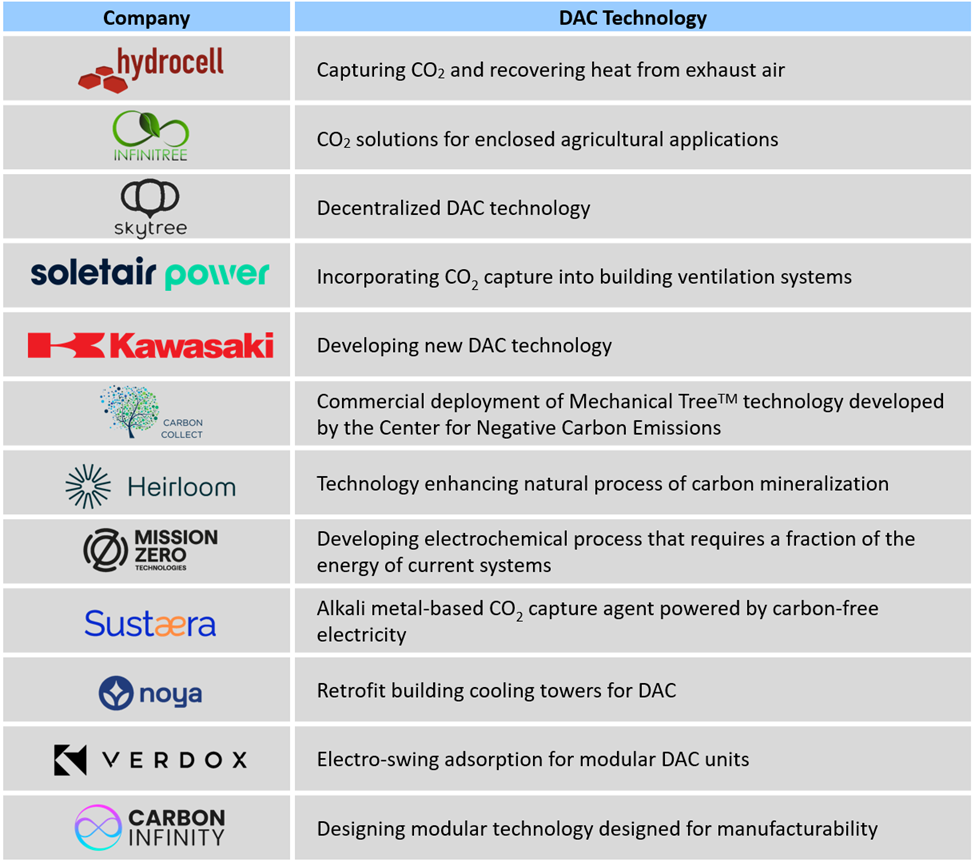

Beyond these specific projects, Exhibit 3 shows other companies in the DAC space that are developing or implementing new DAC technologies. These companies may become more significant players in the coming years.

Summary

Policy changes over the last couple of years is moving the DAC industry forward. With funding in place for technology development and tax credits in place for deployment, the DAC industry is likely to see extensive changes and growth over the coming decade. These changes are likely to alter the complexion of the market in terms of major players, costs, and technology.

Launching an in-depth multi-client study on NCS

ADI Analytics is launching a new multi-client study on Direct Air Capture (DAC) to be completed in mid-December. Below are the key topics covered in the study:

- Existing state of DAC market and forecasts through 2030

- National and international policies and regulations affecting this space

- Public and private funding for initiatives and advances in DAC

- Current and emerging DAC technologies and costs

- Review of DAC projects including those existing, in development, and planned

- Stakeholders involved in the DAC sector including tech developers, facility operators, and suppliers

- Challenges facing the industry and the technology and commercial innovations addressing these challenges

- Strategic implications for key market participants and associated risks and uncertainties

Download the study prospectus and contact us to join this multi-client study. Subscribers have an opportunity to shape the study’s research agenda along with developing an in-depth view of how NCS can help energy markets.

This is part of our Going Blue blog series on carbon capture. ADI Analytics closely monitors energy policies and the energy transition. Contact us to learn more about our research and how we can help.

– Dustin Stolz