Energy prices have soared throughout Europe since the beginning of the year. The crisis is particularly acute in the EU’s largest economy, Germany, which relies heavily on Russian gas for its economy. Recent events have exacerbated the problem and the German government is taking actions to combat the effects of the crisis on its people and the economy.

In 2021, Germany relied on Russia to supply 55% of their gas imports. By June 2022, that amount declined to 26%, partly due to reduced flows on the Nord Stream 1 pipeline. In late August, Gazprom completely shut off the pipeline, stating that it would only last a few days. Then, in a late announcement on Friday, September 2, just hours after G7 countries imposed a price cap on Russian oil, Gazprom announced that the shutdown would be indefinite.

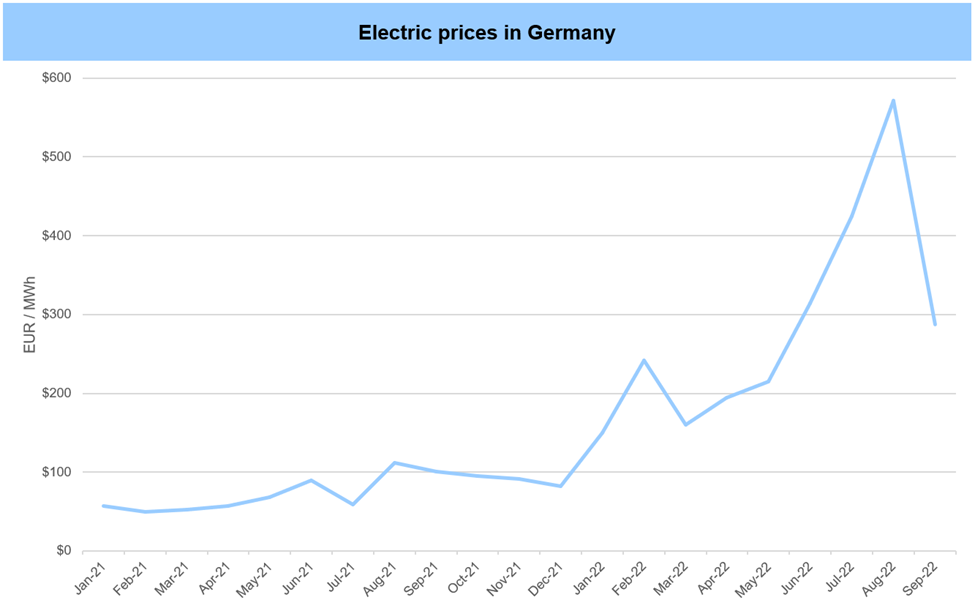

The energy crisis is affecting energy prices and the economy. Electricity prices have soared, with the average price of €284.42 per MWh in 2022 versus €71.62 over the same period in 2021, nearly a 300% increase. Natural gas prices show a similar trend, with EU import prices climbing over 300%. Consumers have reported even higher increases to their utility bills.

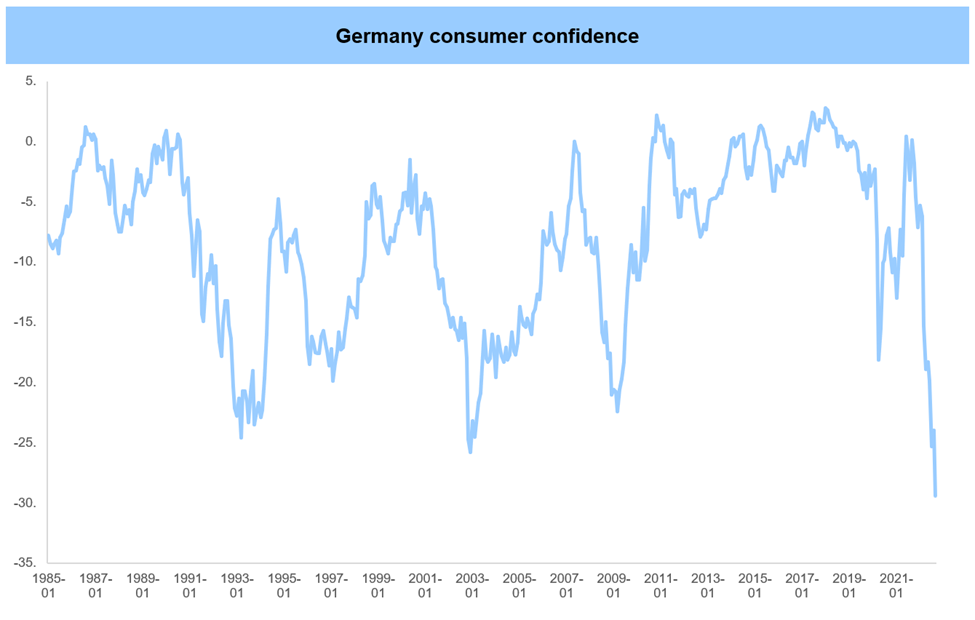

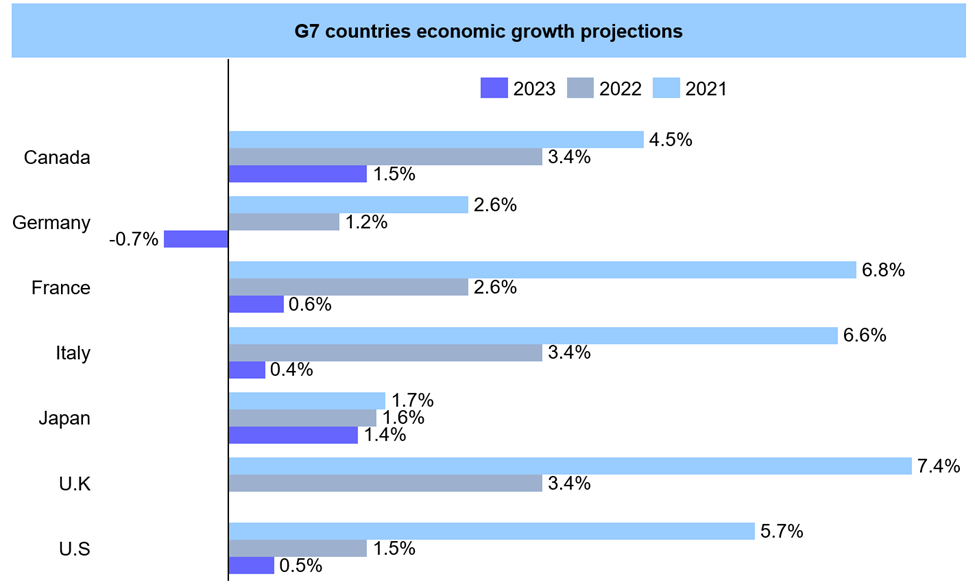

As a result of these prices and the growing economic concerns worldwide, German consumer confidence is at record lows (Exhibit 2) and German businesses have growing concerns about bankruptcies that could further disrupt the supply chain. Recently, the Organization for Economic Cooperation and Development predicted that Germany’s economy will shrink by 0.7% next year, the worst among the G7 countries and the only one with negative growth predicted (Exhibit 3).

The German government has made several announcements recently to combat the energy crisis. On September 5, Germany’s Federal Ministry for Economic Affairs and Climate Action (BMWK) announced that two of Germany’s three remaining nuclear power plants will remain available to produce electricity, if necessary, through mid-April 2023 to supply power southern Germany over the winter. In addition to delaying the closure of these power plants, Germany has re-opened or extended the closing dates of at least 20 coal-fired power plants. The increased demand for coal has caused prices to double since the beginning of the year, and currently sits at $435 per ton at the time of this writing.

On Thursday, September 29, Germany announced a price cap on electricity and natural gas for consumers and companies, up to a yet to be determined level. Above that level, market rates will still apply. The announcement also included scrapping a planned tax hike on natural gas in 2023. The costs of these measures could total €200 billion. Several other European countries have enacted energy price caps or windfall taxes on energy companies, and the EU is debating for a broad price cap for the entire bloc to help mitigate inflation pressures for the whole region.

While these measures may temporarily ease the financial pain of some consumers, they do little to solve the overall energy crisis. Price caps do not solve energy shortages. Companies will have little incentive to supply energy to German utilities if the price caps do not cover costs controlled by a global market. Moreover, suppliers will have little incentive to sell fuel at a price cap if there is a market elsewhere paying a higher price (e.g., Asian buyers who may be willing to pay more for LNG). These actions could lead to energy shortages in the region.

Extending the life of a few nuclear and coal power plants may help in the short term, but a longer-term solution is still needed to ensure a cheap and reliable supply to German consumers. Diversifying the overall energy mix, including a greater degree of investment in the natural gas infrastructure (e.g., to source LNG from the U.S., Asia-Pacific, and Africa) will be an important long-term solution.

ADI Analytics is closely tracking the impact of the Ukraine war on the European economy and global energy and chemical markets. Reach out to us to learn more about how we can help.

– Dustin Stolz