As the shale patch enjoys the current upswing in commodity prices and prepares to supply the marginal barrel of demand growth, operators have significantly accelerated the adoption of artificial lift options. Through a mix of primary research conducted with oil & gas operators in the Permian, Bakken, Eagle Ford, and the Rockies, coupled with extensive secondary research, ADI is finding operators reporting a greater reliance on artificial lift to drive production growth. Similarly, oilfield service companies are reporting rapid growth in demand for artificial lift services. Broadly speaking, we see three key themes with the acceleration of artificial lift in the shale patch.

First, the current oil price environment is a strong incentive for oil & gas operators to accelerate oil (and gas, too, given the record-high prices in a decade) production. As a result, oil and gas operators are sufficiently motivated to deploy artificial lift to enhance production rates. In some sub-plays such as the Midland where formation pressures have traditionally been low limiting free flow in wells, many operators are opting to install artificial lift systems – with a strong preference for electric submersible pumps (ESPs) – right away without waiting to first operate wells based on its natural formation pressures.

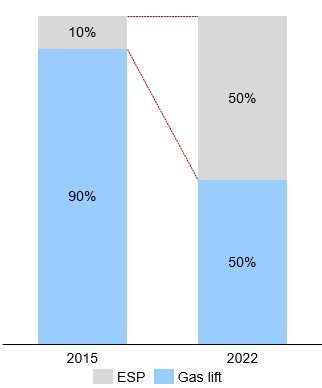

Second, five years ago, Permian operators were far more likely to adopt gas lift with only one in 10 wells using ESPs to drive additional recovery. Today, ESPs account for nearly half of all wells opting for artificial lift options (see Exhibit 1). ESPs offer high recovery rates generating an additional 3,000 to 7,000 barrels per day of well fluids. Operators are considering ESPs for multiple applications including enhancing production and dewatering reservoirs with high water cuts. Once the decision to use artificial lift is made, operators are today installing ESPs without exception in wells with limited bottomhole pressures, low gas-oil ratios, and high water cuts. A big driver for the shift towards ESPs over gas lift has been the availability of reliable power in the Permian. Operators in the Permian have made significant investments on bringing reliable, high-quality power to the play enabling efficient and continuous utilization of the pump.

Exhibit I: Shift in ESP adoption from 2015 to 2022 in the Permian.

Finally, oilfield equipment manufacturers and vendors of electric submersible pumps have invested in production innovation to improve the reliability and performance of ESPs – long a pain point for operators — in extreme downhole conditions and gas reservoirs. For example, Summit ESP, acquired by Halliburton, is researching utilization of a hydro-helical gas separator which can handle at least 20% more flow than conventional gas separators.

New unconventional wells are seeing longer laterals with smaller casing and tubing sizes. Conventional ESP systems are not designed for such narrow spaces. ESP vendors are starting to reduce the size of the pump to adapt to the changing drilling designs. Operators in the Permian are also looking at replacing conventional induction motors with permanent magnet motors (PMMs) which induce no electric current. Minimization of electrical losses and rising heat can increase motor efficiency by 10%. PMMs have been able to reduce ESP energy consumption in certain cases by as much as 46%.

Collectively, adoption of artificial lift and ESPs is seeing significant acceleration across key shale plays in North America. ADI Analytics is closely following and modeling the North American and global artificial lift markets. Reach out to learn more about ADI’s artificial lift research and consulting services.

– Ritwik Mukherjee and Uday Turaga