The recent sanctions on Russia have caused Western Europe to rely on other countries for natural gas imports. The U.S. is one of the key countries that has expanded its import to Western Europe, and we expect this role only to grow due to multiple factors, including the following:

- Natural gas production has grown by 20 billion cubic feet per day over the last five years in the U.S., and this trend will continue from 2023 to 2027.

- Natural gas consumption in the U.S. will, however, remain stagnant over the next five years. Therefore, the industry will have to export the increase in natural gas production as LNG exports.

Natural gas production by play

Focused on natural gas production, we see growth centered in three major plays.

Appalachia

Over the past decade, Appalachia has established itself as the greatest source of natural gas, accounting for nearly 1/3 of all dry gas production in the country. Gas production in the region will grow around 4% annually over the next 5 years, followed by significant natural gas growth in Haynesville and associated gas growth in the Permian. Drilling wells in the Appalachia has become very productive due to efficiency improvements in horizontal drilling and hydraulic fracturing in the region, which include faster drilling, longer laterals, and better completions.

Permian

In 2021, natural gas production in the Permian Basin reached an annual high of 16.7 billion cubic feet per day. Since 2012, the Permian has been rising in annual marketed natural gas production and is considered the second-largest shale gas-producing region in the U.S. after the Appalachian Basin. Unlike Appalachia, most of the natural gas production in the Permian is associated gas produced by oil wells, so natural gas producers with operations in the Permian respond most to crude oil price fluctuations and plan their exploration and production (E&P) activities around them. Given the industry’s interest in increasing E&P activity due to projected crude oil prices, natural gas production levels in the Permian may grow 4.2% annually from 2022 to 2027.

Haynesville

Haynesville is the third-largest share gas-producing play in the United States, with a 25.6% annual growth rate in natural gas production from 2017 to 2021. It was the highest growth rate in natural gas production compared to Appalachia, Permian, Niobrara, and other plays. The growth in Haynesville’s natural gas production is tied more closely to global demand growth for U.S. LNG due to the play’s proximity to LNG export facilities on the U.S. Gulf Coast. As a result, E&P activity in Haynesville closely follows natural gas prices due to the need to drill very deep wells, ranging from 10,500 to 13,500 feet underground, thus incurring higher drilling costs. Collectively we anticipate the natural gas production at Haynesville to grow 2.6% annually from 2022 to 2027.

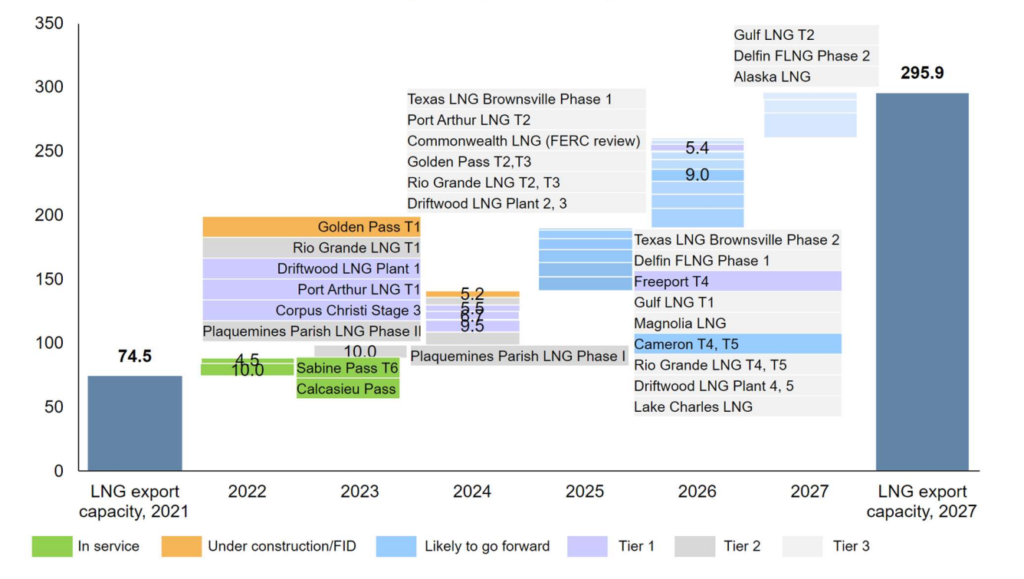

Currently, LNG capacity is about 89 metric tons per year, with plans to add new capacity totaling up to 300 metric tons per year by 2027 (Exhibit 1).

Although not all projects will move forward, this expansion will cause the U.S. to be the largest producer of LNG in the world by 2023. New pipeline projects are underway to facilitate this growth in natural gas production. The U.S. has approximately 2.1 million miles of pipelines, including main distribution pipelines (64%), gathering pipelines (21.5%), and transmission pipelines (14.5%). Most of the upcoming LNG projects will need gathering pipelines to bring new gas production, with a small amount of growth in transmission pipelines to increase takeaway capacity and to move gas from production facilities to new LNG terminals. Distribution mains will not significantly increase since U.S. consumption will remain near current levels.

Closing

These three regions account for nearly all the natural gas production growth in the short term, which will propel the U.S. to become the world’s largest exporter of natural gas and LNG. ADI Analytics closely follows the global LNG market and maintains a database of operational, planned, and announced LNG export and import capacities globally along with annual studies of North American and global small-scale LNG. Subscribe to our monthly newsletter to stay updated and contact us to learn more.

Jacqueline Unzueta and Richard Germana