Note: This blog was originally written in 2017

As natural gas supply continues to grow and operators become more aware of the environmental benefits of switching to natural gas from coal-based power generation, ADI identified trends in capital equipment purchasing. In countries where natural gas has a cost advantage over coal, such as the United States, there have been large reductions in carbon emissions in power generation. Many countries such as the United Kingdom, Egypt, Mexico, and China are following suit to reap the economic and environmental benefits of natural gas by reforming gas markets. Better access to gas infrastructure is expected to improve new investments made by the private sector.

Apart from these benefits, higher natural gas consumption is driven by higher coal prices, coal plant retirements, nuclear outages, and growing energy-intensive industries, such as the chemical and mining industries. In China, natural gas is not more cost-competitive than coal, but the government is promoting gas-fired boilers for better efficiency and lower carbon emissions. Bigger cities in China have high smog levels and natural gas-fired units are expected to improve air quality. North America accounts for a quarter of the world’s natural gas consumption due to its development efforts in gas-fired technologies and capital.

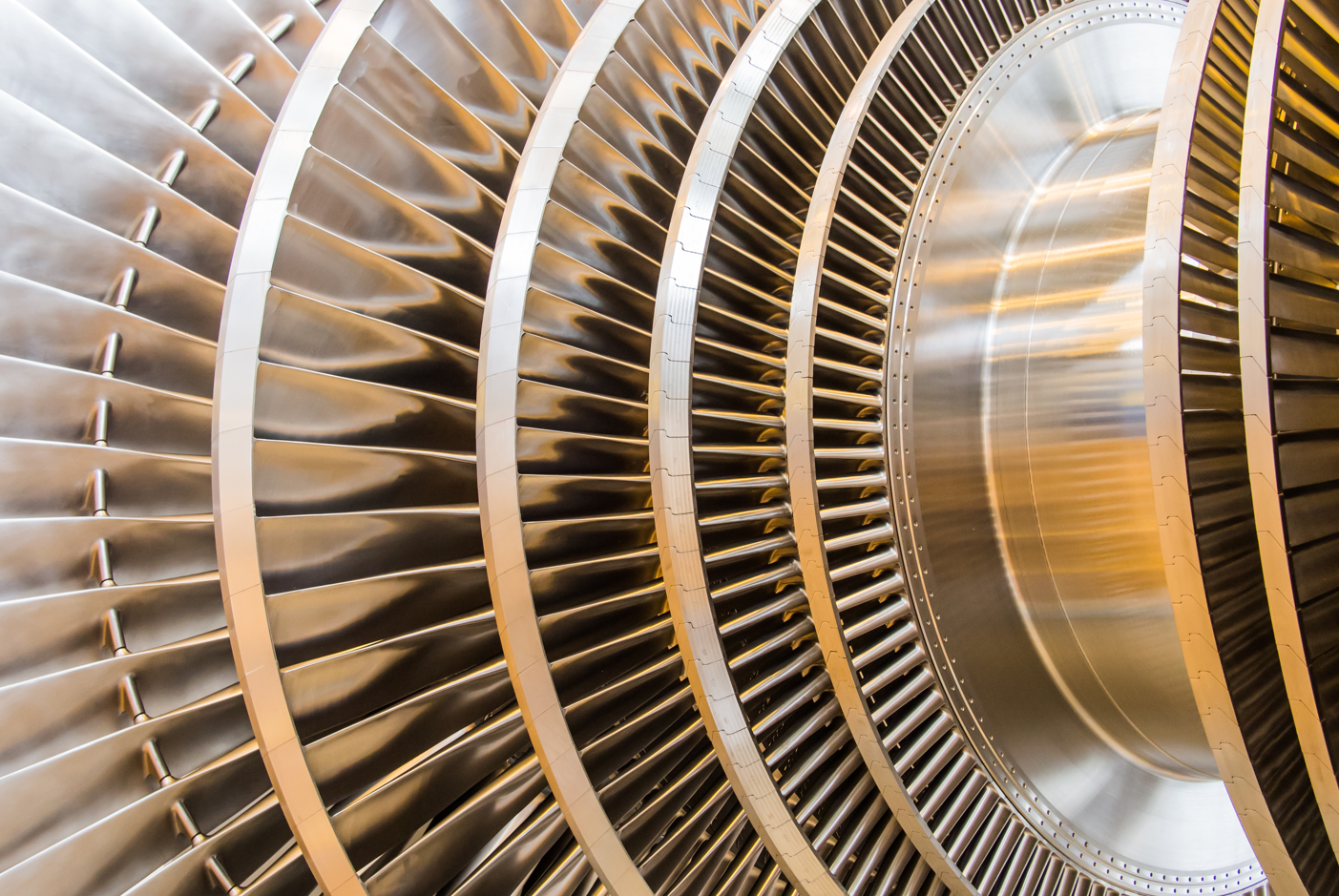

Steam turbine orders were analyzed for the past 7 years to identify market trends in capital equipment purchasing. Globally, new orders increased from 66 in 2009 to 181 in 2014 (Exhibit 1). The prevalence of coal for power generation explains Asia’s exceeding number of steam turbine orders compared to other regions.

ADI also assessed the weighted average output in kilowatts of steam turbines globally and regionally (Exhibit 2). The weighted average output in the Middle East and Asia is greater than the global average output, indicating that coal units in these regions are much more common than in other regions.

Regulations also greatly influence a country’s natural gas consumption. Recently, South Korea’s government enforced a policy that promotes coal as the primary energy source due to its favorable prices. However, other efforts to phase out nuclear energy and coal-fired power generation will likely attract natural gas for power generation. In France, safety concerns around nuclear reactors resulted in higher gas-fired power generation. Coincidentally, the Japanese government approved many nuclear power stations to come online in the upcoming years, which are expected to significantly reduce gas-fired power generation. ADI has supported a number of OEMs including steam and gas turbine manufacturers and service providers with market sizing, voice-of-customer research, customer and competitive landscaping, and growth and M&A strategies. Please contact us to learn more about our services.

Jacqueline Unzueta and Swetha Sivaswamy