Note: This blog was originally written in 2017

Global natural gas supply has grown 1.6% annually from 2011 to 2016, and it is projected to continue to grow over the next 5 years. The United States, the world’s largest gas producer, will account for 40% of the growth in global natural gas production over the next five years, followed by China (40%) and the Middle East (20%).

Many countries are mobilizing capital to build and install gas infrastructure and gas-fired power generation given the ample supply and lower carbon emissions. To understand how gas-fired power is penetrating energy markets globally, ADI studied gas and steam turbine sales data to understand the shift from coal to natural gas in various regions. Specifically, ADI analyzed data on new sales of turbines over the past 7 years and correlated it to power generation trends to better understand the impact of natural gas by region.

A cursory glance at global and regional gas turbine sales would suggest a flat and insipid market (Exhibit 1). From 2009 to 2015, 605 gas turbines were sold globally on average. Most years had annual sales close to the average, suggesting the market hardly changed. In North America, Asia, and the Middle East, regional unit sales are close to their respective average sales with little variation.

In contrast to unit sales data, the weighted average of turbine output in megawatts is a better metric to understand the size of turbines (Exhibit 2). The Middle East and North America have the highest average turbine outputs indicating larger plants in those regions. This could be directly related to the extensive supply of natural gas in those regions, as compared to other markets. In recent years, the average turbine output rose in North America, which is consistent with the region’s shift from coal to natural gas power generation, following the big discoveries of shale plays.

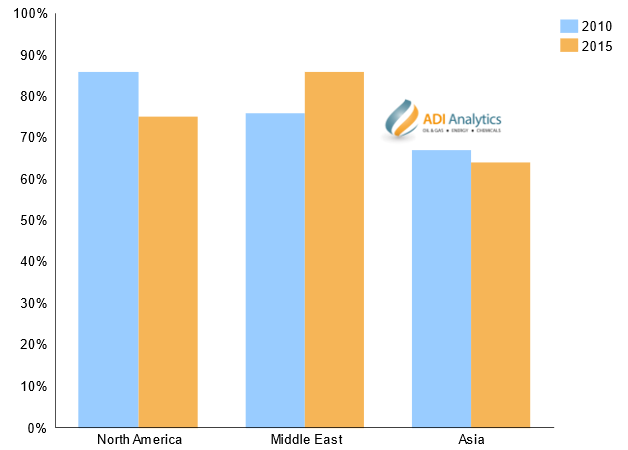

Furthermore, the percentage of power generation from gas turbines exceeding 120 MW is higher in North America and the Middle East compared to Asia (Exhibit 3). This is primarily due to Asia’s limited supply of natural gas and distributed populations. In North America and Asia, the share of large turbines fell from 2010 to 2015 due to a small resurgence in coal-based power generation due to declining coal prices. Lastly, the Middle East is focused on increasing gas-fired capacity, which is reflected in the rising share of large turbines in gas-based power generation.

The preference for natural gas for power generation is a function of regional natural gas supply. The United States is the greatest consumer of natural gas for power generation, and it paves the way for several innovations related to gas-based technology. In several other countries, such as India and Malaysia, where a lower unit price is the main driver, coal is the clear winner. Identifying these trends will help OEMs in power generation make better purchasing decisions across world regions.

ADI has supported a number of OEMs including steam and gas turbine manufacturers and service providers with market sizing, voice-of-customer research, customer and competitive landscaping, and growth and M&A strategies. Please contact us to learn more about our services.

Jacqueline Unzueta and Swetha Sivaswamy