Aviation is one of the hard-to-abate industries when it comes to decarbonization. COVID-induced lockdowns and the recession that closely followed slashed global aviation demand by 42% in 2020 compared to 2019. This also resulted in the lowest CO2 emissions from the aviation industry in over two decades dropping from about a billion tons of CO2 in 2019 to a little over half a billion tons of CO2 in 2020.

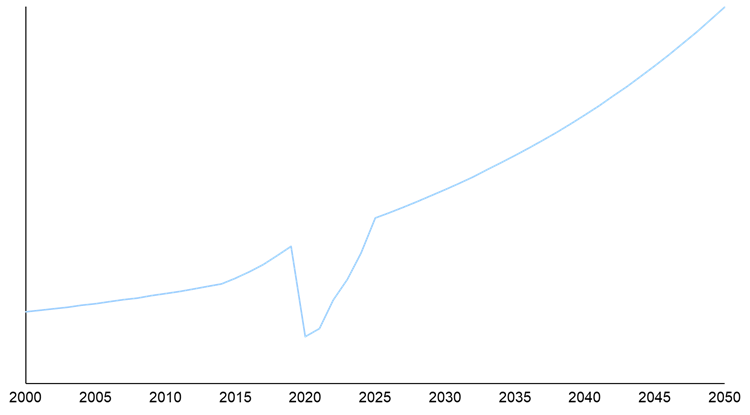

As the world slowly returns to a normal, travel is rising and there has been a steady growth in global aviation demand. Cargo air transport on the other hand, was not impacted as much as passenger air travel during the COVID-related lockdowns. We expect rising population and living standards and economic and infrastructure growth to drive aviation demand over the long term. ADI Analytics expects the global aviation demand to grow more than four-fold by 2050 resulting in CO2 emissions of almost 1.4 billion in a business as usual (BAU) case. However, rising awareness and growing concerns of the environmental impact of aviation are driving several policies, commitments, and investments towards decarbonizing aviation. Exhibit 1 shows projected global aviation demand growth.

Exhibit 1. Global aviation demand growth through 2050 in revenue passenger miles

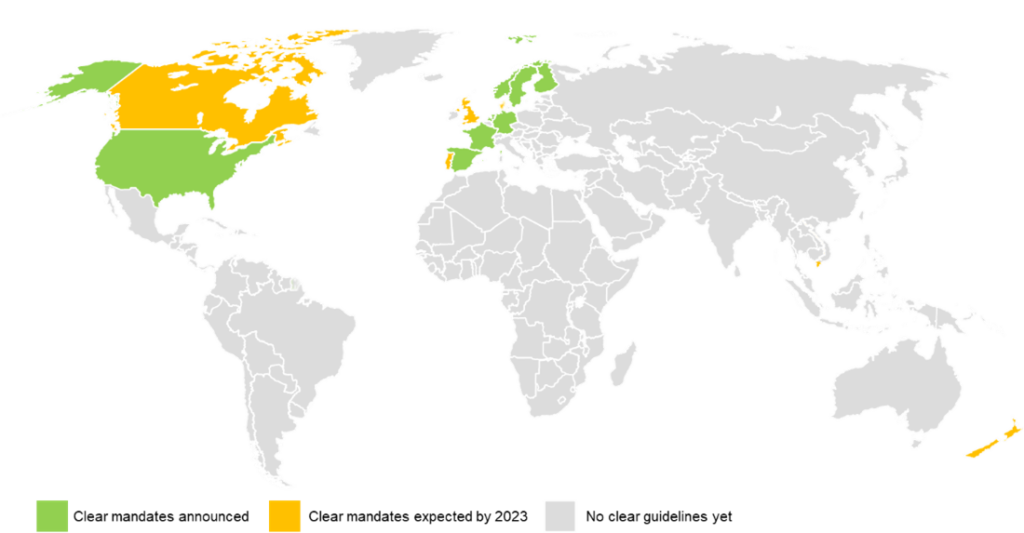

In accordance with the Paris Agreement, the International Air Transport Association (IATA) aims to reduce net CO2 emissions from the aviation industry by 50% of 2005 levels in 2050. There are several options to decarbonize aviation including improving aircraft efficiency, adopting alternative fuels such as sustainable aviation fuel (SAF), hydrogen, and electric batteries, and carbon capture at refineries. SAF is a drop-in fuel compatible with conventional jet fuel and is the easiest option to adopt over the short and medium terms. Disruptive technologies such as hydrogen and batteries, on the other hand, will need significant technological advancements and may be limited to short haul flights over the long term. Summarizing the regulatory landscape, Europe and North America lead efforts to drive SAF use and capacity growth with rest of the world gradually catching up to develop a global value chain. Exhibit 2 below shows regions where a clear mandate has been announced versus where discussions have begun.

Exhibit 2. Countries promoting SAF adoption via regulations

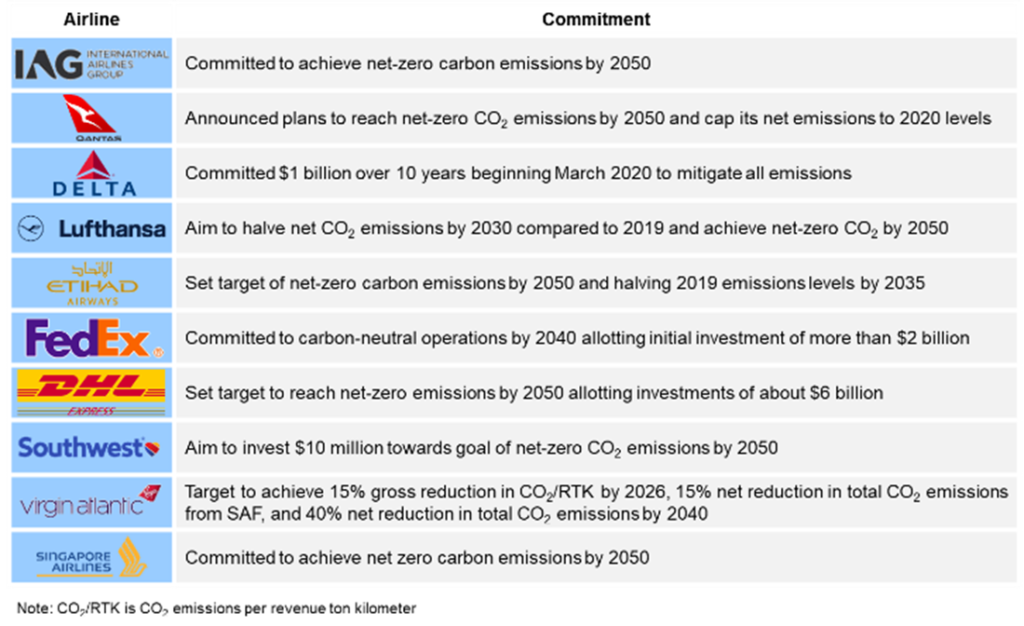

Inconsistent regulations across the world are creating challenges for airlines, most of which operate globally. Further commitments made by global organizations such as the IATA, International Civil Aviation Organization (ICAO), and Air Transport Action Group (ATAG) are driving their members to also make commitments towards cutting CO2 emissions from their operations. Some airlines around the world that have made various levels of commitments towards decarbonization are expected to drive adoption of SAF. Exhibit 3 summarizes a list of some of the leading airlines and their commitments.

Exhibit 3. Decarbonization initiatives by leading airlines

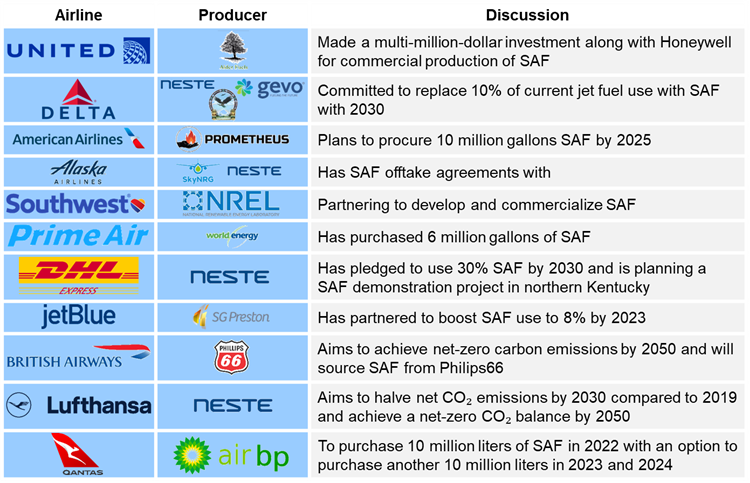

In addition to commitments, several airlines have also entered into agreements to invest in commercial SAF production or research to bring down costs of producing SAF. Exhibit 4 below shows some of the leading airlines that have partnered with SAF producers.

Exhibit 4. Efforts by airlines towards SAF production and commercialization

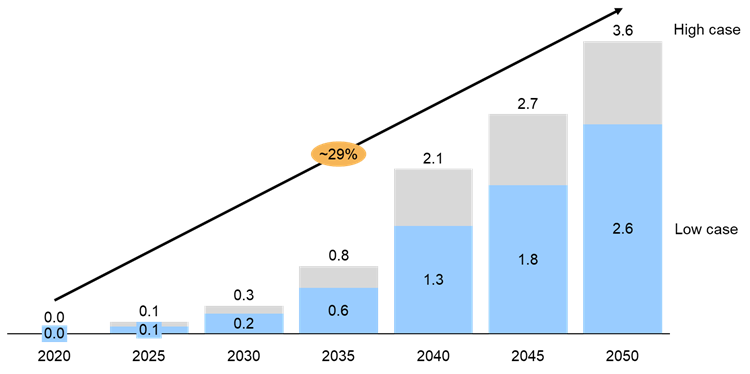

Many large refiners and oil and gas majors have become involved in SAF production and technology development. For instance, Phillips 66, ENI, TotalEnergies, and BP are producing growing volumes of SAF. Additionally, majors are also tying up with SAF producers to cost effectively scale up capacity. Based on regulations, commitments, and capacity announcements, global SAF demand is expected to grow at ~29% annually through 2050. Exhibit 5 shows estimated SAF demand growth globally.

Exhibit 5. Estimated global SAF demand trough 2050 in million barrels per day

In addition to growing aviation demand, decarbonization efforts, and efforts by SAF producers and refiners, growing supply, techno-economic advancements, and feedstock supply will drive global SAF demand growth. We will discuss these topics in part II of the blog. ADI recently published a multi-client study on jet fuel and sustainable aviation fuel markets which is available immediately and continues to track the very dynamic market. Contact us for an updated view on SAF commitments by airlines, off-take agreements, and partnerships for commercialization.

By Panuswee Dwivedi