The Eastern US is battling high coal prices which has suppressed gas to coal switching in recent months, even with the current natural gas market dealing with a decrease of supply and high trading prices. The constraints within the coal market have created an ever-increasing natural gas demand in the power sector. But how and when is it decided to switch from natural gas to coal, vice versa, and how can high natural gas prices provide coal-fired power an opportunity to increase its market share within the power sector?

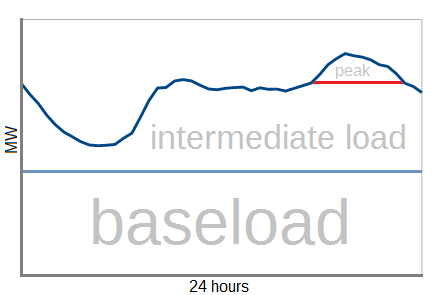

To answer this question, we first need to understand how different types of generation capacity are used throughout the day. This is based on the region’s load curve, a diagram breaking down how much energy is used at any given hour of the day as shown in Exhibit 1. The load curve is broken down into three segments: baseload, intermediate/cycling, and peak. The baseload is run continuously and is the established minimum capacity needed in the region. Above the baseload is the intermediate/cycling capacity which ramps up or down during the day dependent on demand. Above that is peak capacity which is only used at peak demand throughout the day, typically late afternoon and during the summer.

Exhibit 1. Load curve diagram

To meet the needed capacity throughout the day in an orderly manner, a generation stack is used. A generation stack is the order at which a grid operator will increase the generation capacity based on the variable cost of the plant where the least expensive units are called for first and the most expensive last. Typically, nuclear and coal are the cheapest power generators and are used to supply the baseload energy requirements with natural gas combined-cycle generation turbine (CCGT) plants and renewables supplying needed intermediate capacity, and natural gas combustion turbine plants supplying peak capacity as they are the most expensive to operate.

Switching between coal-fired and gas-fired generation occurs when one or the other is the primary generator for the baseload energy requirements. The decision to switch is based on location of plants, operational requirements, temperature/weather, other plant outages, and fuel costs as the primary driver to switch.

With natural gas prices at historical highs increasing the fuel costs for gas-fired plants there could be an opportunity for coal-fired power to increase its market share of power generation in the power sector as coal-fired operational costs could become a cheaper alternative than gas-fired, switching the primary source of energy generation for baseload capacity. However, currently we are seeing coal prices at record highs which has subdued any switching and raised the price at which switching would make economic sense. If natural gas prices continue to increase while coal prices stabilize or increase at a slower rate, there could be enough of an economic advantage for coal-fired power to take market share of baseload capacity in the power sector.

By Garrett Samples