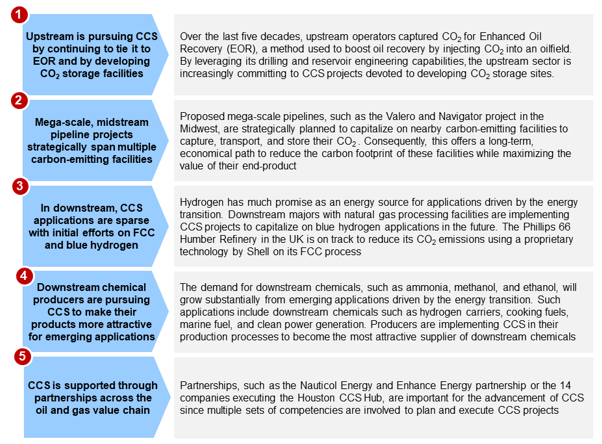

As one of the earliest adopters of carbon capture and sequestration (CCS), the oil and gas industry has contributed significantly to the development of CCS processes over the last five decades. Recently, prominent oil and gas companies such as Chevron, ExxonMobil, Phillips 66, and TotalEnergies have announced new CCS projects across the oil and gas value chain. By studying these new CCS projects, ADI has identified and analyzed five key trends to determine how CCS is evolving (Exhibit 1).

Exhibit 1: Key CCS trends across the oil and gas value chain (Source: ADI Analytics)

Trend #1: Upstream is pursuing CCS by continuing to tie it to EOR and developing CO2 storage facilities

Since 1972, the upstream sector has developed commercial Enhanced Oil Recovery (EOR) projects to improve the oil recovery at a production site. However, as onshore and offshore reserves deplete, CO2 emitting facilities can store millions of metric tons of captured CO2 at these sites. Upstream operators, such as Santos Ltd., Talos Energy, Chevron, and Repsol, planned new projects to come online in the upcoming years and are actively seeking strategic locations to deploy these CCS projects.

Last March, Santos Ltd., an Australian oil and gas exploration and production company, announced its entry into the front-end engineering and design (FEED) phase for the Bayu-Undan CCS Project. Since 2006, Bayu-Undan, an offshore field with a 500-kilometer pipeline to Northern Australia, has been extracting dry gas and transporting it to Darwin LNG, a liquified natural gas (LNG) production plant. However, plans to seize production operations and convert the Bayu-Undan facilities into a carbon storage facility are in the works to reduce Darwin’s carbon emissions. Once production stops, the Bayu-Undan CCS project could have a storage capacity of approximately 10 million tonnes of CO2 per year.

Similarly, Talos Energy and Chevron announced a memorandum of understanding last month for an expanded joint venture. Talos and Chevron will join forces to develop the Bayou Bend CCS Project, an offshore carbon capture hub in state waters near Beaumont, TX, and Port Arthur, TX. The project’s location is increasingly drawing attention as a site for carbon storage due to its ideal geology and proximity to major petroleum infrastructure.

Regarding upstream CCS projects at onshore facilities, the Sakakemang block, a natural gas reserve operated by Repsol, Petronas, and Mitsui Oil Exploration in Indonesia, will reach total production by 2027 with CCS. The CCS project in Sakakemang will store 2 million metric tons of CO2 annually, or a cumulative 30 million metric tons of CO2 for the entirety of the project’s life. Repsol will store the captured CO2 in two depleted gas fields, Gelam and Dayung, and is actively searching for two more storage candidates before the end of the year.

Santos is currently at the front-end engineering design phase for its Cooper Basin CCS Project in South Australia, which will enter service in 2024. Santos will capture the CO2 from its Moomba gas plant and transport it through an underground pipeline from permanent storage in Cooper Basin, a depleted gas reservoir with a storage capacity of up to 1.7 million metric tons of CO2 per year.

Trend #2: Mega-scale, midstream pipeline projects strategically span multiple carbon-emitting facilities

Midstream operators are not only deploying oil and gas CCS projects, but they are also serving other hard-to-abate industries by building large-scale pipelines to connect carbon-emitting plants with sequestration hubs. TotalEnergies, Sempra Infrastructure, Mitsui, and Mitsubishi are collaborating on a carbon capture project at Cameron LNG, a natural gas liquefaction plant in Hackberry, Louisiana, to produce cleaner LNG for its customers. Once accepted by the Environmental Protection Agency, it will be the state’s first carbon dioxide injection well.

Similarly, NextDecade is paving a path to more sustainable LNG production through CCS. This past April, NextDecade and Mitsubishi Heavy Industries America signed an engineering services agreement for the design, license, and performance guarantee of the CCS technology used at Next Decade’s Rio Grande LNG project, KM CDR Process™. The project aims to capture more than 5 million metric tons of CO2 for permanent storage in South Texas.

Trend #3: In downstream, CCS projects seek to build a stake in blue hydrogen

Though sparse, downstream operators announced CCS projects to decarbonize refinery operations and produce hydrogen earlier in the year. The Phillips 66 Humber Refinery in the United Kingdom is on track to become the first refinery to reduce its CO2 emissions using the Cansolv® CO2 technology, pioneered by Shell Catalysts & Technologies. The Humber Refinery runs a fluid catalytic cracking (FCC) process. About 300 FCC plants are operating around the globe, and the Humber Refinery could potentially serve as a model for decarbonizing these plants in the future.

Apart from decarbonizing refineries, other operators in the downstream sector, such as Borealis, Shell, Woodside, and Eni, are focused on producing “blue hydrogen” at natural gas reforming facilities by implementing CCS. Last March, ExxonMobil shared its plans to build one of the world’s largest CCS projects at its Baytown complex, an integrated refining and petrochemical site. The proposed hydrogen facility would produce up to 1 billion cubic feet of blue hydrogen per day to use as a fuel at the Bayport olefins plant and provide lower-emissions products for its customers.

Additionally, Eni and the Egyptian Electricity Holding Company signed an initial agreement last year to produce blue hydrogen in Egypt. Woodside’s H2Perth project will also produce blue hydrogen and ammonia through its product-integrated process.

Trend #4: Downstream chemical producers are pursuing CCS to make their products more attractive for emerging applications

The demand for downstream chemicals, such as ammonia, methanol, and ethanol, will grow substantially from emerging applications driven by the energy transition. Such applications include downstream chemicals such as hydrogen carriers, cooking fuels, marine fuel, and clean power generation. Producers are implementing CCS in their production processes to become the most attractive supplier of downstream chemicals.

One industrial-scale downstream chemicals CCS project currently in the works is a 1,2000-mile pipeline across the Midwest. Valero, BlackRock, and Navigator are leading this project to gather and transport CO2 from five Midwestern states, with a storage capacity of up to 5 million metric tons of CO2 per year. Valero expects to secure most of the pipeline’s capacity with its Midwestern renewable fuel operations to produce low-carbon fuels.

Occidental and White Energy propose to capture CO2 from White Energy’s ethanol facility in Hereford, Texas. Occidental will securely store the captured CO2 in the Permian Basin to decarbonize White Energy’s ethanol production. Nauticol Energy and Enhance Energy are planning a CO2 capture and sequestration project on Nauticol’s proposed methanol facility near Grande Prairie, Alberta, Canada. The CCS project can capture 1 million metric tons of CO2 per year from the methanol process to produce blue methanol, which is gaining much interest as a marine fuel given the International Maritime Organization’s 2050 GHG reduction goals.

Trend #5: CCS is supported through partnerships across the oil and gas value chain

Partnerships between upstream, midstream, and downstream majors facilitate the development of each stage in a CCS process. Such partnerships will be critical to further support the growth of CCS, especially at CCS hubs. Houston, known as the Energy Capital of the World, intends to store up to 50 million metric tons of CO2 per year by 2030 and about 100 million metric tons per year by 2040 with the help of 14 companies, including Ineos, Valero, Shell, Marathon, and Dow.

Going Blue: A Blog Series

ADI Analytics is thrilled to share Going Blue; a new blog series focused on CCS in the oil and gas industry. Stay up to date with new blogs by subscribing to our newsletter and contact us to see how ADI can assist you in CCS projects.

By Jacqueline Unzueta and Uday Turaga