The effects of the pandemic were evident with a decline in natural gas production during 2020, just when it was expected to grow in 2019. The overall natural gas production from the five major regions in the U.S., namely Permian, Bakken, Eagle Ford, Niobrara, and Anadarko, declined during 2020. Although the output from the Permian increased, it was not enough to offset the fall in the other four areas. Two years after the pandemic, increasing associated gas production and growing demand for liquefied natural gas (LNG) drive natural gas production in the Eagle Ford.

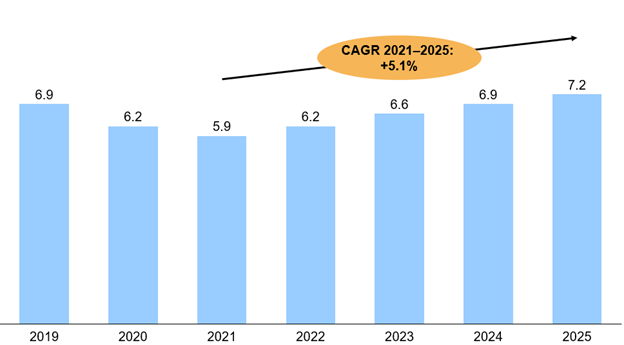

In Eagle Ford, natural gas production decreased 16 percent during 2020; however, since January 2021, production has increased steadily, reaching an average of 6.2 billion cubic feet per day (bcfd) in 2022. Compared to the low of 5.9 bcfd in 2021, this is an increase of 13 percent, and Eagle Ford is expected to reach the pre-COVID production level by 2025. According to ADI Analytics’ projections in Exhibit 1, the Eagle Ford will grow by 5.1 percent annually through 2025 to reach 7.2 bcfd of natural gas.

A significant driver for natural gas production growth in Eagle Ford is associated gas. As activity increases in the region, dry shale gas production will also grow. A different driver is the position of the U.S. as a global LNG supplier, with increasing demand requiring more natural gas production. The geographic proximity of the Eagle Ford shale to ports in Texas such as Corpus Christi and Freeport makes it a vital source of natural gas for liquefaction which will eventually contribute to supplying the increasing global natural gas demand.

While the activity grows, several greenhouse gas (GHG) emissions reduction efforts are adopted, led by flaring, equipment upgrades, power utility integration, and energy credits. For instance, EOG Resources, which increased flaring intensity by 43%, achieved a 9% drop in GHG intensity. Marathon, another top operator in the play, has invested in upgrading its equipment to prevent unmonitored venting, purchasing renewable energy credits (RECs) to offset Scope 2 emissions, and connecting sites to utility power to reduce the reliance on generators.

Eagle Ford’s 22 trillion cubic feet of proved gas reserves, strategic location close to significant LNG export terminals, and rising global demand for LNG make it a crucial gas-producing play.

By Manuel Diaz