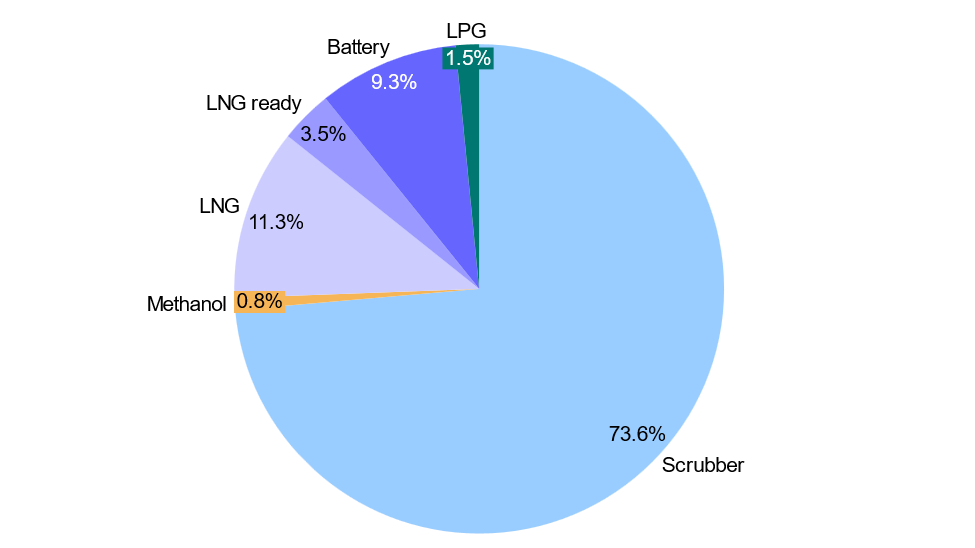

On January 1, 2020, a new rule by the International Maritime Organization (IMO), known as “IMO 2020”, came into force and marked a significant milestone for the shipping industry. This rule limited the sulfur content in fuel oil used on board ships to 0.5% mass by mass, compared to the previous limit of 3.5%. Since then, ships have transitioned from heavy fuel oil into cleaner fuel alternatives or have installed scrubbers to reduce the output of sulfur oxide emissions (SOx) to comply with IMO 2020 (Exhibit 1).

Exhibit 1: Uptake of alternative fuels and technologies in operating ships and ships on order (%) (Source: DNV, 2022)

However, the IMO has also announced ambitious goals to halve GHG emissions by 2050 compared to 2008 GHG emission levels, which task shipowners and ship engine manufacturers to carefully consider a broader range of marine fuels for the world’s future fleet. The chemical industry sees this as a golden opportunity to penetrate the marine fuel market by offering alternative fuels that are practical and competitive. Two of the alternative marine fuels that have gained a lot of interest in recent years are ammonia and methanol.

Methanol can serve as an alternative marine fuel with many benefits. Methanol is easily transported and distributed to end-use markets through existing infrastructure. The history of the safe handling of methanol is long-standing, and it offers additional environmental benefits by having low emissions and the capability to biodegrade rapidly in water. When diving into the costs and economics, methanol is price competitive as a marine fuel due to its compatibility with existing diesel fuel infrastructure. At ambient temperature and pressure, methanol is a liquid, which means that the incremental cost to build new or retrofit existing vessels to use methanol as a marine fuel is significantly less than other alternative fuels due to its physical properties.

Ammonia also shows a lot of promise as the future’s marine fuel since it does not contain any carbon and it does not release carbon dioxide or sulfur oxide emissions upon combustion. In addition, there are further opportunities to reduce global CO2 emissions by producing ammonia through electrolysis or by adding a carbon capture, storage, and sequestration (CCUS) unit to an existing steam methane reforming or auto-thermal reforming process. Like methanol, importing and exporting ammonia from production facilities to end-user markets is well-established with various ports around the world.

Many chemical industry majors that produce either methanol or ammonia are cognizant of the emerging market for clean marine fuels and have openly expressed their interest in this opportunity in the past. Methanex, the world’s largest producer and supplier of methanol to major international markets, is looking to advance methanol as the leading alternative marine fuel. Currently, Methanex has the world’s largest dedicated fleet of methanol ocean tankers. Approximately 40% of its long-term fleet is powered by methanol with a ship deadweight tonnage of about fifty thousand across eleven ocean tankers. Methanex has stated its intent to further pursue methanol as a marine fuel since it proves to meet current and future emission regulations, has proven dual-fuel engine technology at a commercial scale and provides a pathway to 2050 compliance.

Similarly, ammonia producers are defining a path forward to what they believe will be a very attractive growth area for ammonia to serve as a potential fuel source for the marine industry. During an Earnings Call held on July 16, 2021, the President of Yara International discussed how Yara Clean Ammonia is setting up to support the marine industry’s move to zero-emission ships. Additionally, the CEO of LSB Industries has a similar stance about ammonia as a marine fuel by stating that the marine industry is a major emitter of CO2 and that LSB’s existing knowledge in ammonia manufacturing, handling, storage, and logistics positions the company extremely well to become a significant player in this arena.

The shipping industry will require huge investments and support to build new ships and retrofit the existing fleet to meet IMO’s 2050 goals. ADI Analytics has published extensively on this topic here, here, and here. Our firm serves many stakeholders in the shipping industry that need expert guidance during uncertain times. Contact us to see how ADI could help you define a path towards 2050 compliance and learn about our other areas of expertise here.

By Jacqueline Unzueta