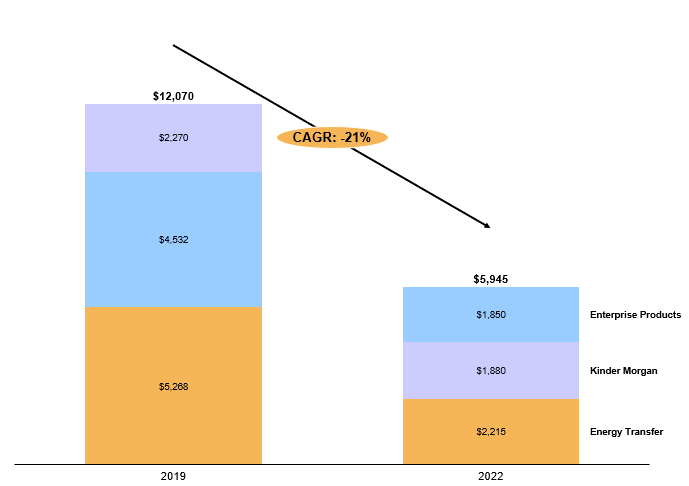

Since 2019, midstream companies have been lowering their capital spending annually. For example, Kinder Morgan expects to spend roughly $390 million less in capex in 2022 than they did in 2019, as seen in Exhibit 1. This trend for companies in the industry is due to a multitude of factors which were covered in depth at the 2022 ADI forum. Three of the main drivers are companies’ focus on capital discipline, the slow growth and recovery of the upstream oil and gas industry, and new regulatory and ESG pressures from the government and investors, respectively.

Exhibit 1: Select midstream players’ capital spending in USD million.

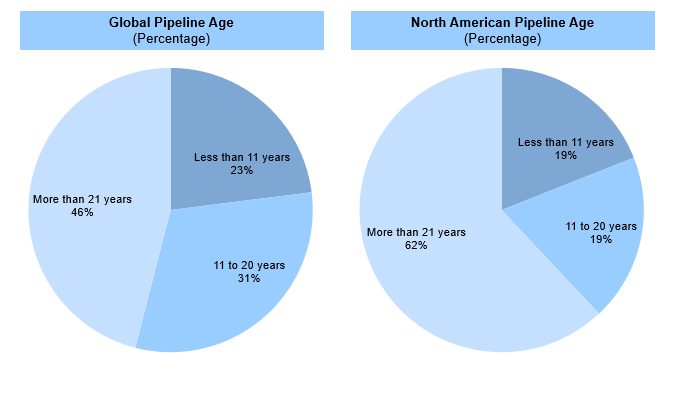

During the COVID-19 pandemic, midstream companies were greatly affected by the economic downturn due to a lack of production and dropping oil prices. This led many companies in the last few years to develop more responsible practices in spending less to pay back investors and recover. There has also been a shift in projects from building new infrastructure to updating existing pipelines. In Exhibit 2, we see that 46% of pipeline infrastructure in the world is over 21 years old, with that figure rising to 62% domestically. Because of this, companies are working to update what they already have and are putting new pipelines and expansions on hold.

Exhibit 2: Global and U.S. pipelines segmented by age.

Another factor lowering midstream spending is the holdups in upstream. Despite oil prices recently skyrocketing into triple digits, upstream producers have still been slow to drill new wells and raise production. This is largely due to producers being disciplined about production growth to focus on investor returns, uncertainties with U.S. regulations moving forward, difficulty and expense in finding materials and manpower, and the ESG pressures many producers are facing from investors. Because of this lack of growth in upstream, midstream has effectively “caught up” with production in the major U.S. shale plays and will not likely need to expand pipelines for a few years.

Similar to upstream, midstream companies also faces difficulties with new regulatory and ESG pressures. The regulatory environment under the Biden administration has made starting new projects more difficult for midstream companies by giving states the right to block off certain regions and make the application for new pipelines much more strenuous. Meanwhile, the continued push from investors for companies to focus their efforts on creating a cleaner image and electrification and digitization of operations has taken much attention away from new expansion projects.

Overall, uncertainties around production and regulations on the oil and gas value chain as well as ESG and financial pressures are preventing new pipeline expansions from midstream companies. Because of this, midstream capex is falling and is unlikely to return to pre-pandemic levels in the current climate. Midstream will likely focus its capital efforts on restoration of current infrastructure and emission reductions and efficiency improvements of their current operations.

Our team at ADI Analytics has supported a wide range of clients for oil and gas, power and utilities, renewables, and energy transition including assessing midstream oil and gas capacity, ESG, and flaring. Please reach out to us to learn more about how we can help.

– Thomas Dennis