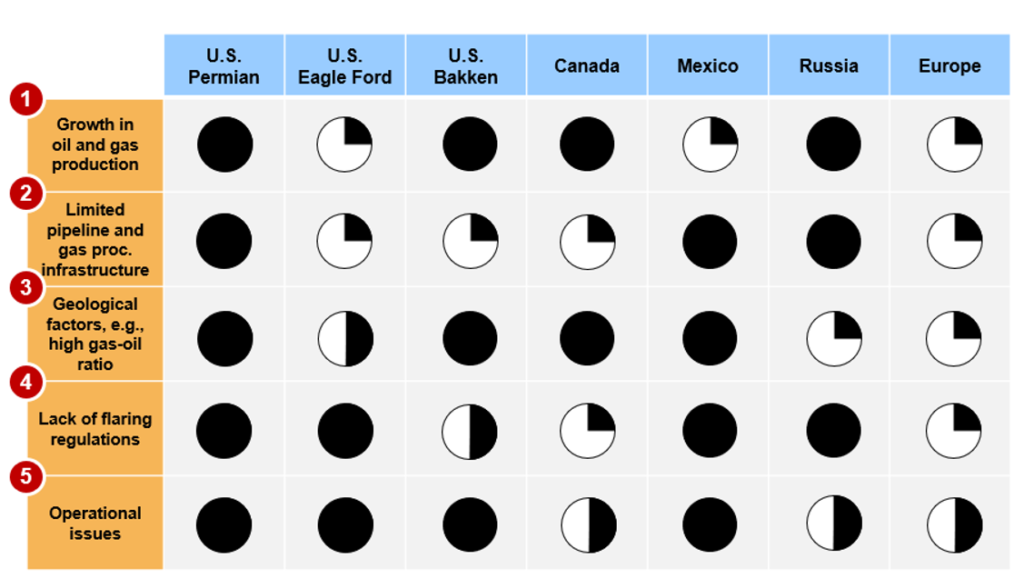

Flaring possesses considerable challenges due to the recent growth in associated gas production primarily from oil-producing plays such as the Permian, Eagle Ford, and Bakken. Flaring can be a consequence of bottlenecks in midstream infrastructure, well development, or process upsets at the well site. As shown in Exhibit 1, key drivers for flaring include higher oil and gas production, lack of regulations to limit flaring, geologic factors such as the gas-oil ratio which rises with maturing plays, and operational issues. Drilling growth also drives both non-routine and routine flaring as operators flare gas production from new wells until midstream infrastructure is built.

Exhibit 1: Natural gas flaring drivers and regional impact

Why is it important to reduce flaring?

In 2020, the U.S. upstream producers flared around 1.1 billion cubic feet per day of natural gas. According to the International Energy Agency (IEA), in 2020, nearly 36 million tons of CO2 and ~9 million tons of methane were released into the atmosphere from unconventional oil and gas production in the Lower 48s. Most of these emissions came from non-emergency flaring and venting which contributed ~70% of the total methane emissions. In the U.S., natural gas flaring volumes fell in 2020 due to a decline in oil production, limited drilling, and new gas pipeline infrastructure, but the current rise in oil prices can result in more upstream activity which might result in an increase in flaring volumes going forward. High natural gas prices are also incentivizing operators to consider options to cut flaring.

What can operators do to reduce flaring?

Growing ESG pressure from investors, rise in public awareness towards climate change, and countries setting ambitious net-zero emission targets have motivated upstream operators to invest in technologies that can reduce their carbon footprint. Most of the large E&P independents and oil majors have committed to climate goals and are actively investing in flare-mitigation solutions. Recently, Pioneer Natural Resources and Diamondback Energy have announced plans to connect all new wells to sales pipelines prior to well completion and shut-in oil production to limit faring wherever possible.

Other operators can beef up operational excellence by investing in leak detection and repair (LDAR) technologies and remote monitoring system solutions that can efficiently track venting locations.

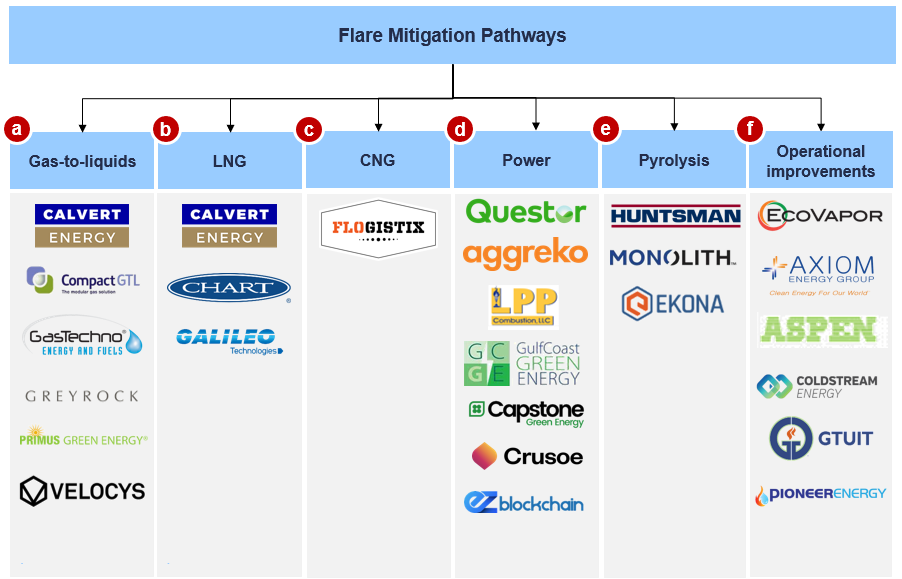

Exhibit 2: List of players providing flare mitigation solutions

Exhibit 2 shows an illustrative list of emerging players and incumbents which are providing flare mitigation solution for the upstream industry. Operators can pursue long-term flare mitigation projects such as bitcoin mining, capturing flared gas to produce LNG, using the flared gas to produce onsite power, and gas-to-CNG projects.

Our team at ADI Analytics has supported a wide range of clients for oil and gas, power and utilities, renewables, and energy transition including assessing upstream oil and gas activity, ESG, and flaring. Please reach out to us to learn more about how we can help.

– Utkarsh Gupta