ADI Analytics along with the U.S. Energy Association and Gas Technology Institute explored the opportunities for U.S.-based small-scale liquefied natural gas (LNG) in Central and Eastern Europe for the U.S. Department of Energy in 2020. While decarbonization, energy security, and supply diversification were identified as the key drivers of U.S.-based small-scale LNG adoption in the region, the global and European energy crisis following the COVID-19 pandemic opened the doors for an expansion of large-scale U.S.-based LNG imports.

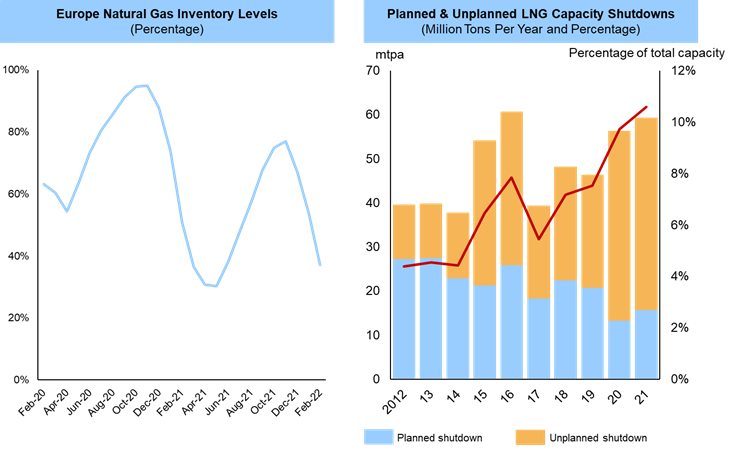

To summarize the European energy crisis, the region experienced one of the coldest winters in 2020-21, draining natural gas inventory. Additionally, domestic production in the region had been declining and the Russian energy giant, Gazprom, unlike historically, refused to go beyond contracted piped gas supply to meet the increased demand. Global LNG capacity also faced several planned and unplanned outages resulting in a severe supply shortage and historically high gas prices in Europe.

As shown in exhibit 1, on the left we see that the cyclic natural gas inventory that generally reaches its lowest during April was already at the lowest in February of 2021 and 2022. On the right, we can see planned and unplanned LNG capacity shutdowns globally amounting to over 10% of total capacity.

Exhibit 1. Europe natural gas inventory levels, percentage and planned and unplanned LNG capacity shutdowns, million tons per year and percentage

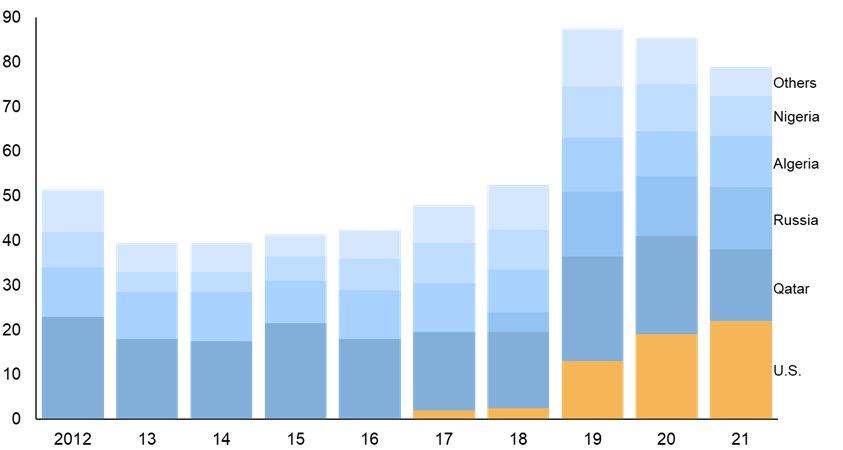

The U.S. is on track to overtake Australia to become a leading LNG exporter this year. As global LNG supply faced several challenges, the share of U.S.-based LNG grew in 2021, although total LNG imports to the region declined. As can be seen in exhibit 2, the share of U.S.-based LNG grew from 4% in 2017 to almost 30% in 2021 and we expect the trend to continue in the current geopolitical scenario and additional capacity of cost-competitive LNG coming up in the U.S.

Exhibit 2. LNG imports to Europe by source country, million tons per year

ADI Analytics closely follows the global LNG market and maintains a database of operational, planned, and announced LNG export and import capacities globally along with annual studies of North American and global small-scale LNG. Subscribe to our monthly newsletter to stay updated or contact us to learn more.

By Panuswee Dwivedi