Flaring is one of the most daunting issues that the current petroleum industry faces. Not only is it a sore eye on the industry, but it also is essentially the equivalent of operators burning money. Despite operators’ desire to stop flaring, for many it makes the most economic sense. This, in large part, is due to what producers would cite as a lack of midstream capacity. Whether it be the absence of pipelines or the inability to process the gas, operators are left with a large volume of natural gas they don’t know what to do with. So instead of costly capturing methods, many have turned to flaring it off. This issue is especially prevalent in the Bakken, an area that has many wells in remote areas of North Dakota where midstream companies have faced an uphill battle from both difficulties in keeping up with drilling and public pressures preventing the building of new pipelines. Because of these issues, the Bakken is still flaring roughly 7% of their total gas produced. As the production of oil continues to rise in the region, midstream will need to complete more projects to keep up to prevent flaring, or operators may have to turn to other options.

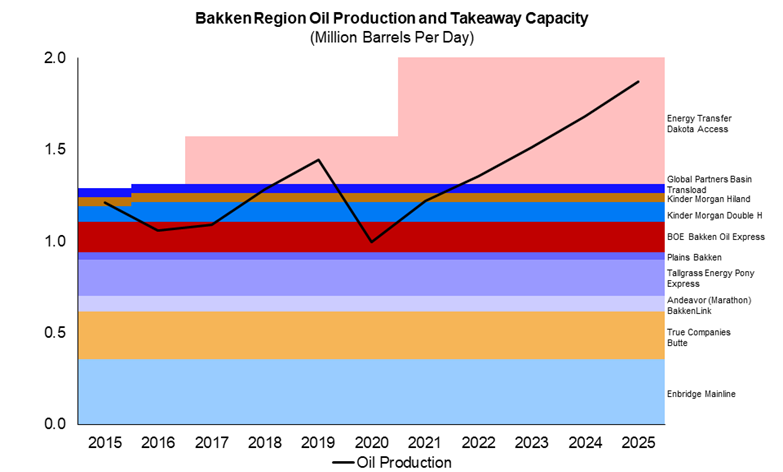

The first thing to consider is what oil production will look like in the Bakken. ADI believes that Bakken’s oil production will likely continue to climb as prices have risen back up. We currently have Bakken oil production for 2022 estimated to be around 1.35 million barrels per day, which is not quite back to the 2019 figure of 1.44 million barrels per day. We believe that production will continue to slowly rise, however, as seen in Exhibit 1 and that there will be ample takeaway capacity for the oil being produced.

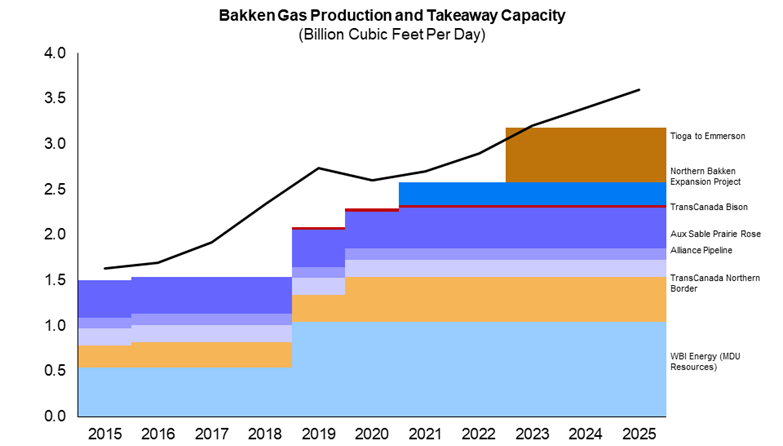

However, with increases in oil production, there will also come increases in produced gas. In Exhibit 2, one can see that there is a similar drop in gas production in 2020 to oil production due to the COVID-19 pandemic. Similarly, we expect gas to begin to rise again at a similar pace to oil. However, due to project cancellations and the protests of new pipelines, gas pipeline infrastructure is not up to par with that of oil pipelines.

Exhibit 1: Oil production and capacity in the Bakken

Exhibit 2: Gas production and capacity in the Bakken

When dissecting the reasons for pipeline capacity drop-off, there are many factors to consider. The first one being that the Bakken is a very widespread region with very little preexisting infrastructure both in the oil and gas industry and in roadways and cities. The lack of industrialized areas leaves oil and gas companies to often pave the way creating a lot more work for midstream companies. Another factor is the speed of drilling new wells due to the shale boom. For the last few years, operators have been drilling as many new wells as they can leaving little to no time for midstream infrastructure to catch up. A third factor is the lack of popular support for oil and gas pipelines. Finally, COVID has cut many companies’ budgets and caused many cancellations of projects.

Because of the lack of midstream gas pipeline capacity, operators are left with few options to try and mitigate flaring. The first option is to reconvert the natural gas into energy for their own operations. Not only does this option provide operators with an application for the gas, but it also allows them to cut energy costs. The only downside to this is that the engines taking in the gas will have to be consistently replaced because the gas is unprocessed and contains heavy hydrocarbons. A second option is to use a third-party technology to convert the gas. There are many options including small-scale LNG or CNG, pyrolysis (which is the conversion of natural gas into hydrogen and carbon), and converting gas to electricity for bitcoin mining. However, all of these options are less preferable to selling the gas via pipeline.

Our team at ADI Analytics has supported a wide range of clients for oil and gas, power and utilities, renewables, and energy transition including assessing midstream oil and gas capacity, ESG, and flaring. Please reach out to us to learn more about how we can help.

– Thomas Dennis