Silver is known most for its use in lush jewelry and silverware. However, these applications account for less that 50% of its consumption. In fact, the estimated domestic uses for silver in 2020 were electrical and electronics (28%), jewelry and silverware (26%), coins and medals (19%), photography (3%), and other applications (24%). Other applications for silver include pharmaceuticals, plastics, batteries, and photovoltaic solar cells. Silver is highly sought after for these industrial uses due to its high thermal and electrical conductivity, malleability, ductility, and resistance to corrosion and oxidation.

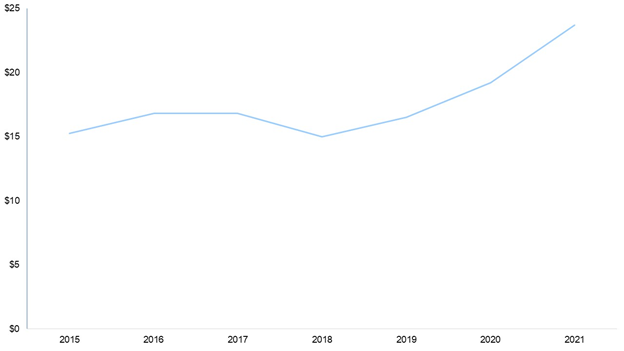

During the first half of 2021, consumption for industrial uses was estimated to have decreased owing to lockdown restrictions in response to the pandemic, supply chain disruptions, lowered inventory replenishment, and reduced labor in factories. However, an increase in industrial demand as well as in investor demand caused consumption to go up raising price of silver back up to 2013 levels in the high $20s to low $30s per ounce in August 2020. The drastic increase in prices was relatively short-lived as prices fell back down in November 2020 and are currently hovering around $22/oz. (Exhibit 1)

Exhibit 1: Silver prices in $/oz from 2015 to 2021 (Source: UBS)

This is to be expected as prices begin to normalize after the effects of the pandemic but, going forward, silver prices are forecasted to decline. As global efforts to decarbonize and electrify gather steam, two main industries that may drive silver consumption are solar energy and automotive and electric vehicles (EV). Therefore, environmentally-oriented fiscal policies should have positive implications on long-term silver demand to the extent that it supports silver usage within these clean energy chains.

Solar industry demand accounts for approximately 10% of the total silver consumption but silver loadings in photovoltaic (PV) cells have been falling due to cost reduction efforts. Currently, the amount of silver used in PV cells accounts for 20-25% of the amount of silver used in PV cells 10 years ago. The pace of thrifting is slowing down, but further reductions are expected. Moreover, the year-on-year growth in annual solar installations is expected to stabilize around 11%. Industry estimates suggest that silver demand from PV cells is peaking, but silver usage is likely to hold in the long run.

Silver is used extensively in vehicle electrical control units that manage a wide range of functions in the engine and main cabin. These functions include navigation systems, electric power steering, and vital safety features, such as airbag deployment systems and automatic braking. Average vehicle silver loadings, which are currently estimated at 15-28 grams per internal combustion engine (ICE), have been rising over the past few decades. In hybrid vehicles, silver use is higher at around 18-34 grams per light vehicle, while battery electric vehicles (BEVs) are believed to consume 25-50 grams of silver per vehicle. The move to autonomous driving should lead to a dramatic escalation of vehicle complexity, requiring even more silver consumption. Silver automotive demand is expected to grow at a 10.2% CAGR to 90 million ounces in 2025 from 61 million ounces in 2021. Despite the increased demand of silver from these two industries, these trends will not significantly impact overall demand, but will motivate growth in mine production until 2025.

ADI is launching a multi-client study – “The New Frontier: Critical Minerals & the Energy Transition” – which is focused on a comprehensive assessment and outlook for critical minerals supply and demand through 2030. This multi-client study builds on ADI’s extensive research and deep expertise in metals, minerals, mining, mineral processing, and energy transition. The study will be based on in-depth primary and secondary research and supply and demand modeling and analytics. Please download the multi-client study prospectus – “The New Frontier: Critical Minerals & the Energy Transition”– and contact us to learn more.

Visit the rest of our blog series, Mining and Metals, to learn more about other critical minerals for the energy transition and stay tuned for upcoming blog posts.

– Jacqueline Unzueta & Swati Singh