ADI is continuing its on-going series of blogs covering the refining industry across major Latin American countries that account for the bulk of the U.S. fuel exports to the region. The blog series will cover Brazil, Mexico, Chile, Ecuador, and Peru and will draw on our extensive research and consulting on refining in Latin America from our recent multi-client study, “Market Outlook for U.S. Refined Products Exports to Latin America”. In the prior blog, we discussed U.S. fuel exports to Brazil with coverage on fuel supply, demand, refining capacity and utilization, fuel terminals, and prices and policies. In this blog, we will be covering Mexico, which is another major country on this topic.

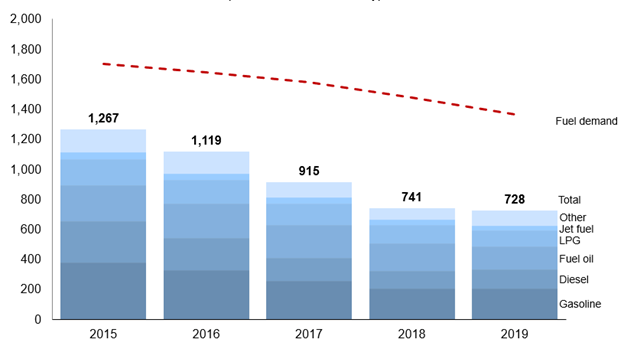

Diesel, gasoline, and liquified petroleum gas (LPG) account for ~75% of Mexican fuel demand. In 2019, Mexico’s production of refined products was slightly over 50% of total fuel demand (Exhibit 1) causing a major shortfall. As a result, the country relies on imports especially from the U.S. to bridge the fuel supply-demand gap.

In 2019, Mexico imported ~1.2 million barrels per day (bpd) of fuel which primarily included gasoline and diesel. U.S. has been the major fuel exporter to Mexico since 2015 and the share has grown without a lot of competition. Further, fuel import in Mexico by private entrants has been growing since 2016 when the government allowed their participation. In 2019, private companies in Mexico imported and distributed almost 14% of total imports and the rest was imported and distributed by state-owned oil and gas company Pemex. Over 60% of the fuel imports by Pemex is comprised of gasoline followed by 21% for diesel. In 2019, Pemex imported 178,000 bpd of diesel, 528,000 bpd of gasoline, and 54,000 bpd of LPG. Further, private companies are expected to increase their share of fuel imports in coming years given their investments in upcoming new fuel terminals in Mexico. However, the government has slowed down approving permits for new import terminals due to concerns around Pemex’s market share.

Additional government tariffs and taxes in Mexico have slowed down Mexico’s fuel demand over the past five years. In 2017, following the energy reforms, prices of gasoline, diesel, natural gas, and LPG were being liberalized to increasingly align with market prices. As Mexico got rid of fuel subsidies, price of fuels rose by almost 20% and demand of transportation fuel started to fall. Pemex’s anti-theft operations to control gasoline theft in Mexico in 2019 also reduced reported gasoline consumption.

However, transportation is expected to drive gasoline and diesel demand going forward supported by vehicle fleet growth and rising share of urban population. Growth in the vehicle leasing market in Mexico will also drive its gasoline demand going forward. Diesel demand in Mexico will likely pick up by extension of existing mandates around sale of low-sulfur diesel post-COVID. Further, Mexico is among the highest per-capita residential-commercial consumers of LPG in the world with around 8 out of 10 homes using LPG. Two-thirds of LPG demand in Mexico comes from the residential sector for cooking and heating purposes which will continue to grow moderately supported by a growing urban population.

Mexico has six oil refineries with ~1.6 million bpd in capacity and they are all owned by Pemex. Mexico’s refining capacity has remained flat over the past five years and a new refinery has been planned but is facing delays. Pemex has started construction of its 340,000-bpd Dos Bocas refinery in Tabasco, Mexico which will be the biggest oil refinery in Mexico and once completed in 2023 will produce ~170,000-bpd of gasoline and ~120,000-bpd of ultra-low sulfur diesel. However, the project is expected to face significant delays and cost overruns.

Additionally, Mexican refineries’ utilization rate has fallen sharply over the past few years by ~44% due to poor maintenance and lack of replacement of idled units. Pemex is undergoing its refinery rehabilitation program and plans to improve utilization of its existing refineries. However, the lack of Pemex’s financial strength makes it highly unlikely for refinery rehabilitation to proceed as planned level and on time. As a result, refined products’ supply from all Pemex’s existing six refineries continue to plummet.

Upcoming fuel storage terminals, falling domestic refinery fuel production, and delays in construction of new capacity will continue to drive Mexican fuel imports in the near-term. ADI’s recent multi-client study addresses several strategic questions on the outlook for U.S. fuel exports to Latin America through 2030 by analyzing the region’s fuel market drivers, refining capacity, utilization outlook, and export/import infrastructure analysis. The study provides fuel-wise and country-wise deep dives for Latin America with competitive strategies for U.S. fuel exporters. Download the study prospectus to learn more.

– Swati Singh