We wrote in an earlier blog that the Paris Agreement’s goal to limit global warming to well below 2 °C compared to pre-industrial levels will be challenged by decarbonization of several hard-to-abate sectors. The chemical industry is both one of the largest consumers of energy globally and a hard-to-abate sector. A large portion of carbon in feedstocks that are used land in end-products but the sector itself contributes less than 16% of the total industrial emissions.

To help companies quantify and reduce their greenhouse gas (GHG) emissions, the GHG Protocol Corporate Standard classifies emissions into three ‘scopes’. Scope 1 emissions are direct emissions from owned or controlled sources. Scope 2 emissions are indirect emissions from the generation of purchased electricity. Finally, Scope 3 emissions are all indirect emissions (not in Scope 2) that occur in the value chain of the reporting company including both upstream and downstream emissions.

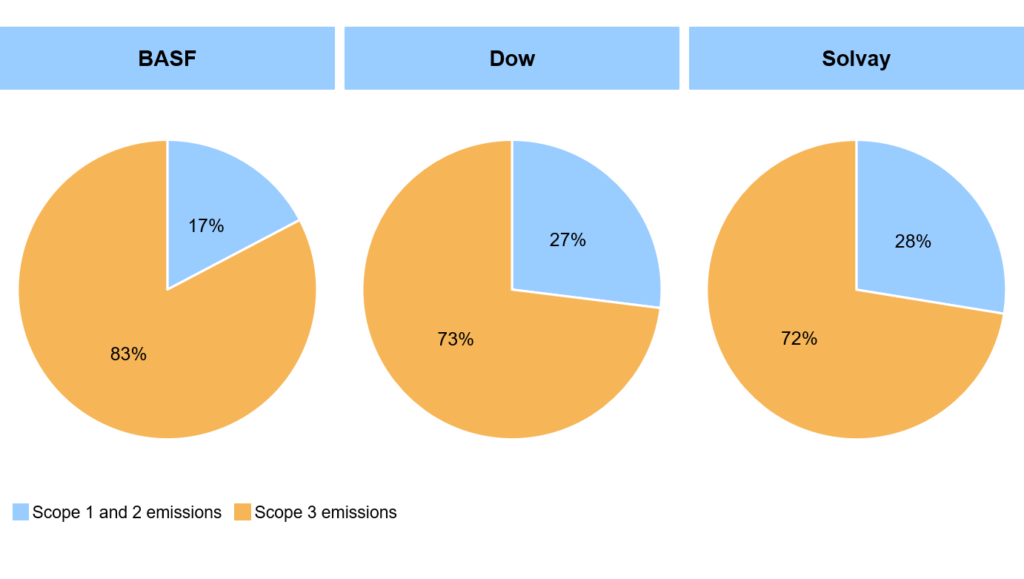

The GHG Protocol Corporate Value Chain (Scope 3) Standard helps companies identify GHG emissions reduction opportunities, track performance, and engage suppliers at a corporate level, thus helping these companies tap missed opportunities to take accountability for their emissions. For example, Kraft Foods found that value chain emissions comprise more than 90% of their total emissions. Exhibit 1 shows that based on annual GHG emissions reported for 2019 by three of the largest chemical companies – BASF, Dow, and Solvay – more than ~75% of their emissions are defined as Scope 3.

Exhibit 1. Scope 1 and 2 and Scope 3 emissions in 2019 reported by BASF, Dow, and Solvay

As discussed above, Scope 3 emissions are indirect emissions, most of which come from processing, selling, and end-of-life treatment of sold products of the chemical companies. This definition to a certain extent shifts the responsibility of those emissions away from the large chemical companies. However, these companies may have much more resources and capabilities to reduce Scope 3 emissions via collection programs, recycling, and alternative materials in the products itself than the average end-user for whom recycling or alternative materials are not accessible. Regulatory and government agencies are introducing various taxes and incentives to drive investments in circular economy which may result in lowering down of not only Scope 1 and 2 emissions from the chemical companies but also optimize Scope 3 emissions. For example, BASF and Mitsui Chemicals in Japan have started to look for ways to locally recycle post-consumer waste in an attempt to curb Scope 3 emissions that arise from waste handling. We shall discuss some of the taxes and incentives to promote recycling in the upcoming blogs.

ADI Analytics actively tracks decarbonization trends in the chemical industry along with drivers such as regulatory push, consumer buying trends, sustainability goals of chemical companies, and recycling technologies. Contact us to learn more.