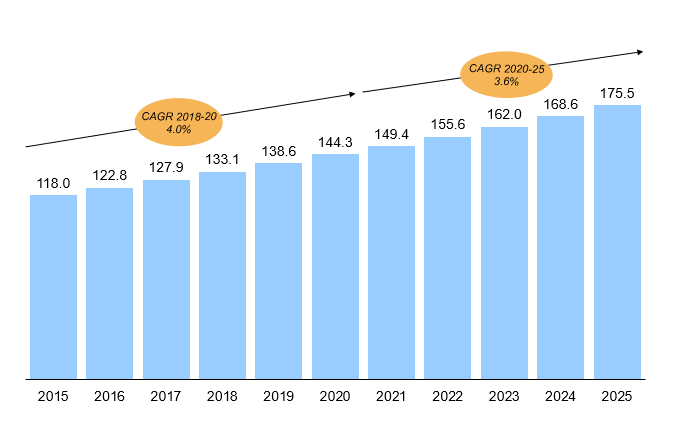

Asphalt (also known as asphalt binder) is a sticky, black, and highly viscous liquid or semi-solid form of petroleum that is found in natural deposits or produced as a refined product in petroleum refineries. Asphalt in its conventional form can be used for various applications such as the construction of highway roads, expressways, city roads, airport runways, and waterproofing. Asphalt can also be used in new ways, e.g., as emulsions in construction of city and rural roads or mixed with polymers for expressways and airport roads. As shown in Exhibit 1, the global demand for asphalt is estimated at ~143 million metric tons per year (MMTPA) in 2020 and is expected to grow at 3.6% annually to reach ~174 million metric tons per year by 2025.

Exhibit 1: Global demand for asphalt binder through 2025

Given this growth potential coupled with other market trends, Alberta Innovates commissioned ADI Analytics to conduct a voice-of-customer and market assessment for asphalt binders in North America and Asia with the objective to identify opportunities for Canadian asphalt binder producers. The primary goal was to build deeper and granular insights on the supply chain of asphalt binders including product distribution and transportation, customer practices and market access, market applications and growth opportunities.

The project was completed with frequent interactions and consultations with a wide range of stakeholders. The first phase included a series of kick-off workshops with key stakeholders in the target regions to identify relevant issues. The second phase was focused on developing the report using a mix of research tools and analytical methods. We did a deep dive of the asphalt markets covering key countries in Asia such as China, India, Vietnam, Thailand, Singapore, Malaysia, and Indonesia. We also assessed U.S., Canada, and Mexico as part of the study. ADI conducted 40+ productive interviews with asphalt end-users, construction companies, and distributors in Asia and North America covering a broad range of market, commercial, end-use, pricing, and regulatory issues.

Based on this mix of primary and secondary research and market size modeling, ADI’s study developed several findings. A few key highlights are discussed briefly here while the entire study is available at no cost by contacting us.

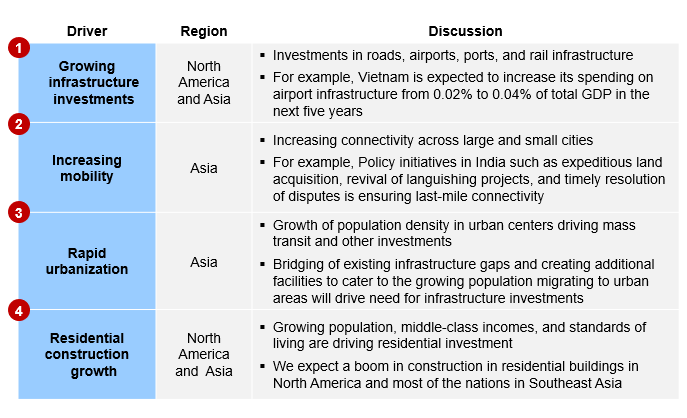

- The asphalt markets in Asia and North America are being driven by rapid urbanization, growing infrastructure investments, increasing mobility, and residential and other construction growth.

Exhibit 2 shows the key growth drivers for asphalt binder markets in both regions.

- Most of the Asian asphalt demand is for conventional grades followed by emulsions and polymer-modified grades. Viscosity grades are the most widely used grades in India. Other countries such as Vietnam, Thailand, Singapore, Malaysia, and Indonesia use pavement grades. North America uses the superpave grading system with a couple being the most popular grades.

- Supplier selection is based on prices, relationships, sector experience, supplier creditworthiness, quality, logistics, offering breadth, and scale of the asphalt supplier. We provided a qualitative overview for scenarios in Asia and North American countries based on these criteria.

- End-users have several pain-points such as price fluctuations, quality issues, and logistical concerns. Contractors look for pricing stability during demand fluctuations and consistent supply of required grades during project execution without compromising quality.

- Most of the asphalt is transported via tank trucks although a few end-users procure small volumes via bitumen drums. Transportation costs range from U.S. $0.07 to U.S. $0.15 per metric ton per mile of distance with transportation costs higher in developed nations such as the U.S. and Singapore.

In addition to these key findings, ADI has studied in detail regional trends including demand and supply of asphalt binders, demand by grades, insights on supplier selection criteria, regional cost analysis, transportation and logistics study, and pain points for asphalt end-users. Contact us to get a complimentary copy of the study.

-Utkarsh Gupta